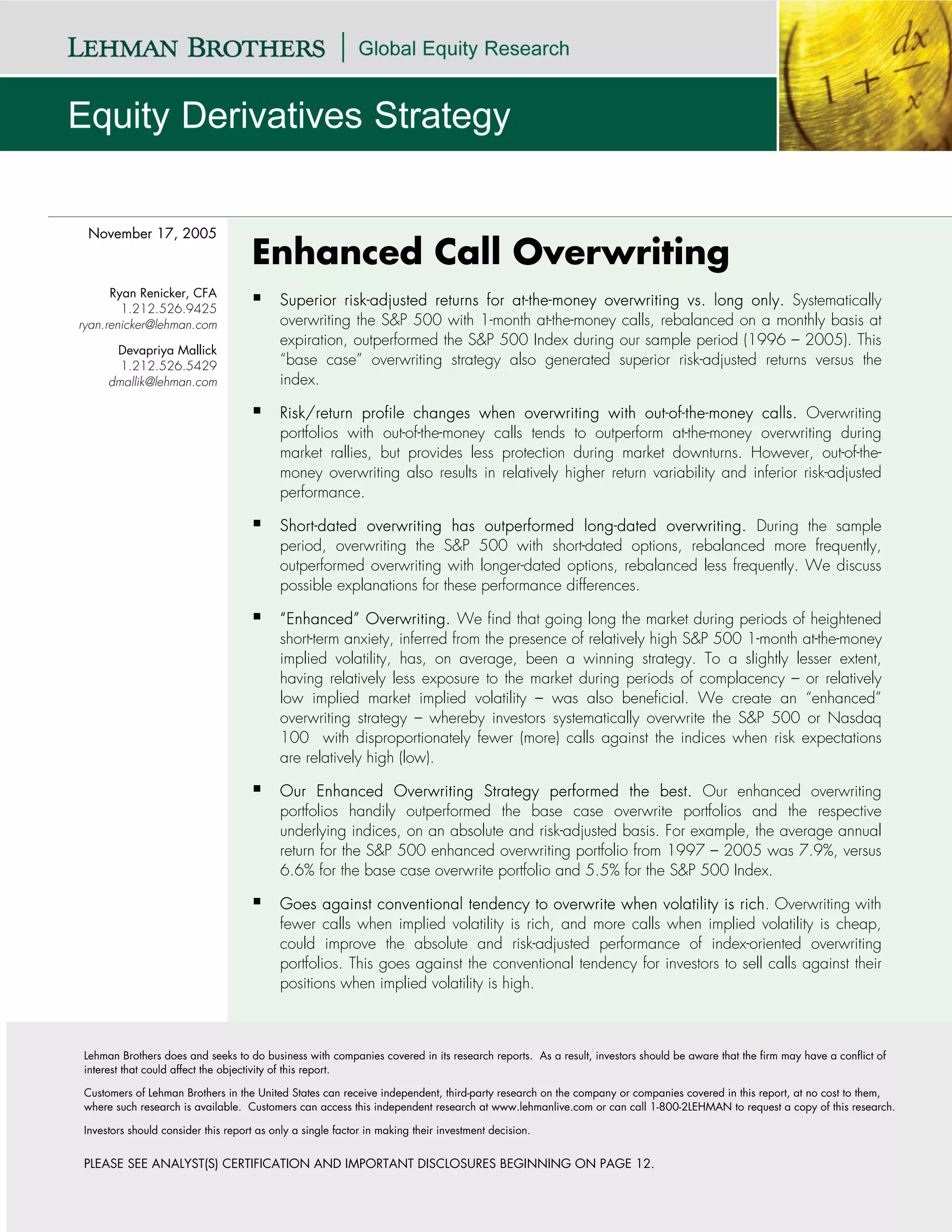

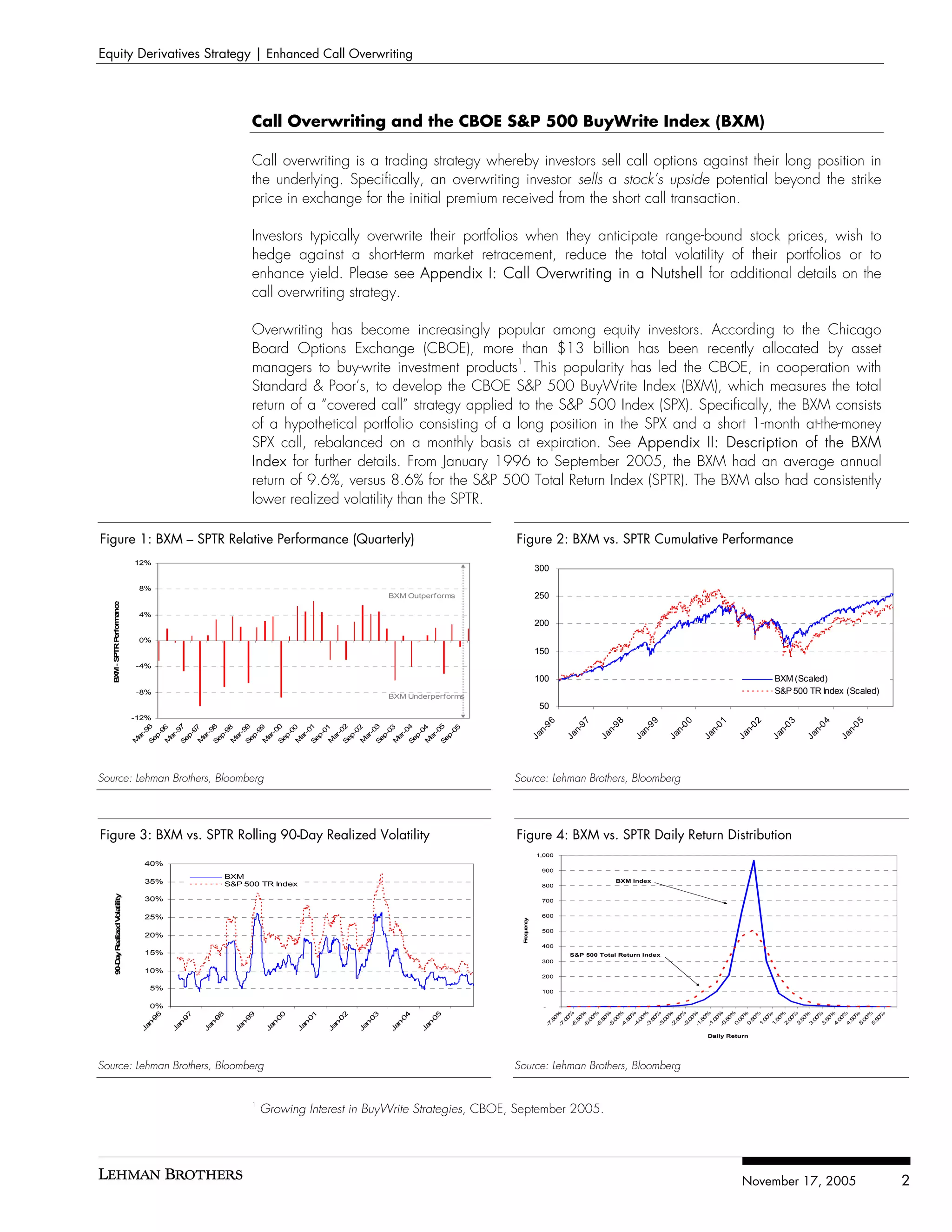

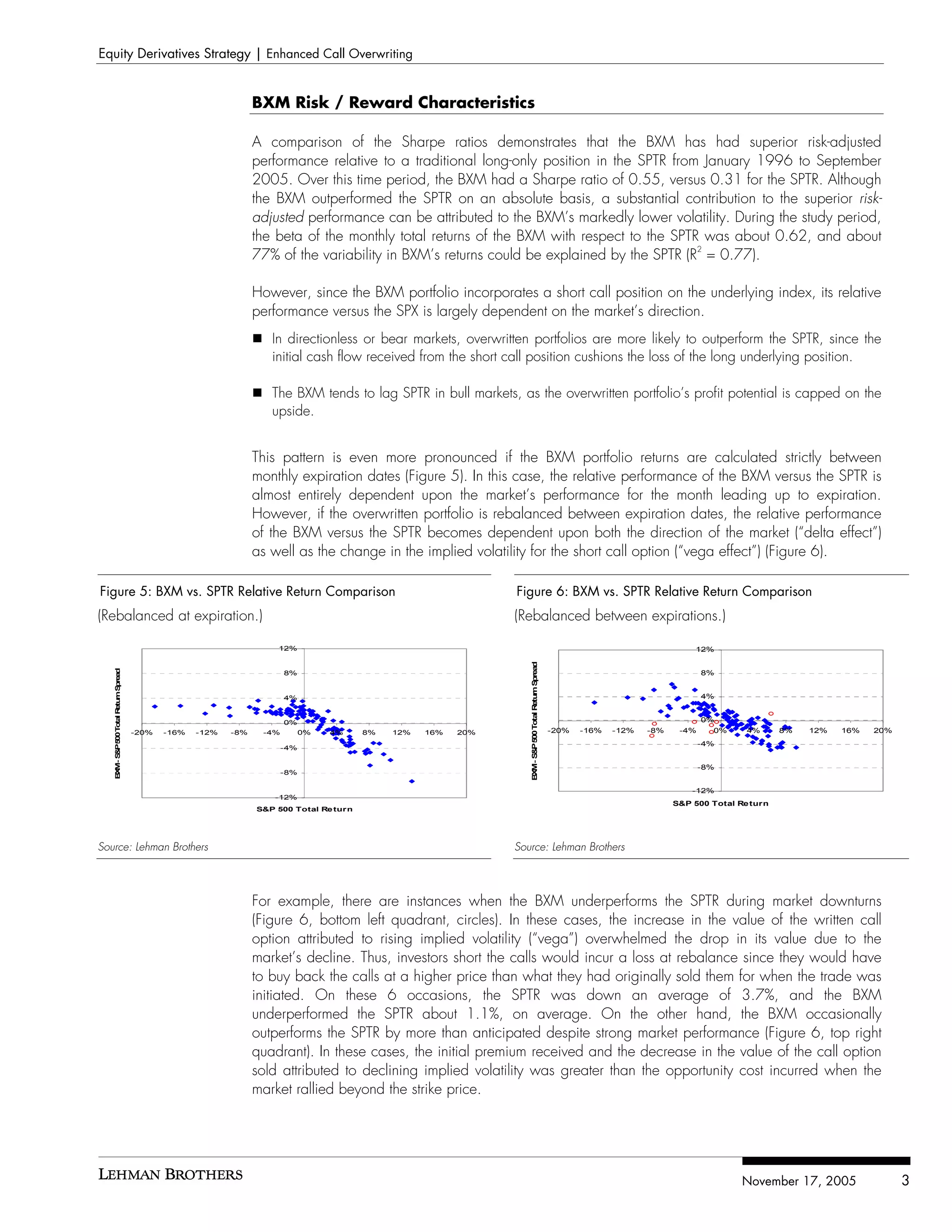

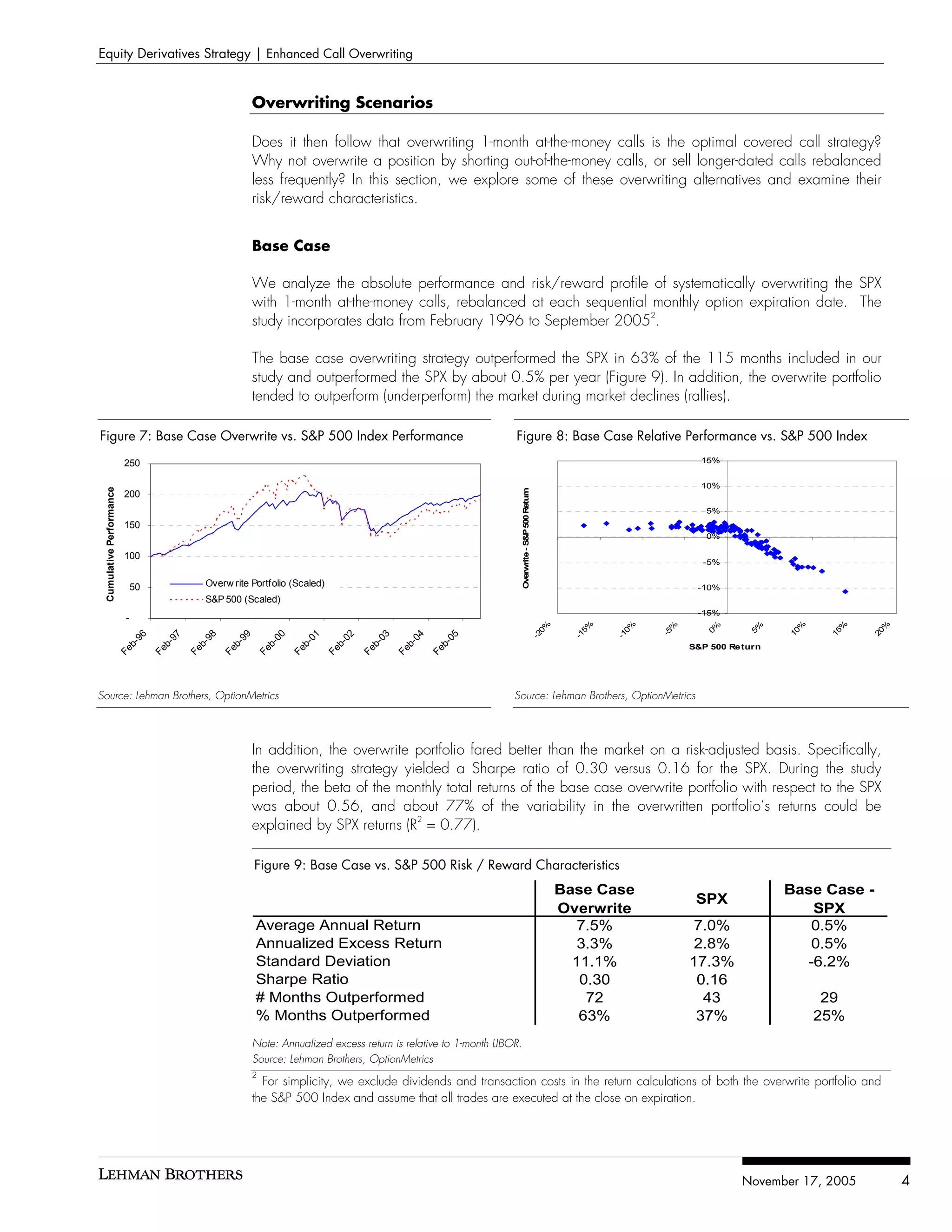

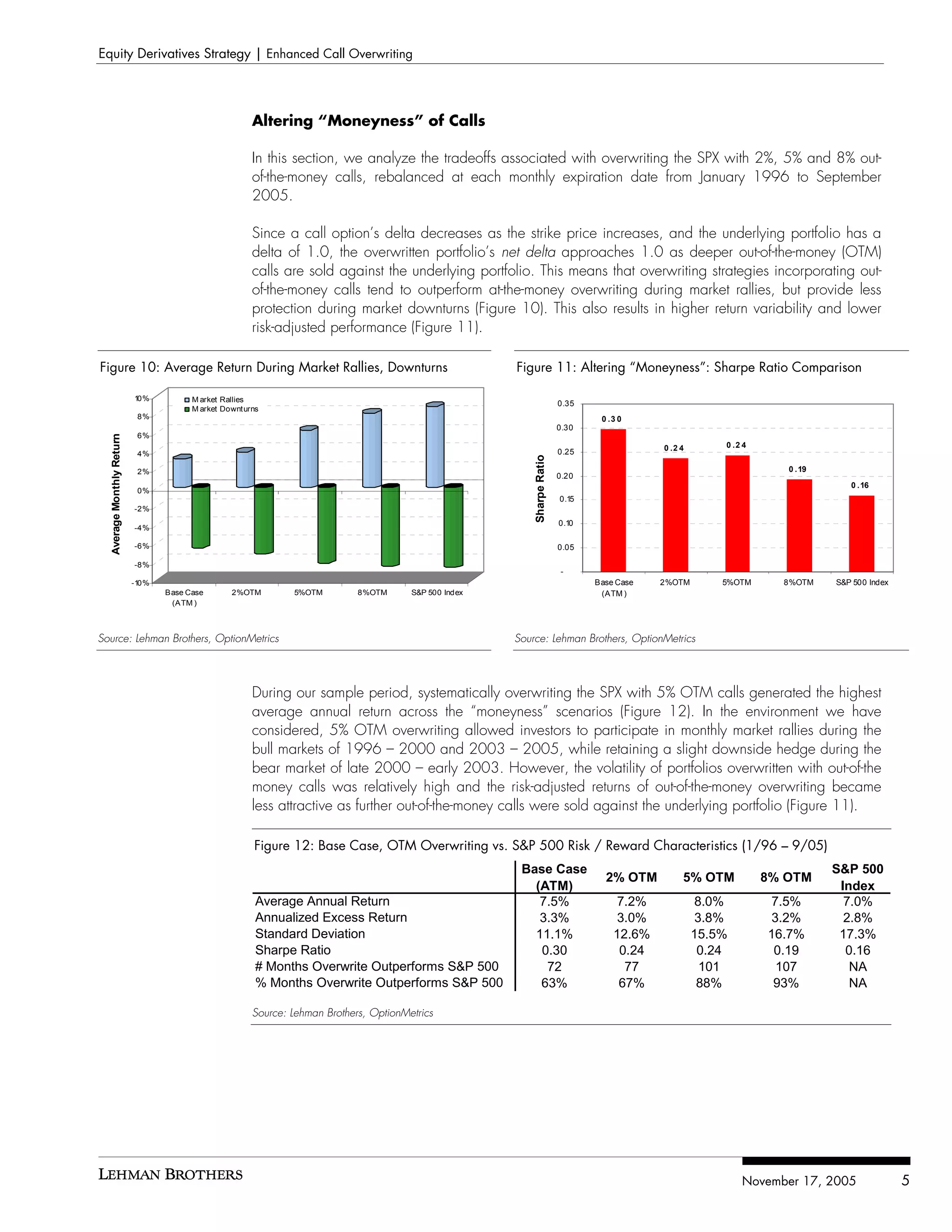

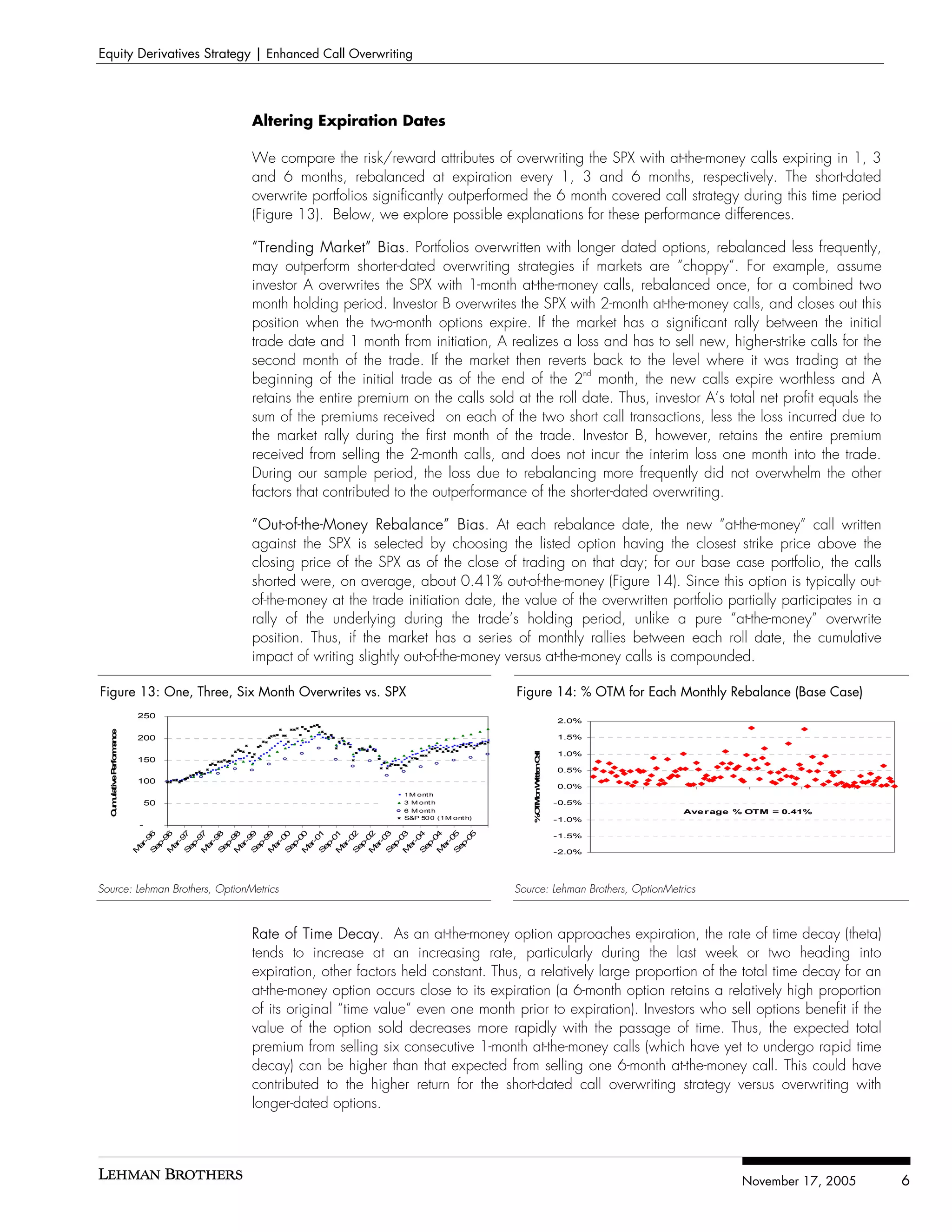

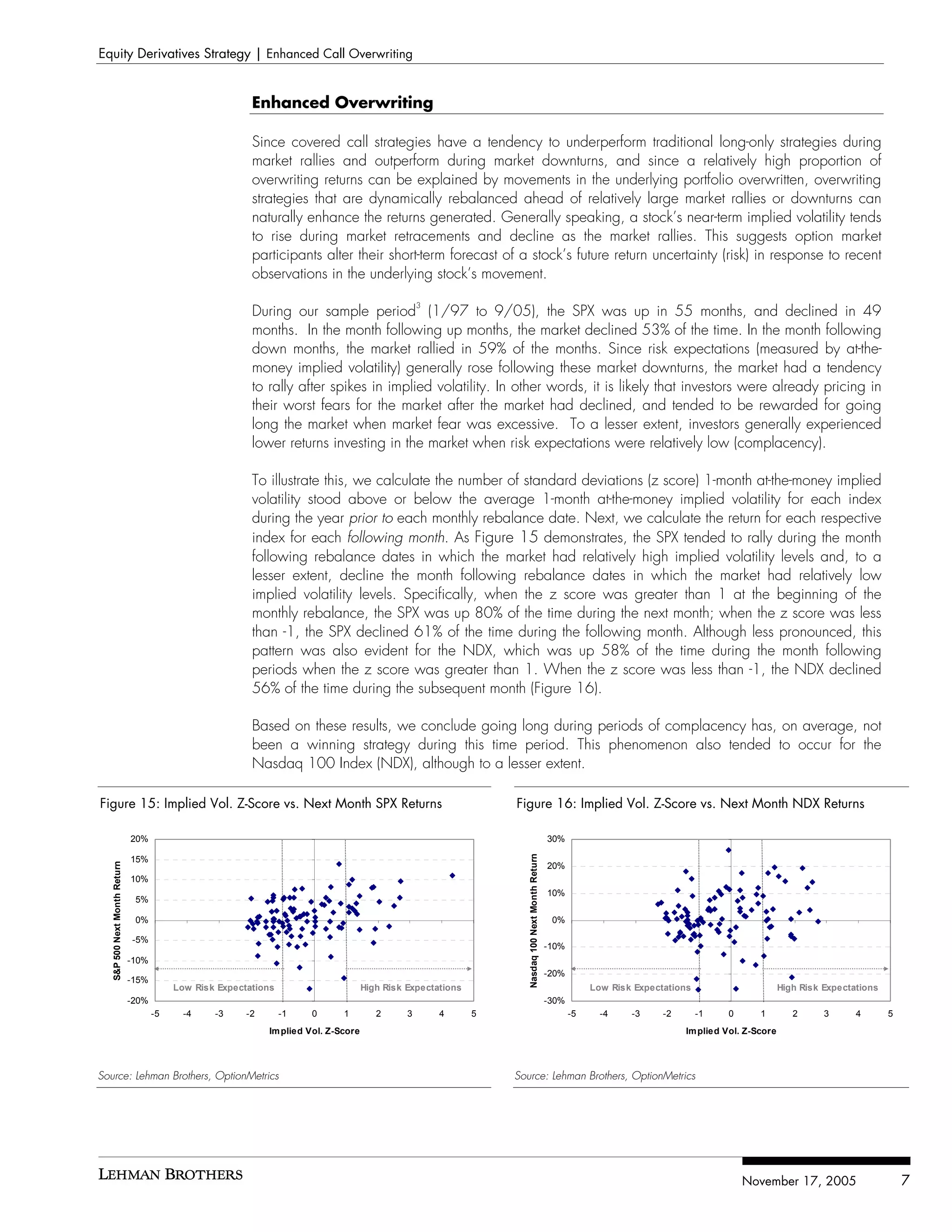

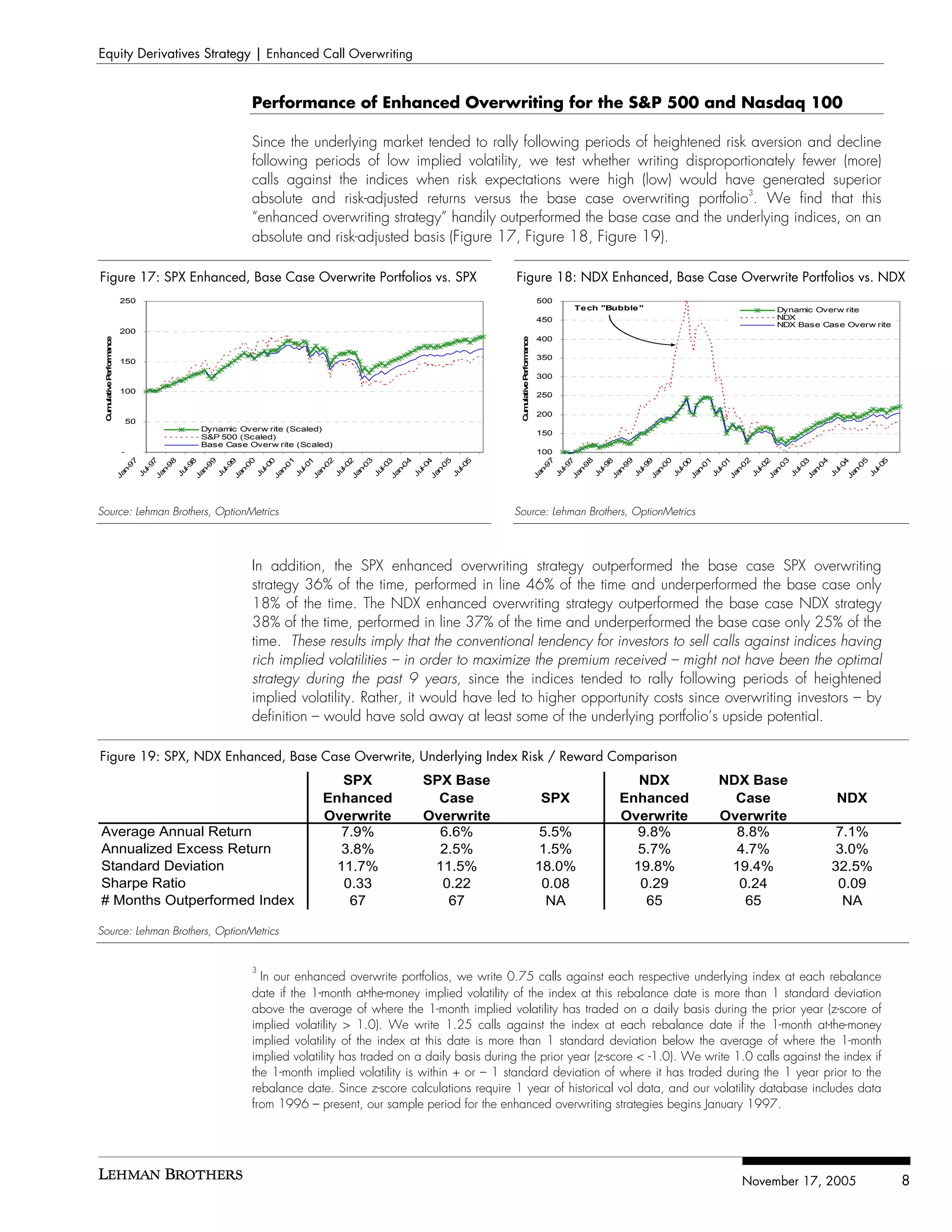

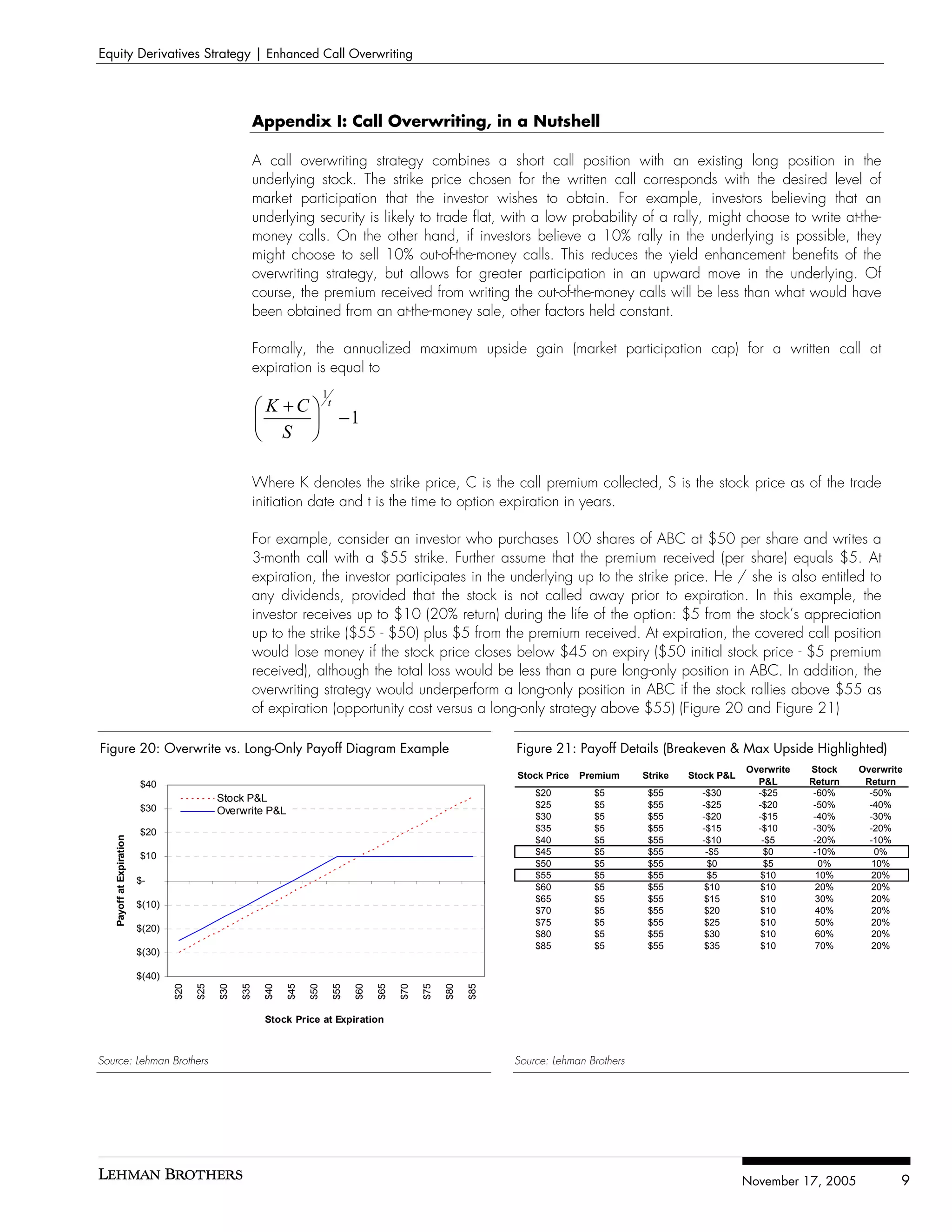

The document discusses the performance of enhanced call overwriting strategies compared to long-only investments in the S&P 500 from 1996 to 2005, highlighting that the enhanced strategy based on volatility levels provided superior risk-adjusted returns. It notes that short-dated options tend to outperform longer-dated options, and that while at-the-money calls generally offer better downside protection, out-of-the-money calls can yield higher returns during market rallies but with increased variability. Overall, the findings support a tailored approach to options overwriting that optimizes performance based on market conditions.