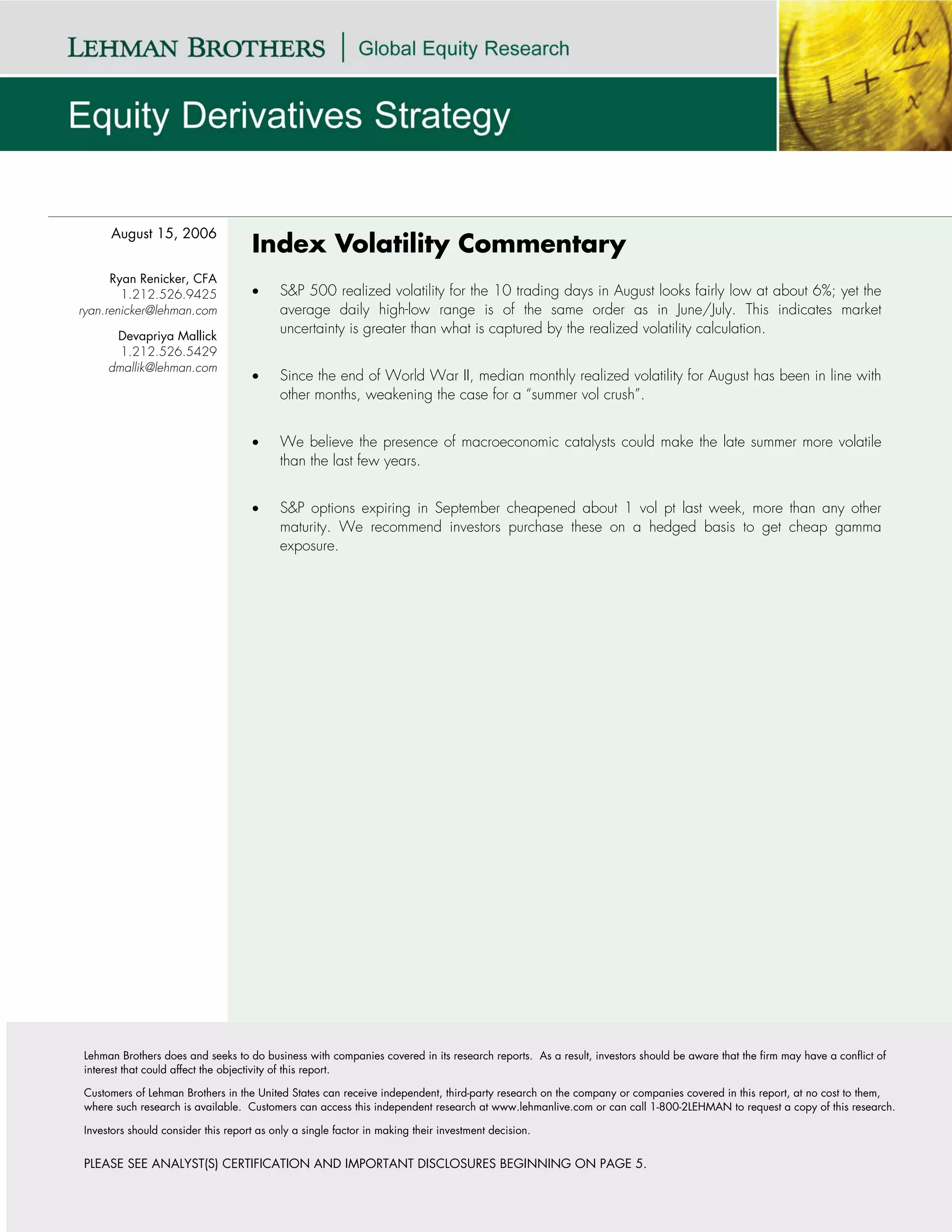

1) Realized volatility of the S&P 500 over the past 10 days was around 6%, but the average daily trading range was similar to June/July, indicating greater uncertainty than realized volatility captures.

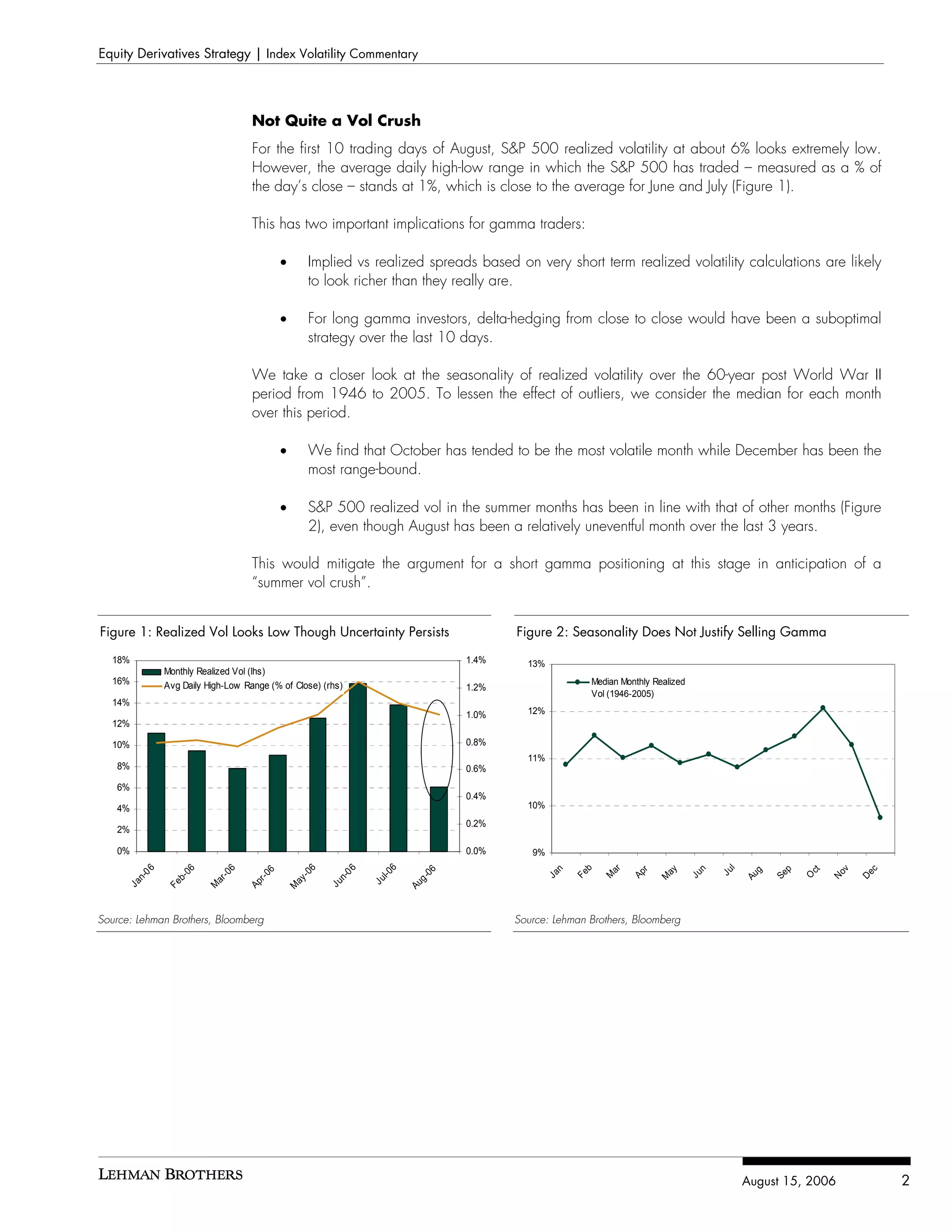

2) Looking at median monthly realized volatility since 1946, August volatility has typically been in line with other months, weakening the case for an expected "summer volatility crush".

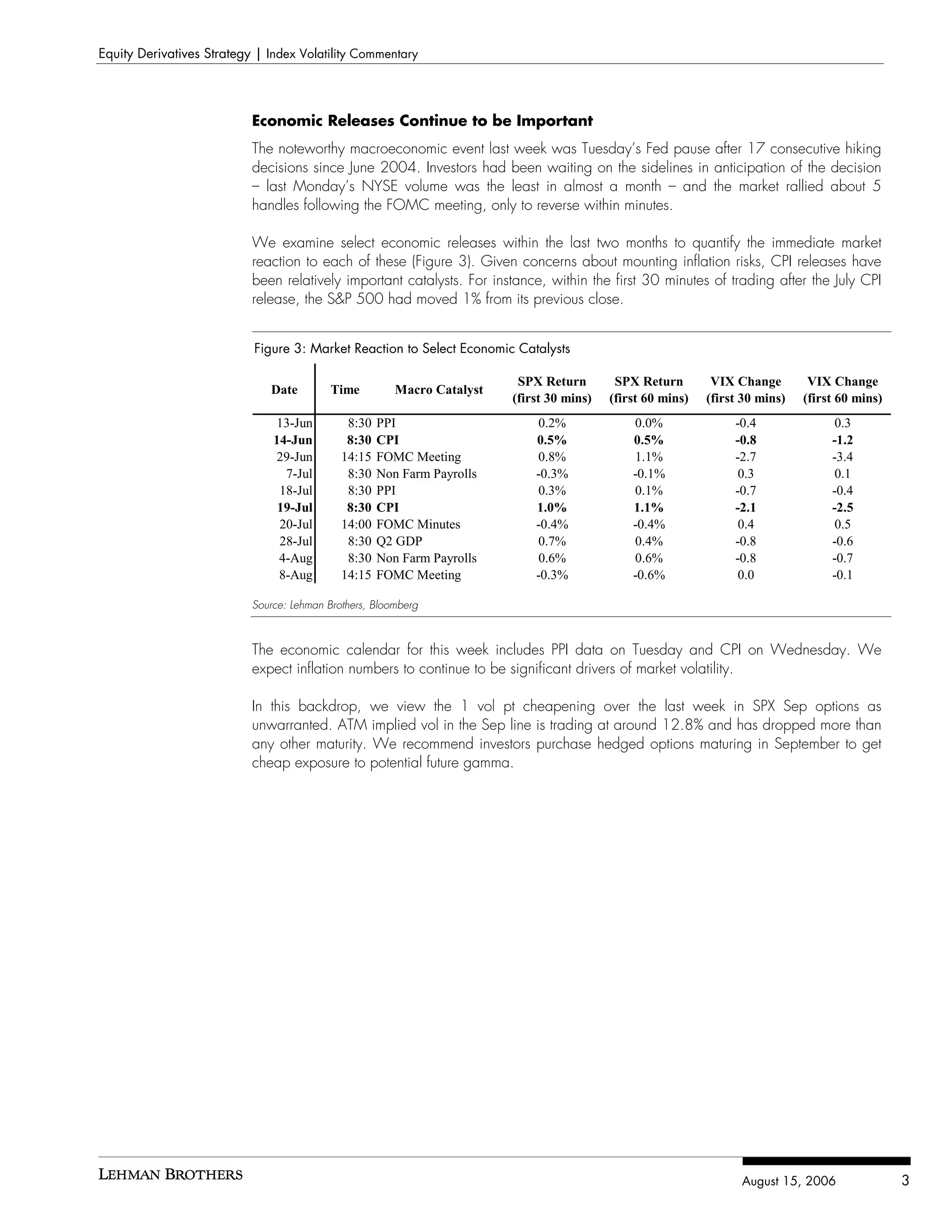

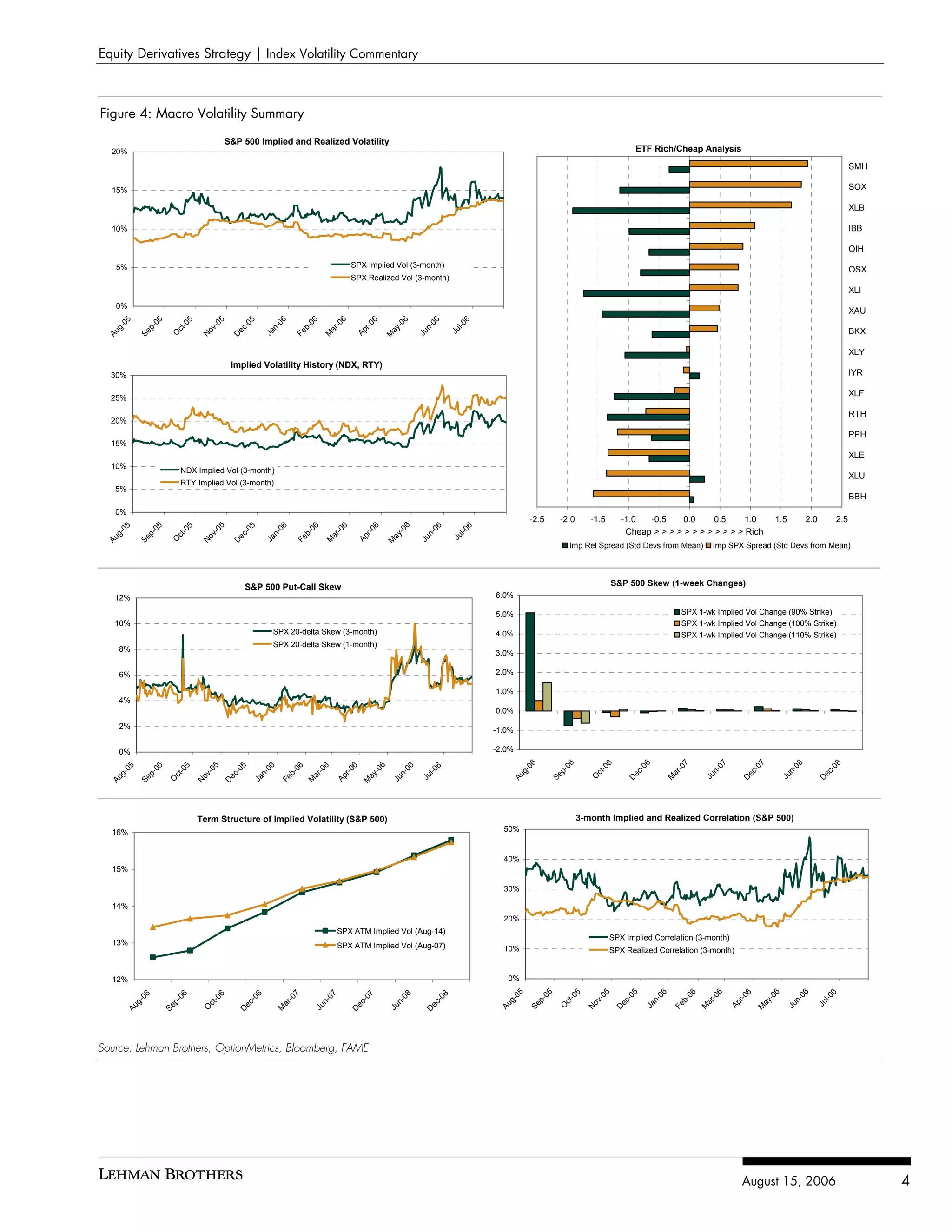

3) The author believes upcoming macroeconomic data releases could increase volatility from the low levels of the past few summers. They recommend purchasing hedged S&P 500 options expiring in September, which recently cheapened more than other maturities.