This document provides an overview of the Employees' Provident Fund Act of 1952 in India. The key points are:

- The Act established a compulsory contributory provident fund for employees and their dependents to support retirement or dependents in case of early death.

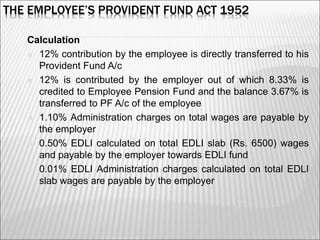

- It applies to any company employing 10 or more people in specified industries. Both employer and employee must contribute 12% of wages each month to the provident fund.

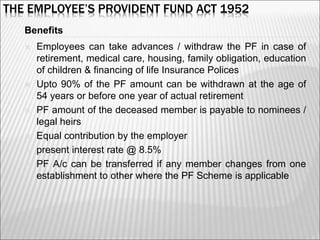

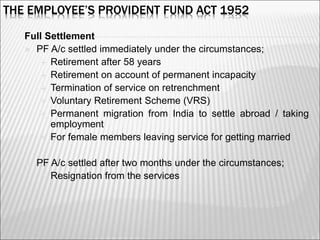

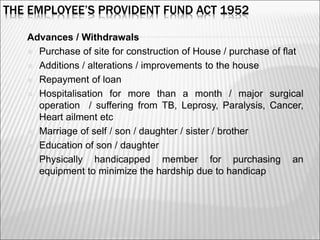

- Benefits include withdrawing partial funds for needs like housing, education or medical expenses. The full amount is paid out upon retirement, permanent incapacity, termination or permanent migration.