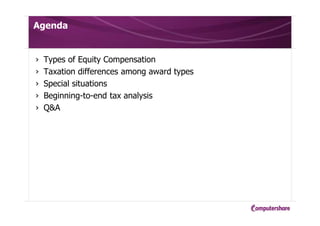

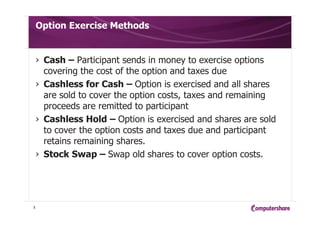

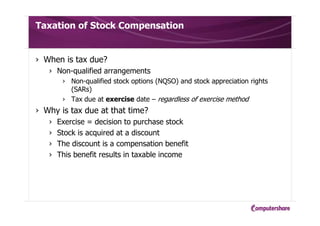

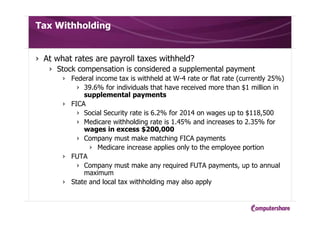

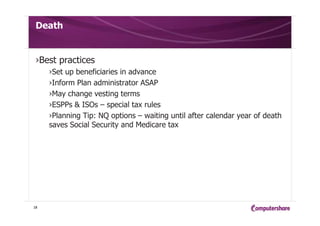

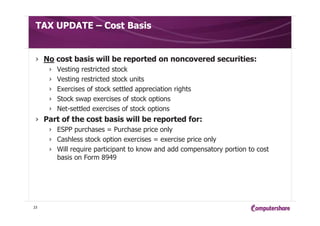

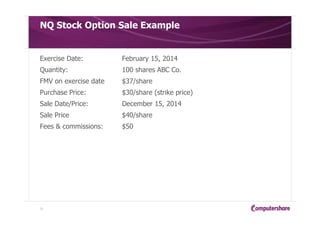

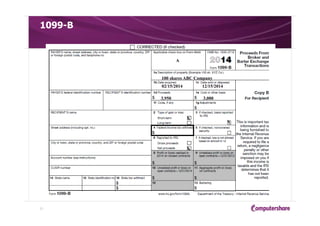

This presentation discusses financial and tax considerations related to equity compensation. It covers various types of equity awards like restricted stock, stock options, stock appreciation rights, and employee stock purchase plans. It explains when tax is due for these different award types and how income is taxed. The presentation also discusses tax withholding rates, tax reporting requirements for companies, and responsibilities of participants. Special situations like retirement, death, and diversification are addressed as well.