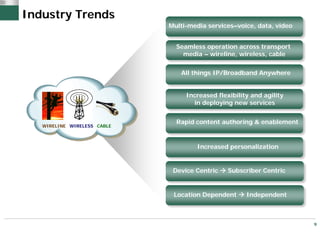

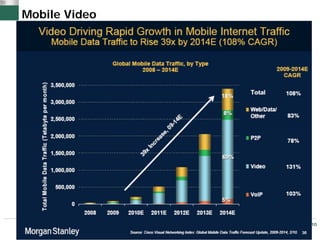

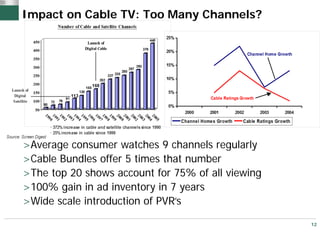

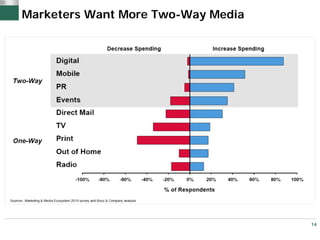

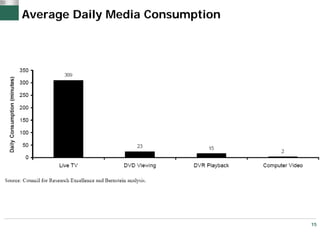

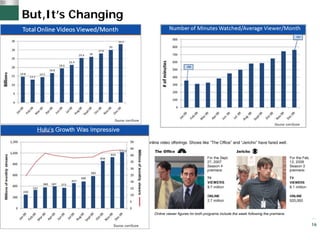

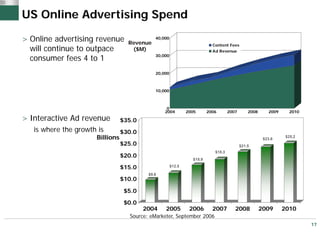

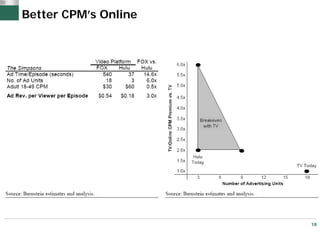

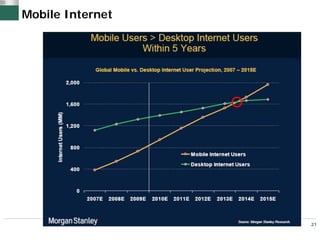

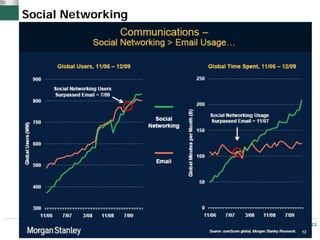

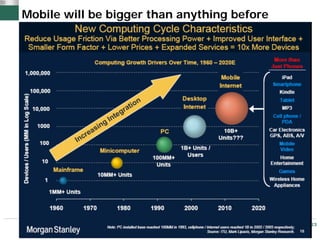

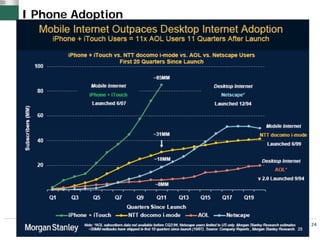

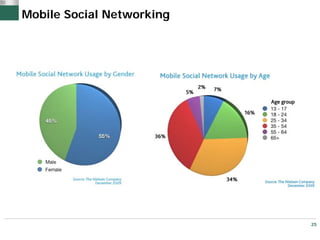

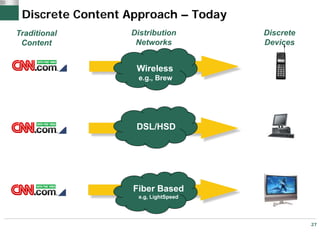

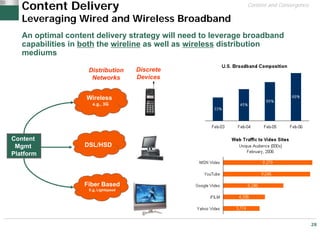

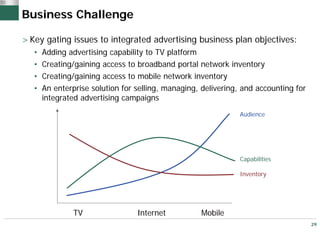

The document discusses the future of enterprise mobile video, focusing on industry trends such as increased flexibility in service deployment, the impact of digital transitions on cable TV, and the shift towards online and interactive advertising. It highlights the growing importance of mobile video and social networking, emphasizing that mobile will surpass previous trends in media consumption. Key challenges for businesses include integrating advertising capabilities across various platforms and managing content delivery through both wired and wireless means.