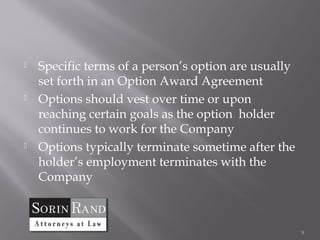

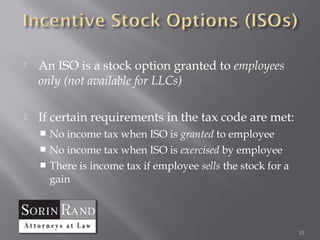

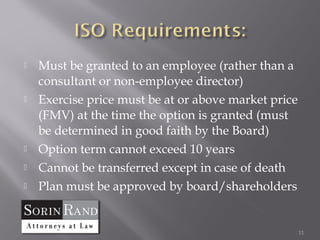

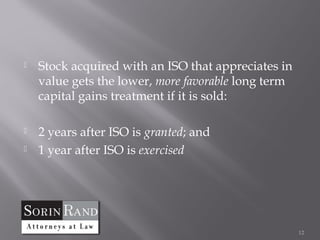

The document discusses options for attracting, retaining, and incentivizing talent including offering equity incentives through an option or equity incentive plan. The main types of equity incentives that can be granted are options, restricted stock, and stock appreciation rights. Options allow an employee to purchase company stock at a set price for a period of time. Restricted stock transfers shares that vest over time if employment continues. Stock appreciation rights provide a cash payment based on stock value increases. Tax implications vary based on option type and timing of stock sales.