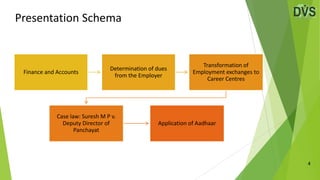

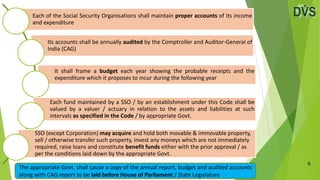

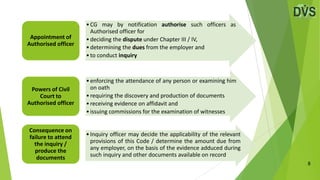

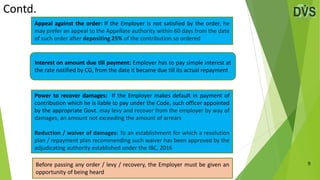

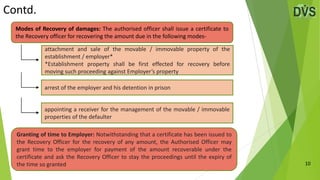

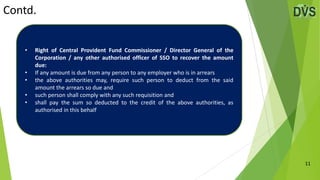

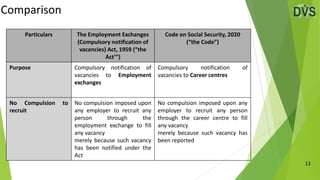

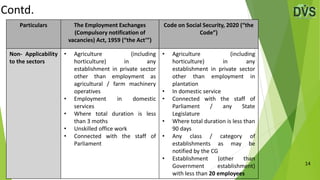

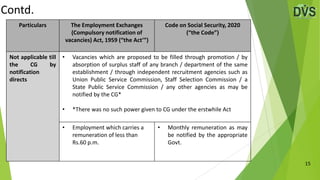

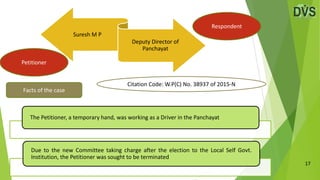

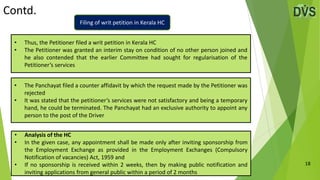

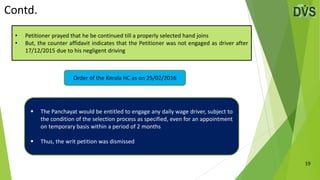

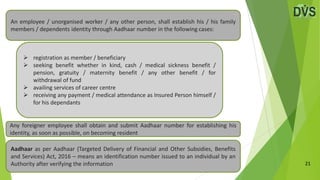

The document outlines the framework and regulatory mechanisms of the Social Security Code of 2020 in India, detailing the responsibilities of Social Security Organizations (SSOs) regarding financial accountability, employer dues, and the appeals process for employers. It delineates the transformation of employment exchanges into career centers, emphasizing the non-compulsory nature of recruitment through these channels, and specifies various exemptions. Additionally, it covers case law relevant to employment disputes and the role of Aadhaar in identifying beneficiaries for social security services.