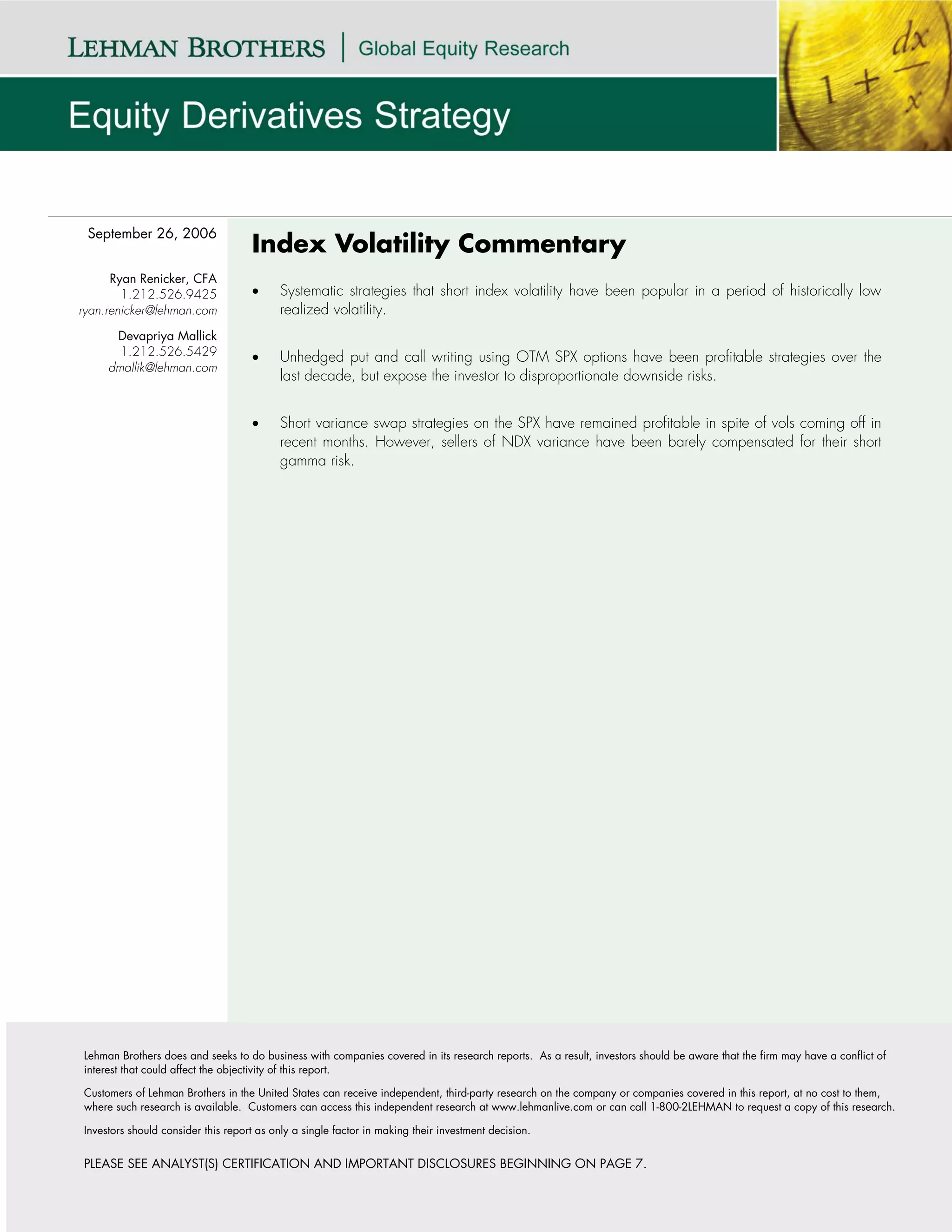

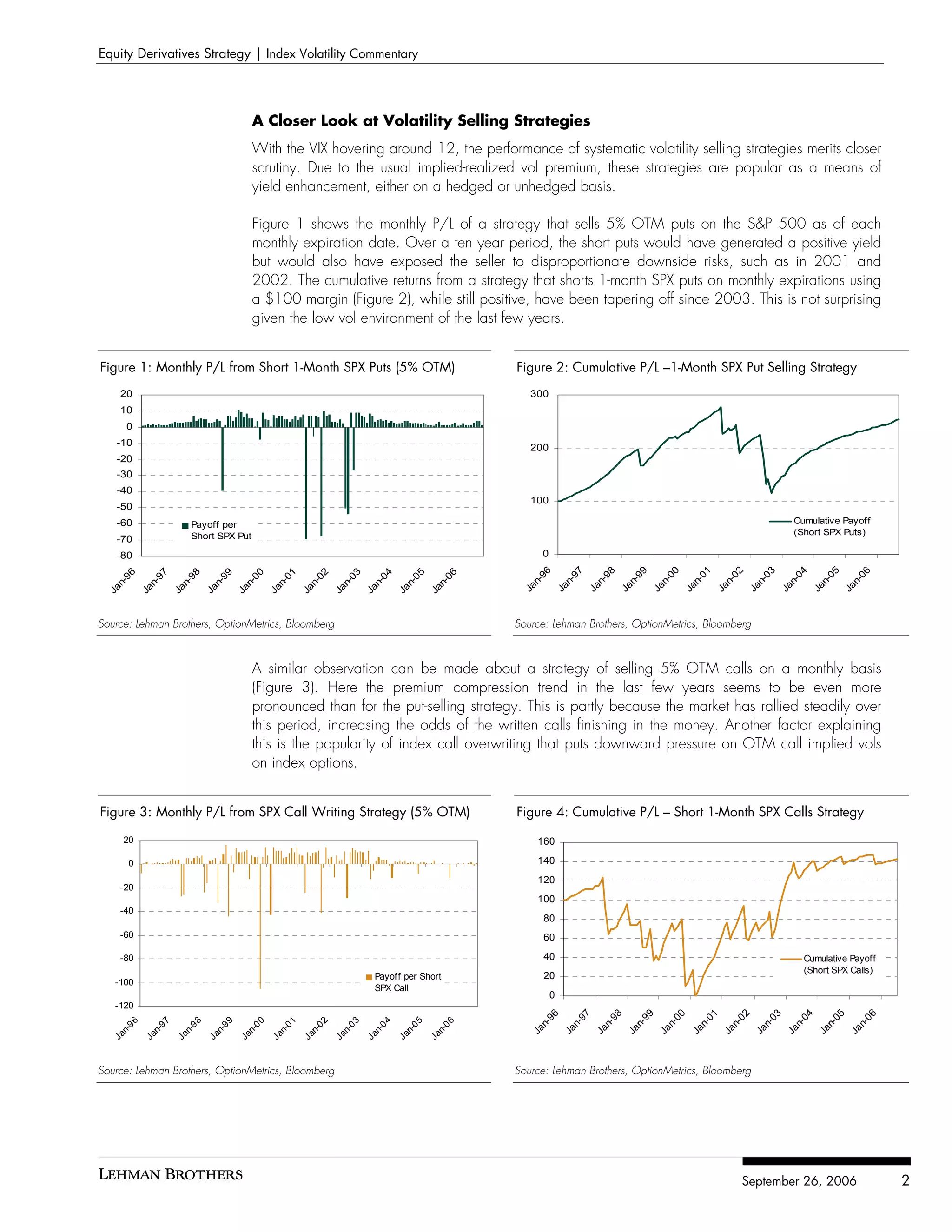

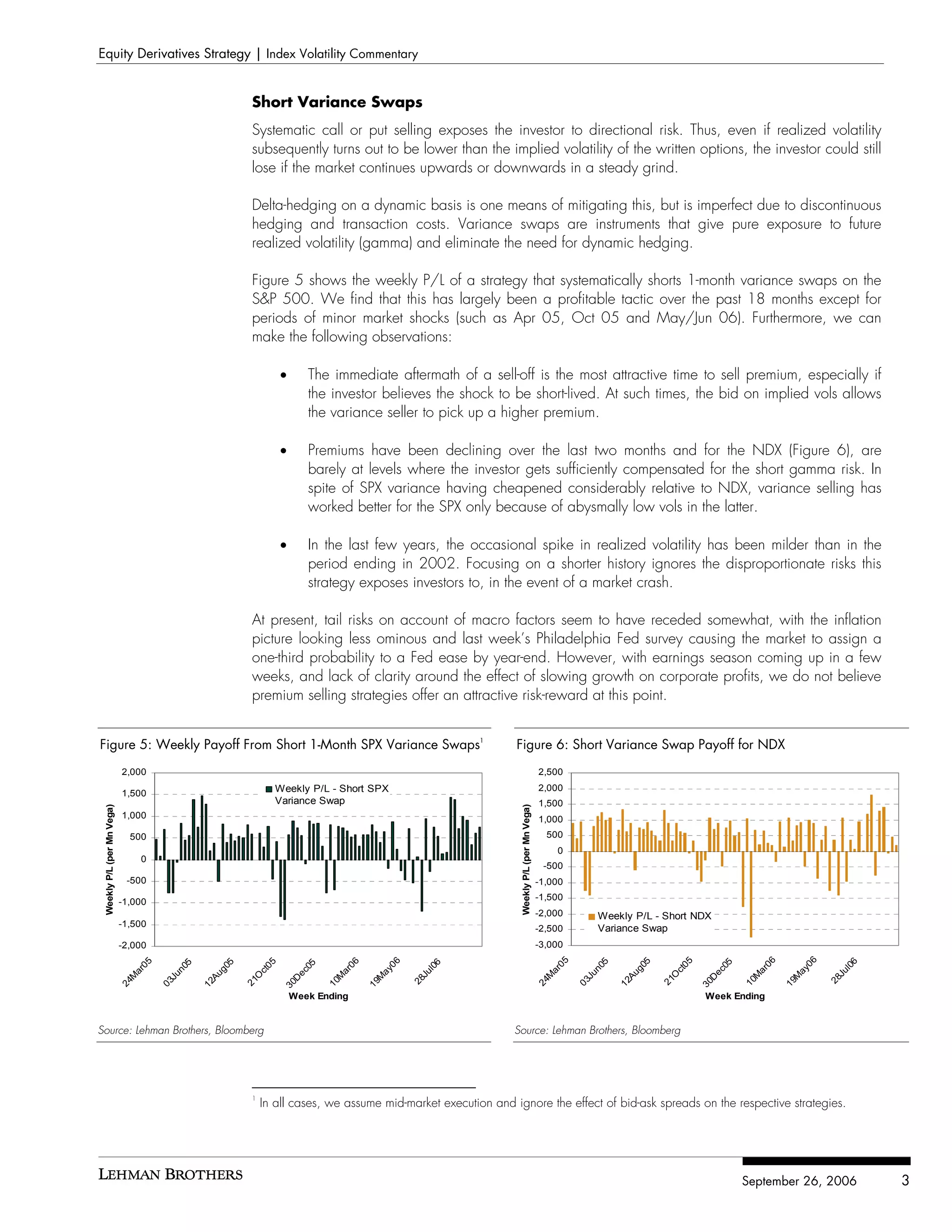

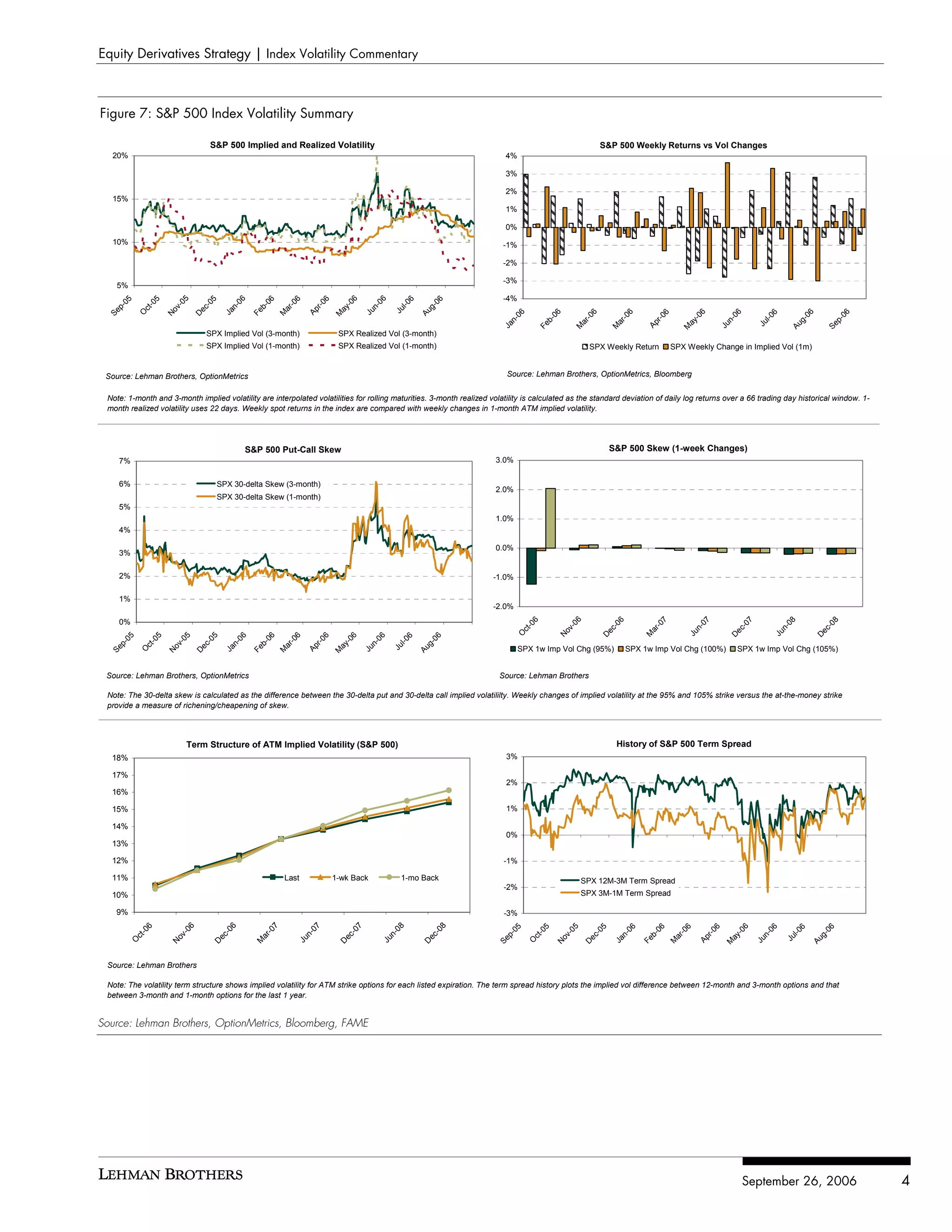

The document provides an analysis of index volatility strategies, particularly focusing on systematic volatility selling that has gained popularity during historically low realized volatility periods. It discusses the profitability of various put and call writing strategies while highlighting the associated risks, particularly the potential for disproportionate downside exposure. Furthermore, it emphasizes the declining premiums for variance swapping in recent months and advises caution regarding volatility selling strategies due to uncertain market conditions ahead.