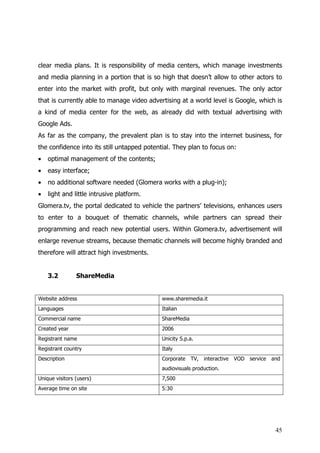

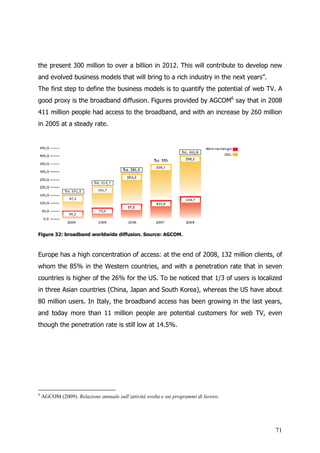

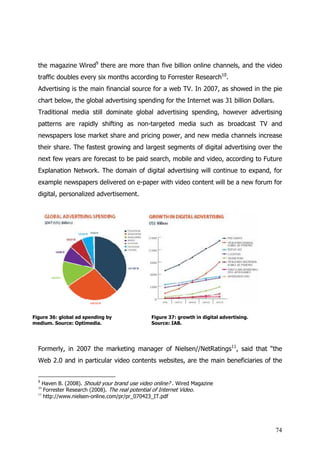

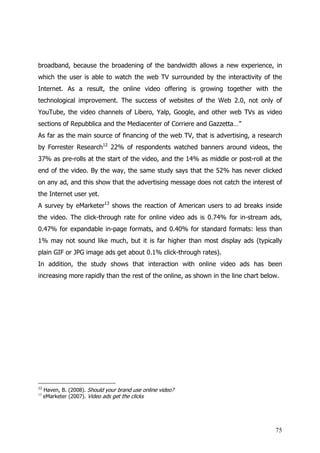

The thesis explores the business models for web TV, aiming to identify sustainable approaches amidst its growing audience and investment opportunities. It differentiates web TV from IPTV, emphasizing user-generated content and a variety of revenue streams, mainly through advertising. Through statistical analysis and case studies, the research provides insights into the strategic variables determining successful web TV operations.