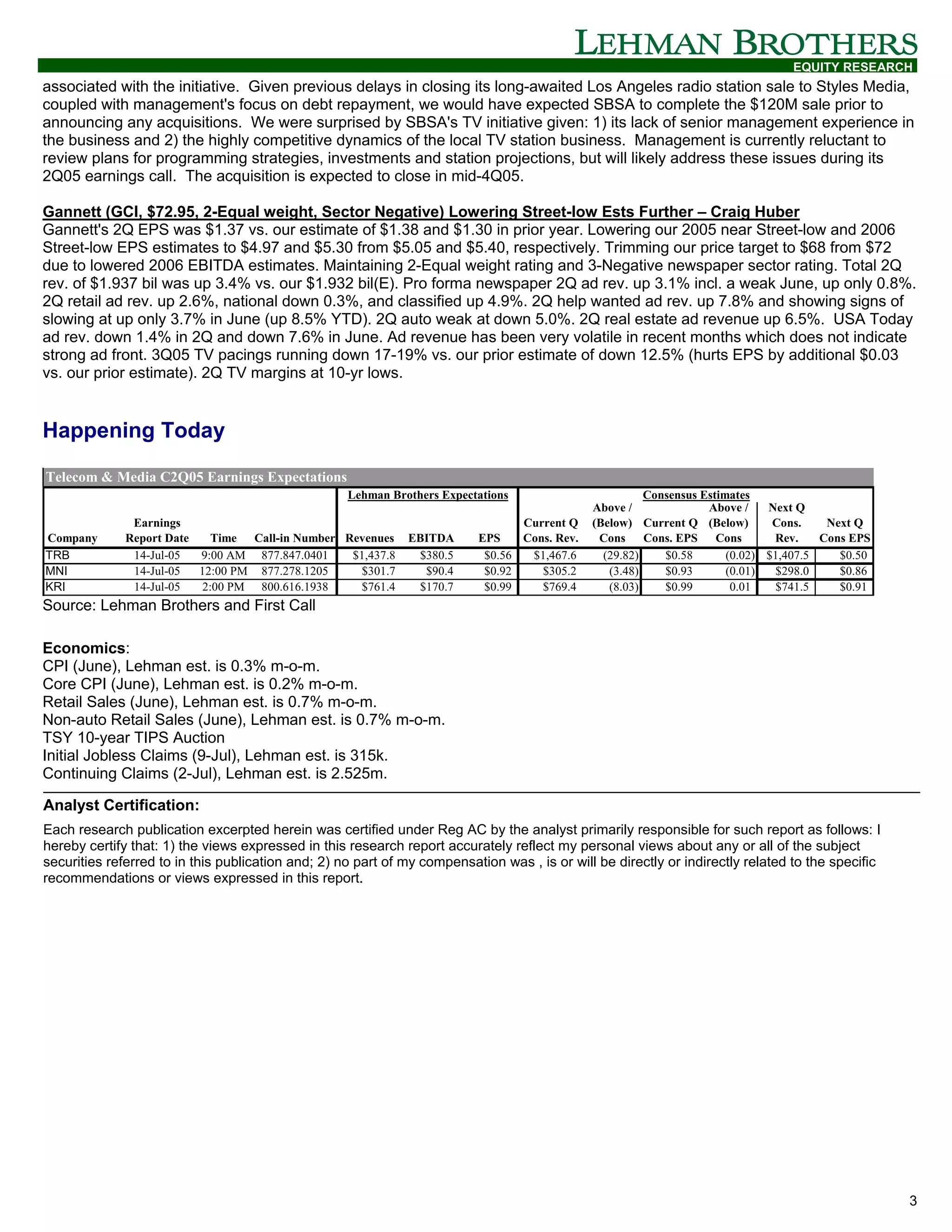

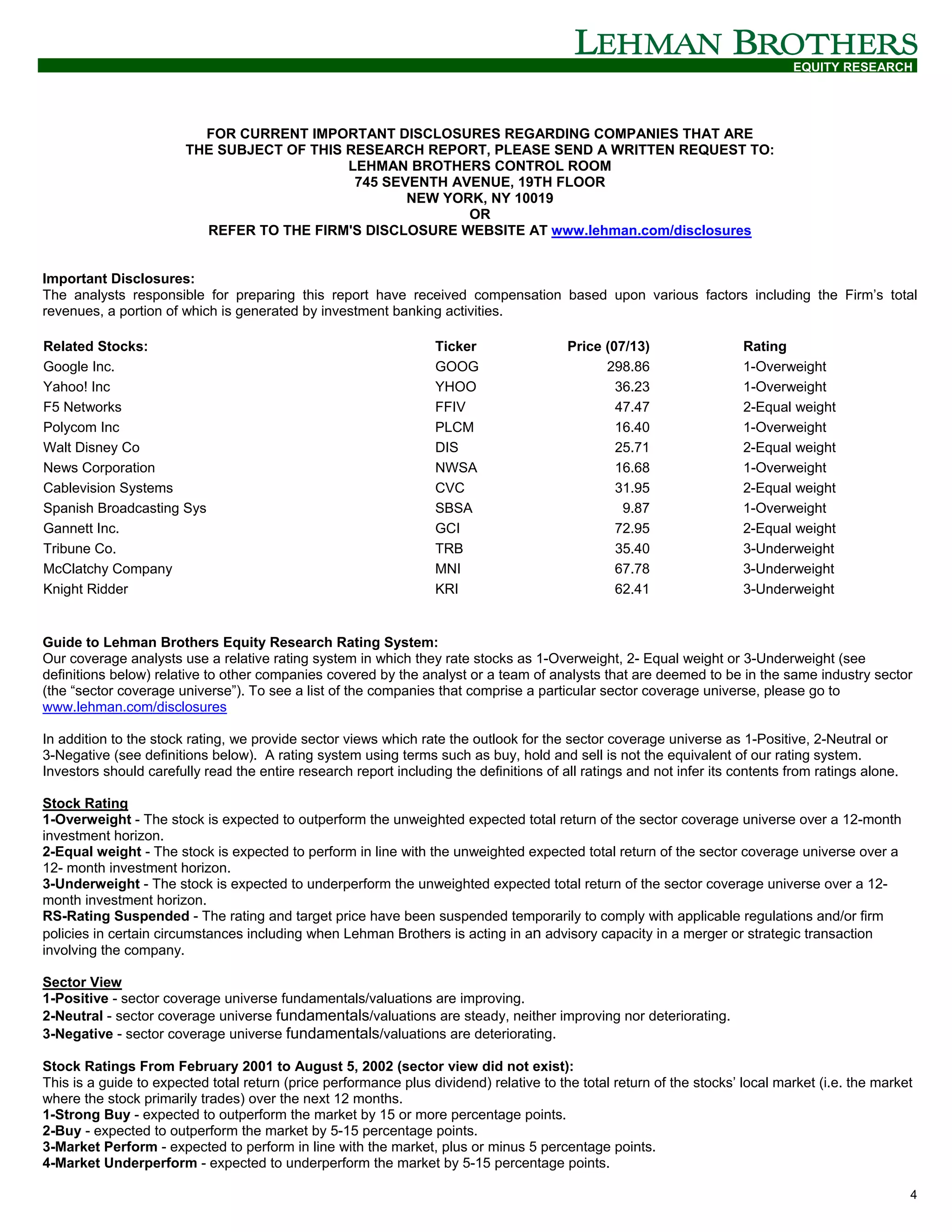

The document provides an analysis of the telecom and media sectors, highlighting positive earnings expectations for key companies such as Google and Yahoo! based on growth prospects and strategic initiatives. It notes raised revenue and EBITDA estimates for Google, potential growth for Yahoo! from branded advertising, and a strategic acquisition by Spanish Broadcasting System. Additionally, the document addresses challenges faced by companies like Gannett and Cablevision due to competitive pressures and litigation outcomes.