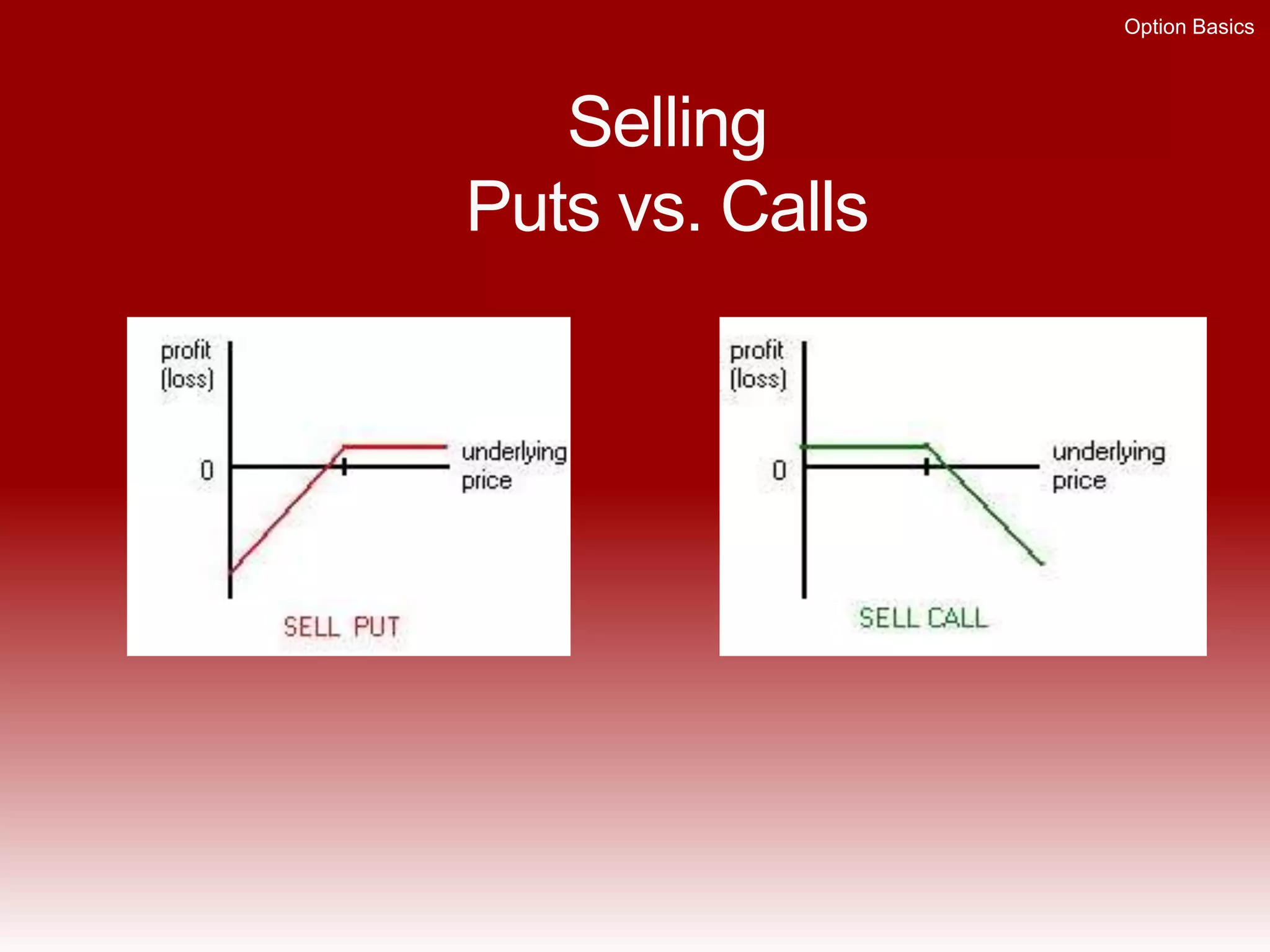

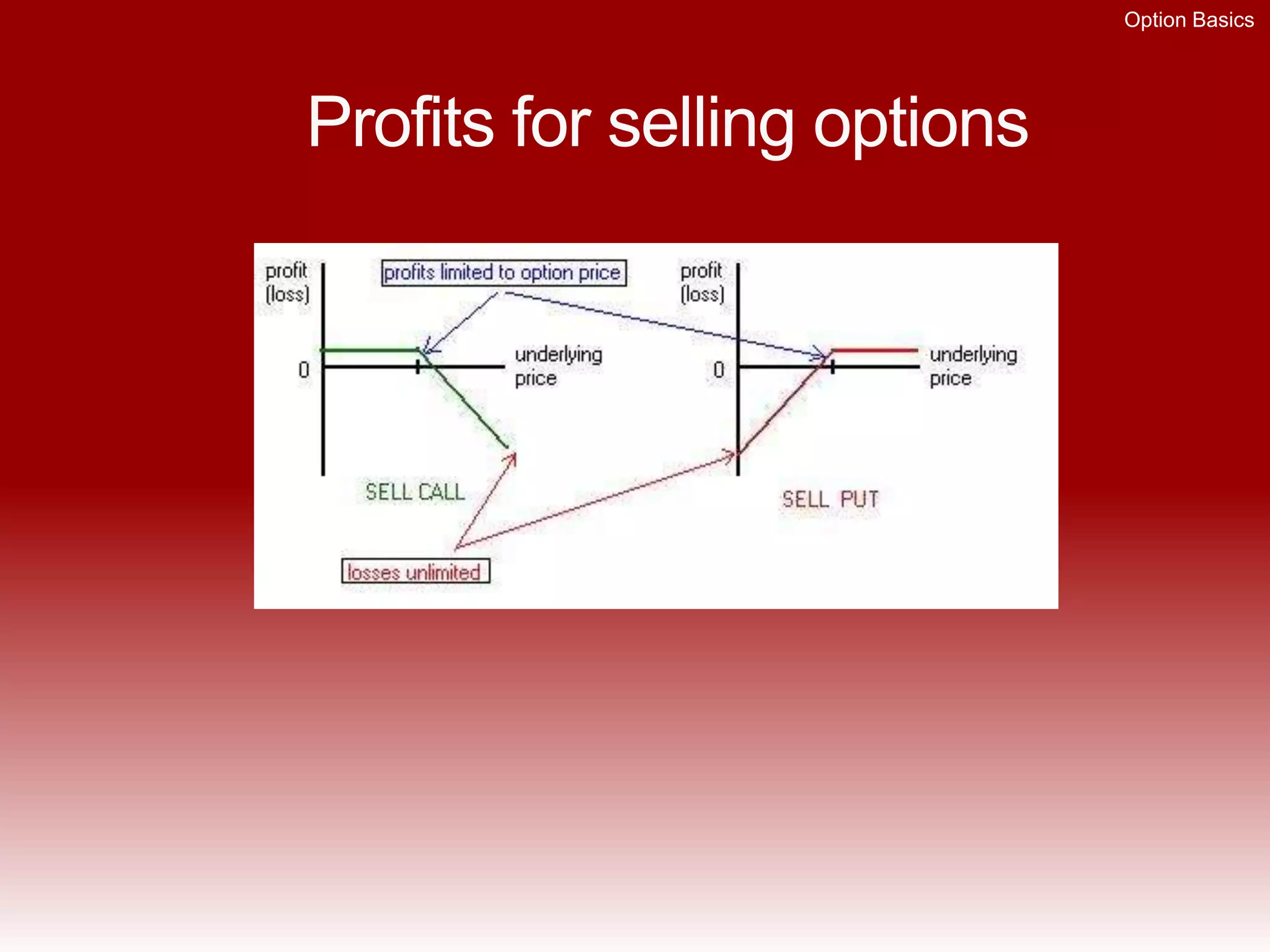

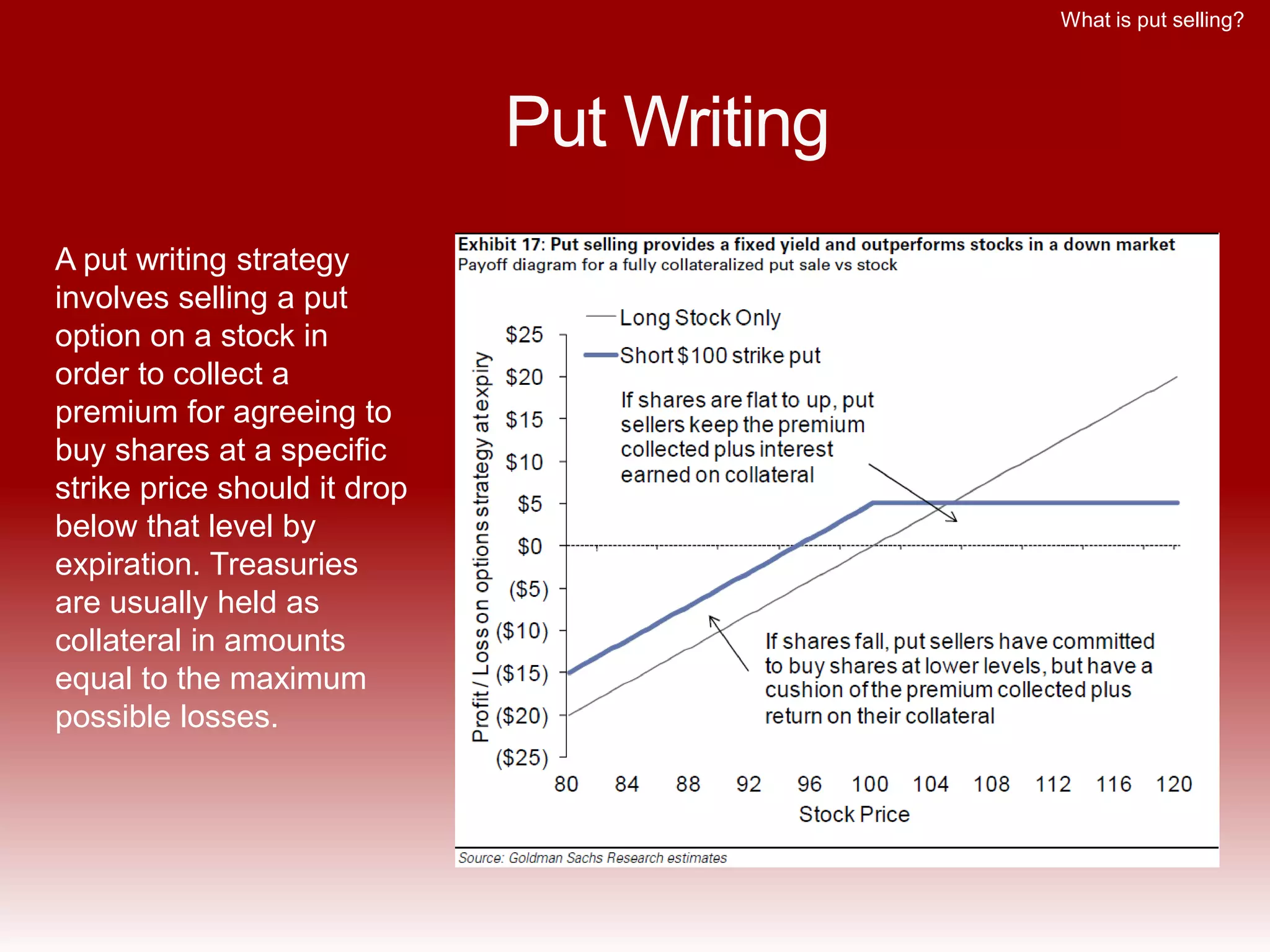

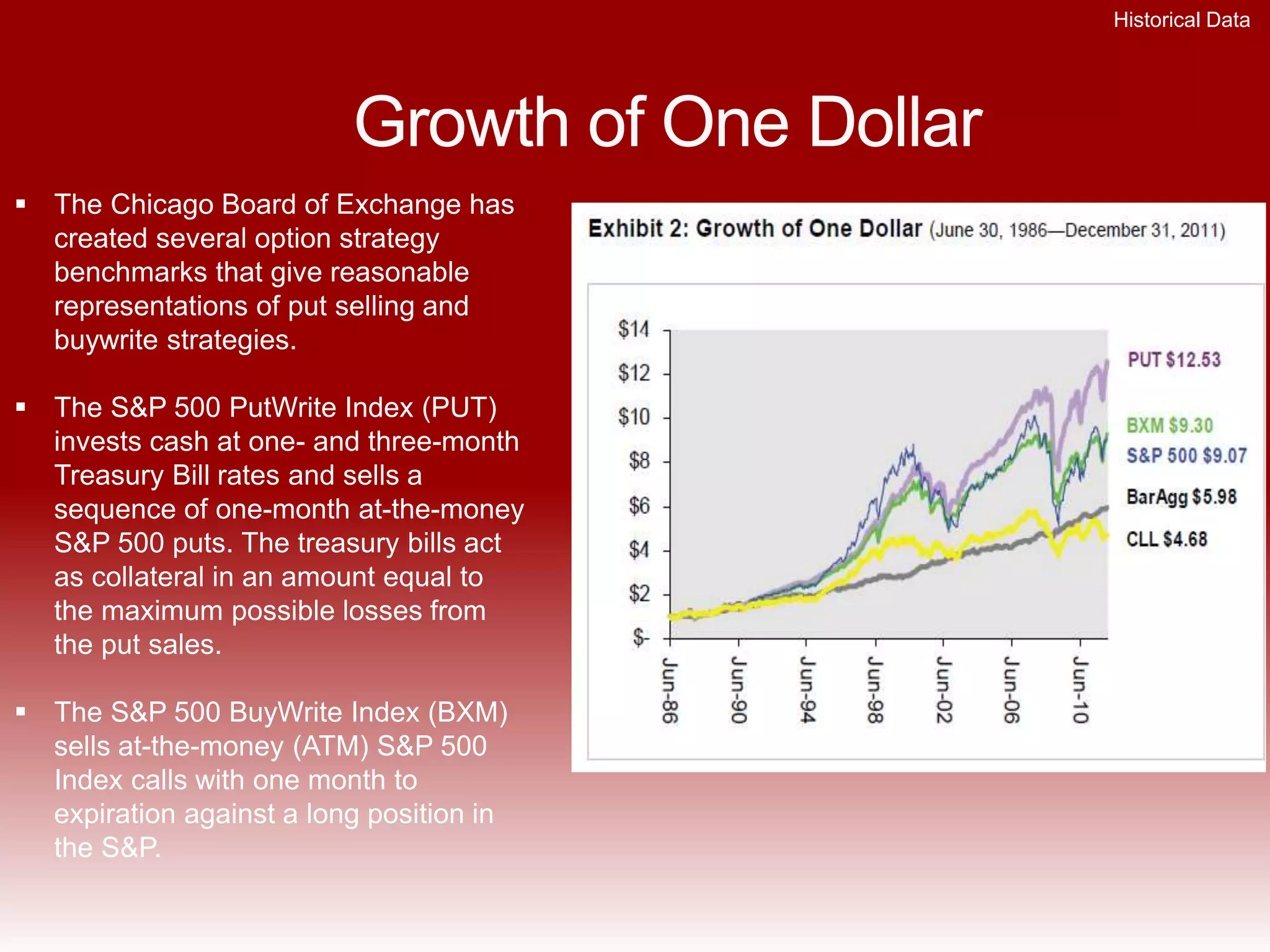

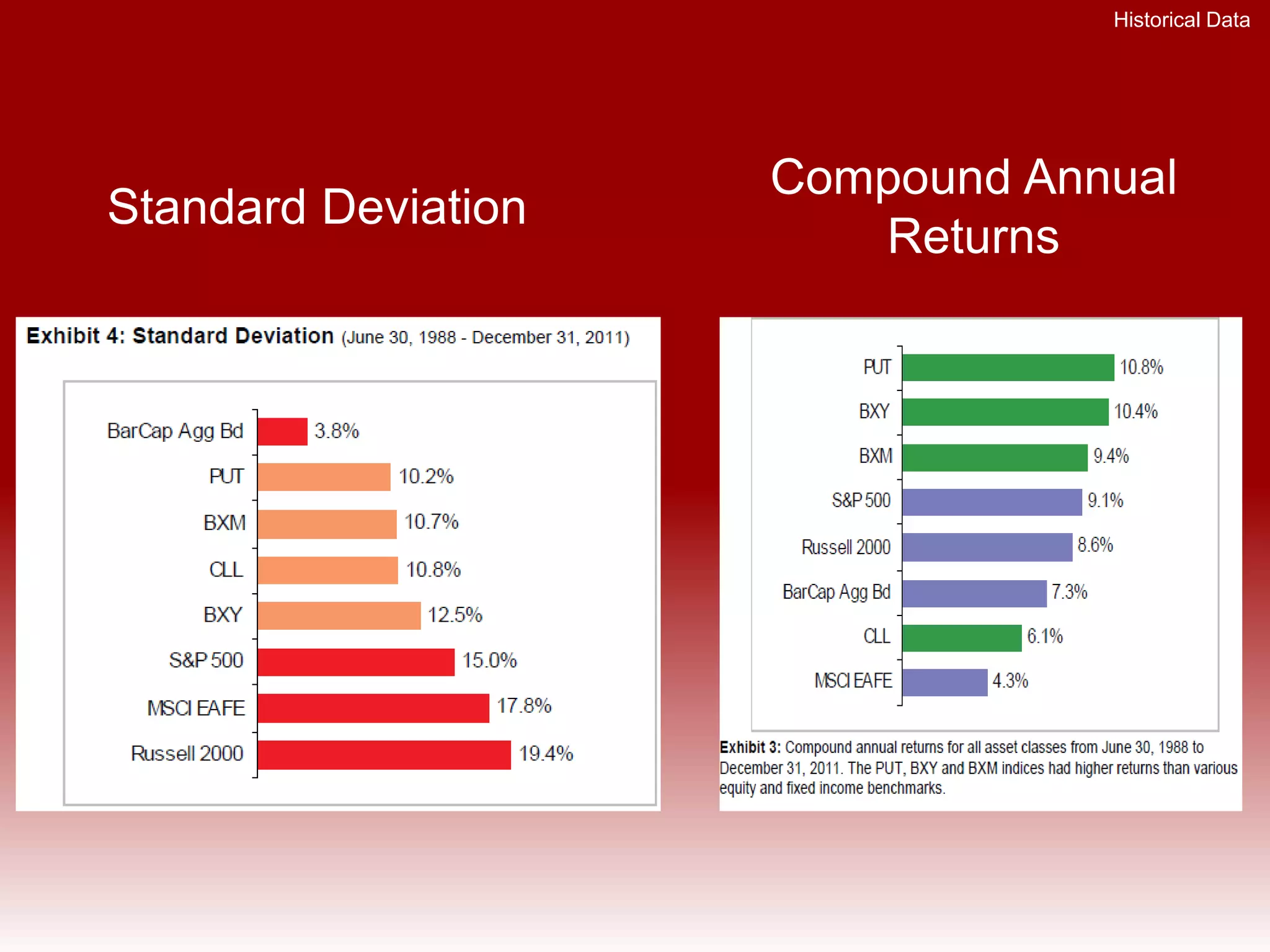

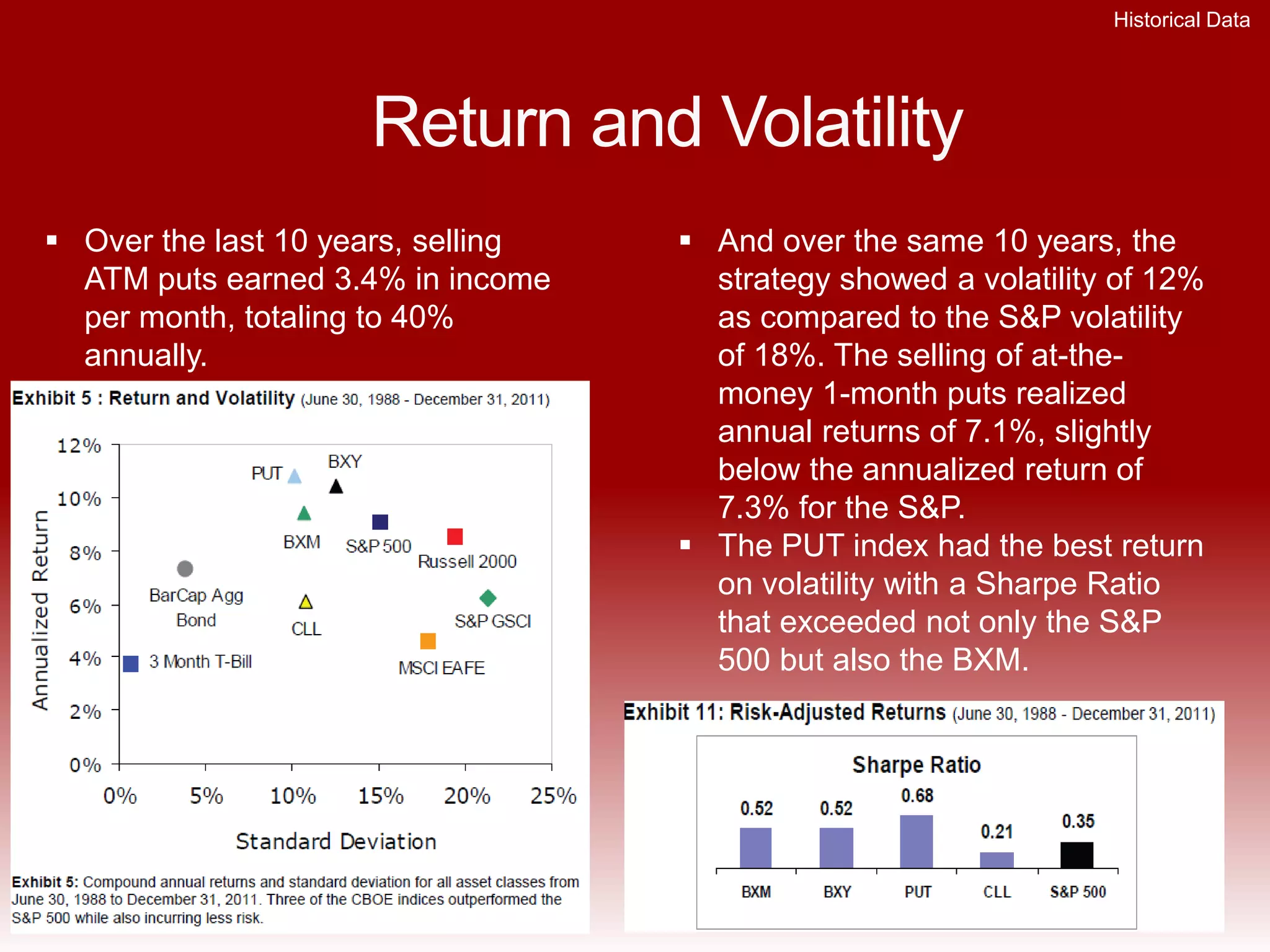

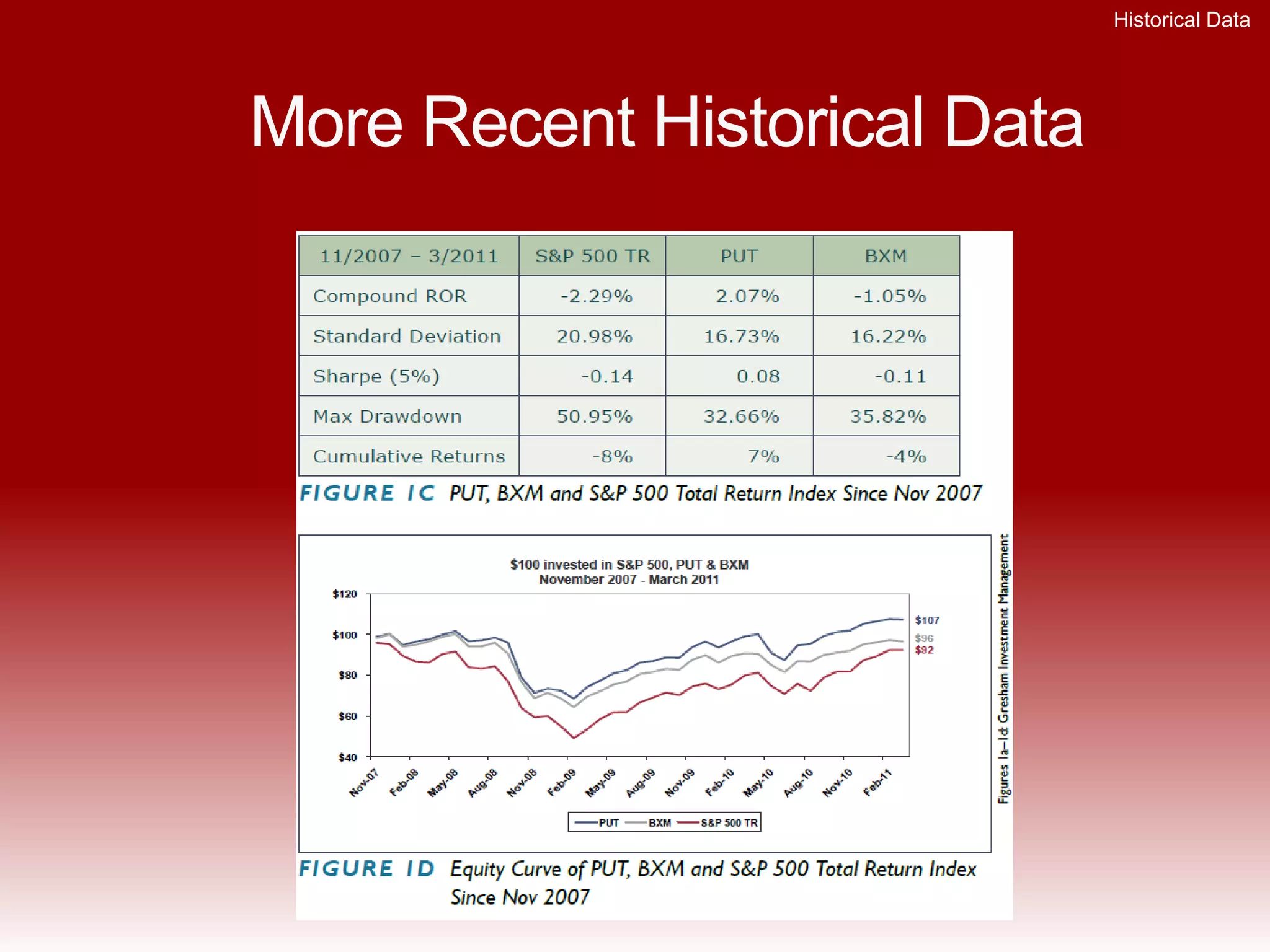

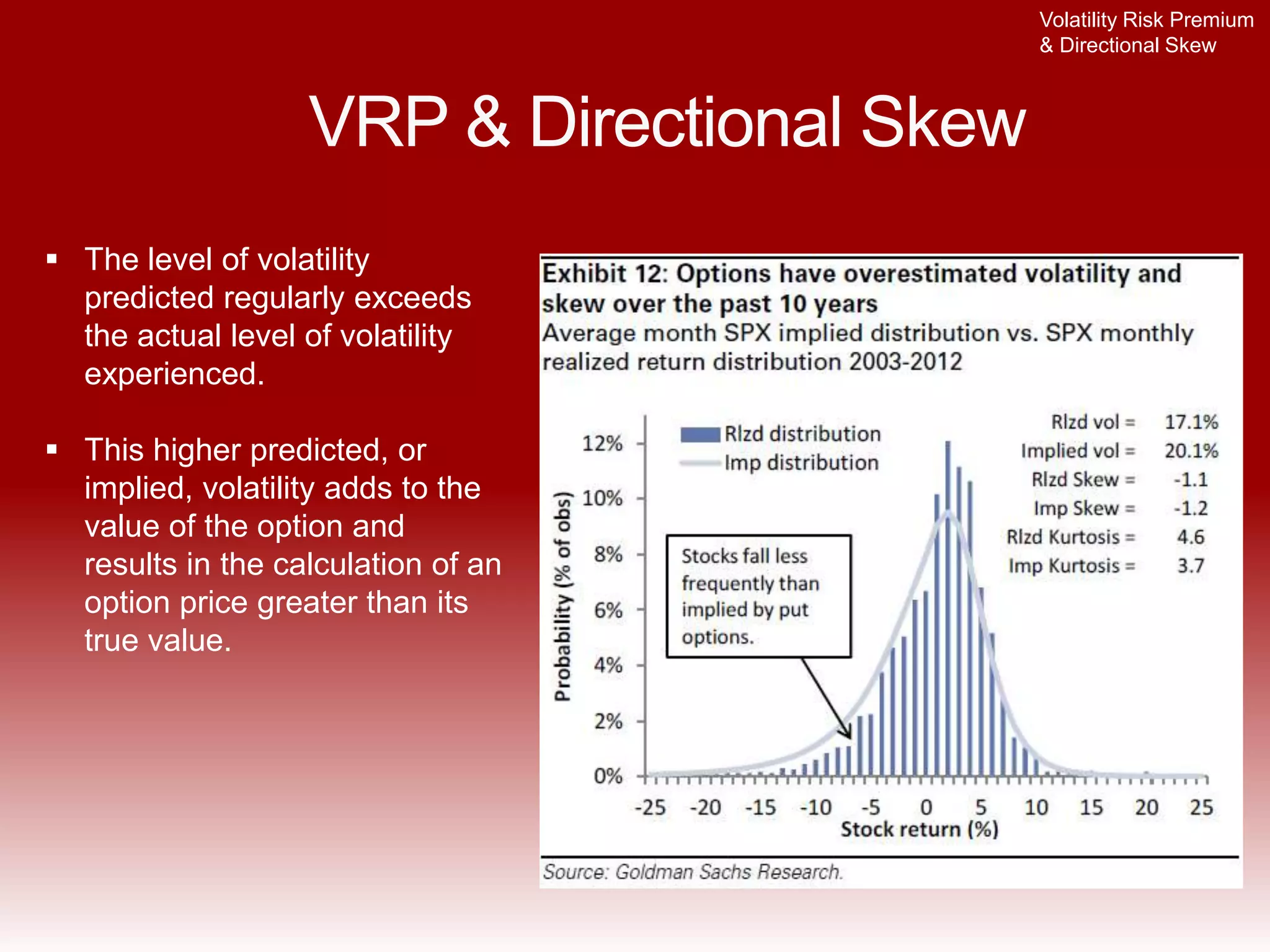

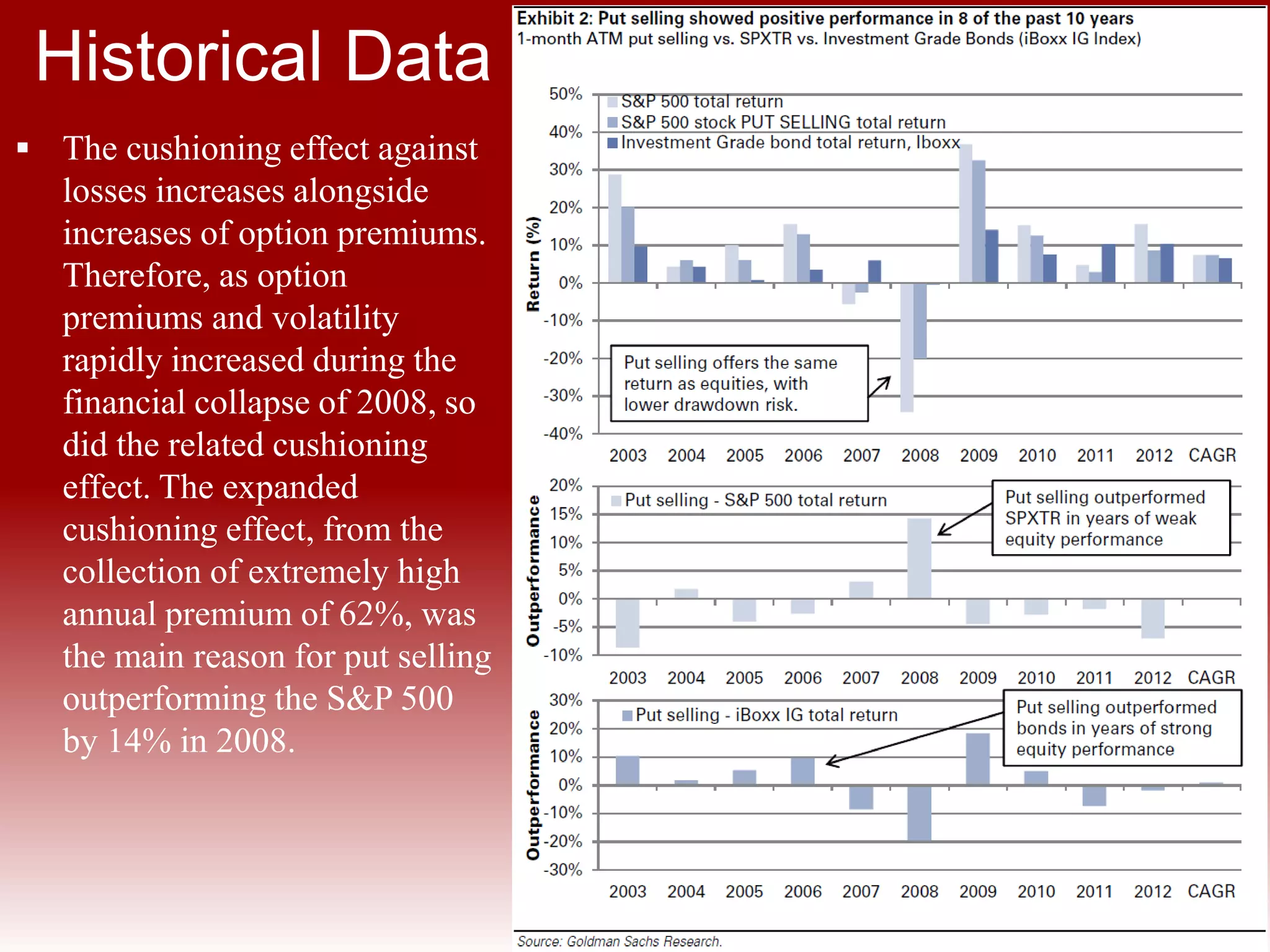

The document outlines a put writing strategy as an alternative to traditional equity allocation, explaining the basics of options, the goals of put selling, and the advantages of this strategy compared to covered calls. It highlights historical performance data showing that put writing can generate competitive returns with lower volatility and risks, particularly during market downturns. Key findings indicate that the strategy is effective in monetizing the volatility risk premium, offering a robust cushion against losses while collecting higher premiums in volatile markets.