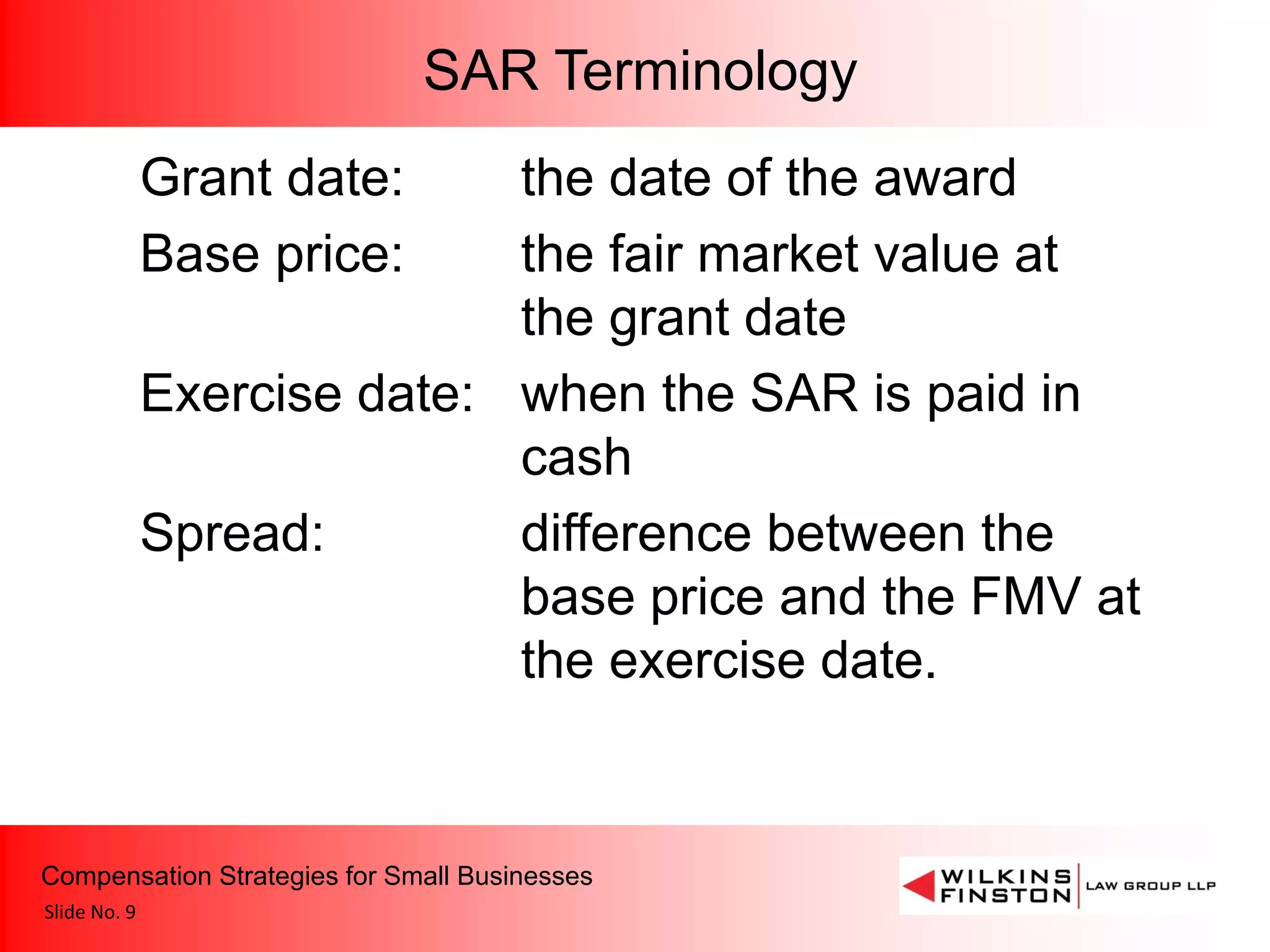

This document discusses compensation strategies for small businesses. It presents options like cash incentives with short and long-term goals, and equity awards like stock options and restricted stock. However, small businesses face challenges in offering equity compensation due to lack of liquidity and the owner's reluctance to share equity. The document proposes using "derivative securities" like stock appreciation rights (SARs) which allow employees to benefit from stock growth without the business sharing actual equity. SARs and profits interests in LLCs are presented as alternatives that can help small businesses recruit and retain top talent.