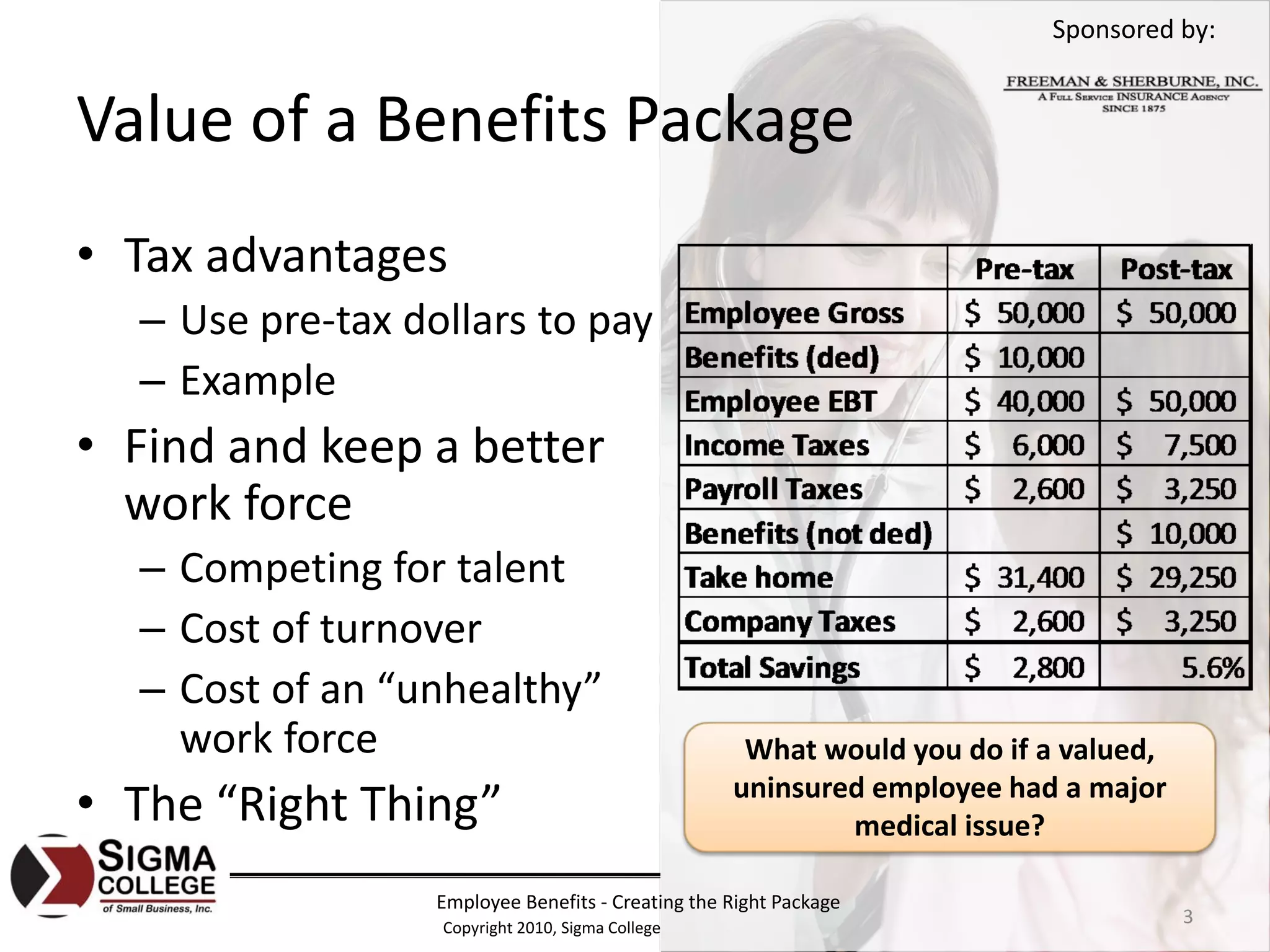

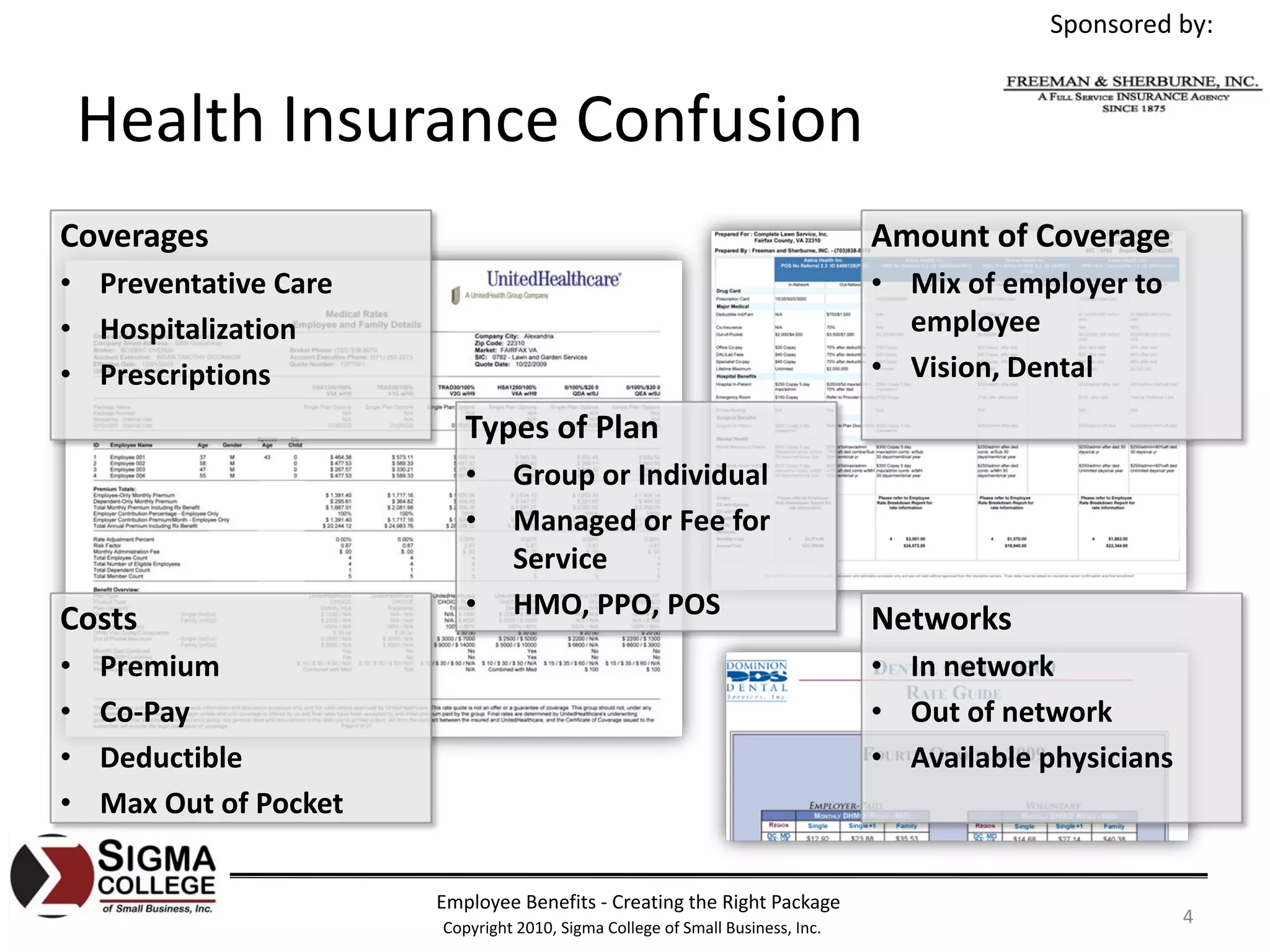

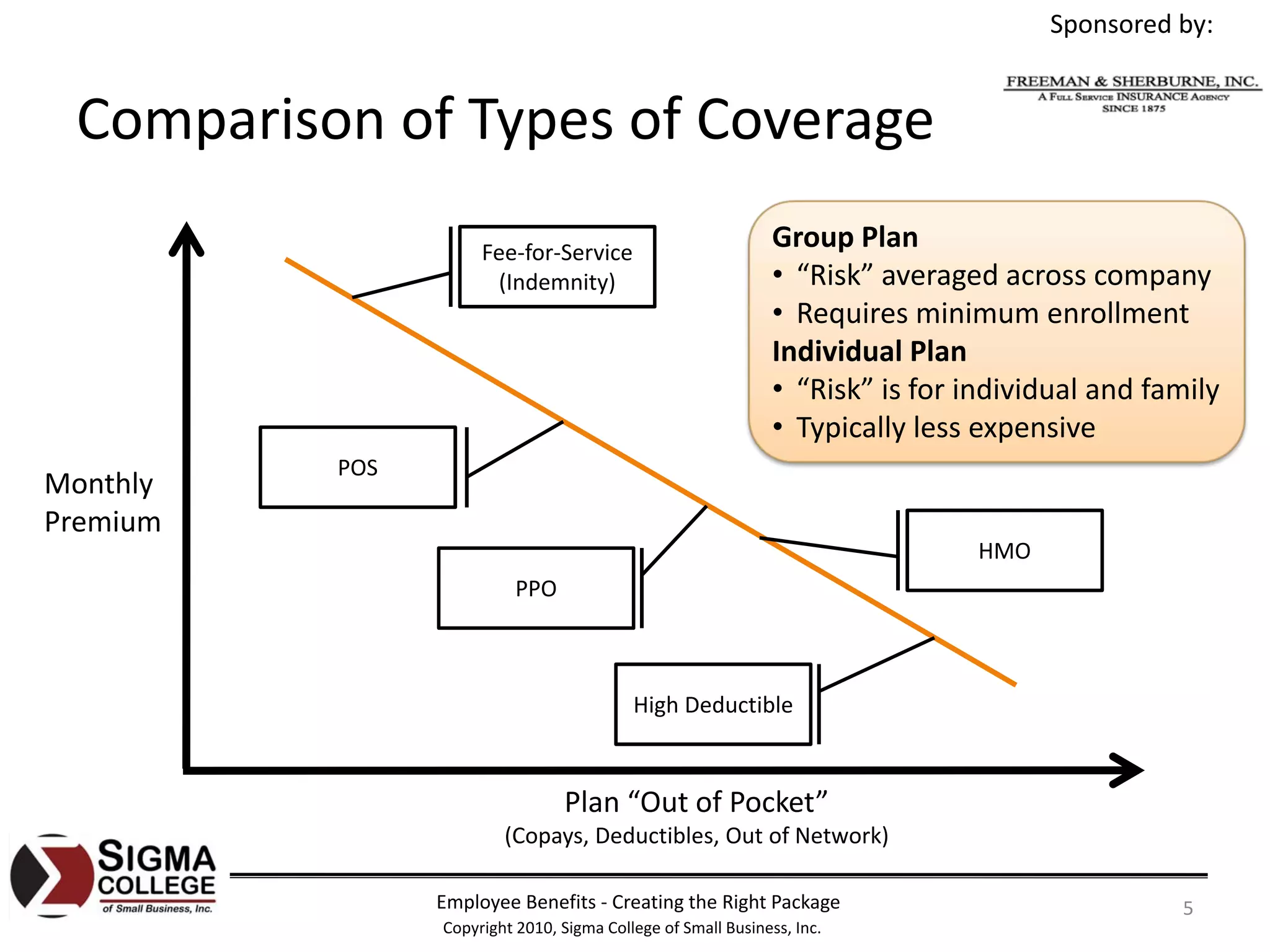

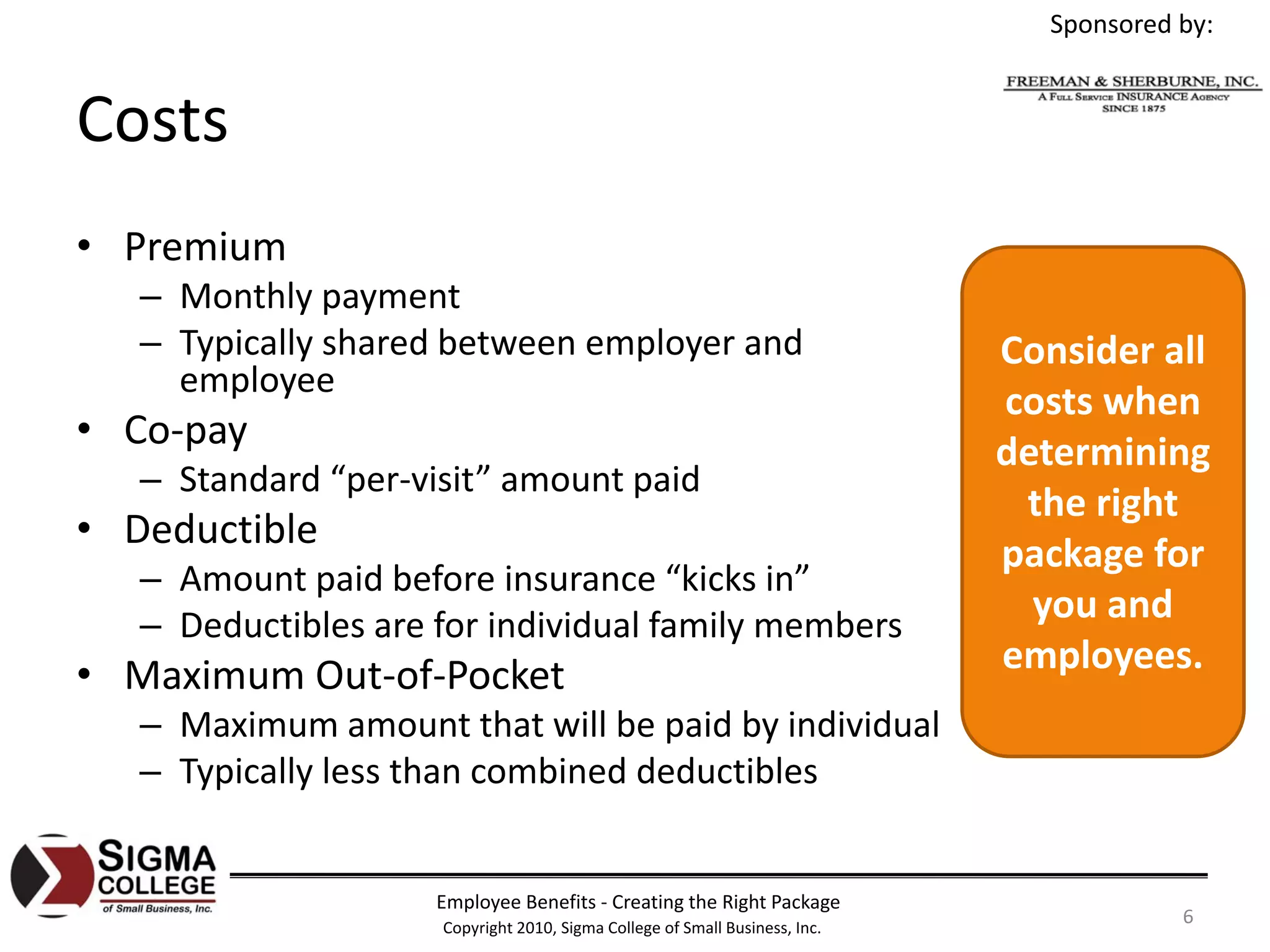

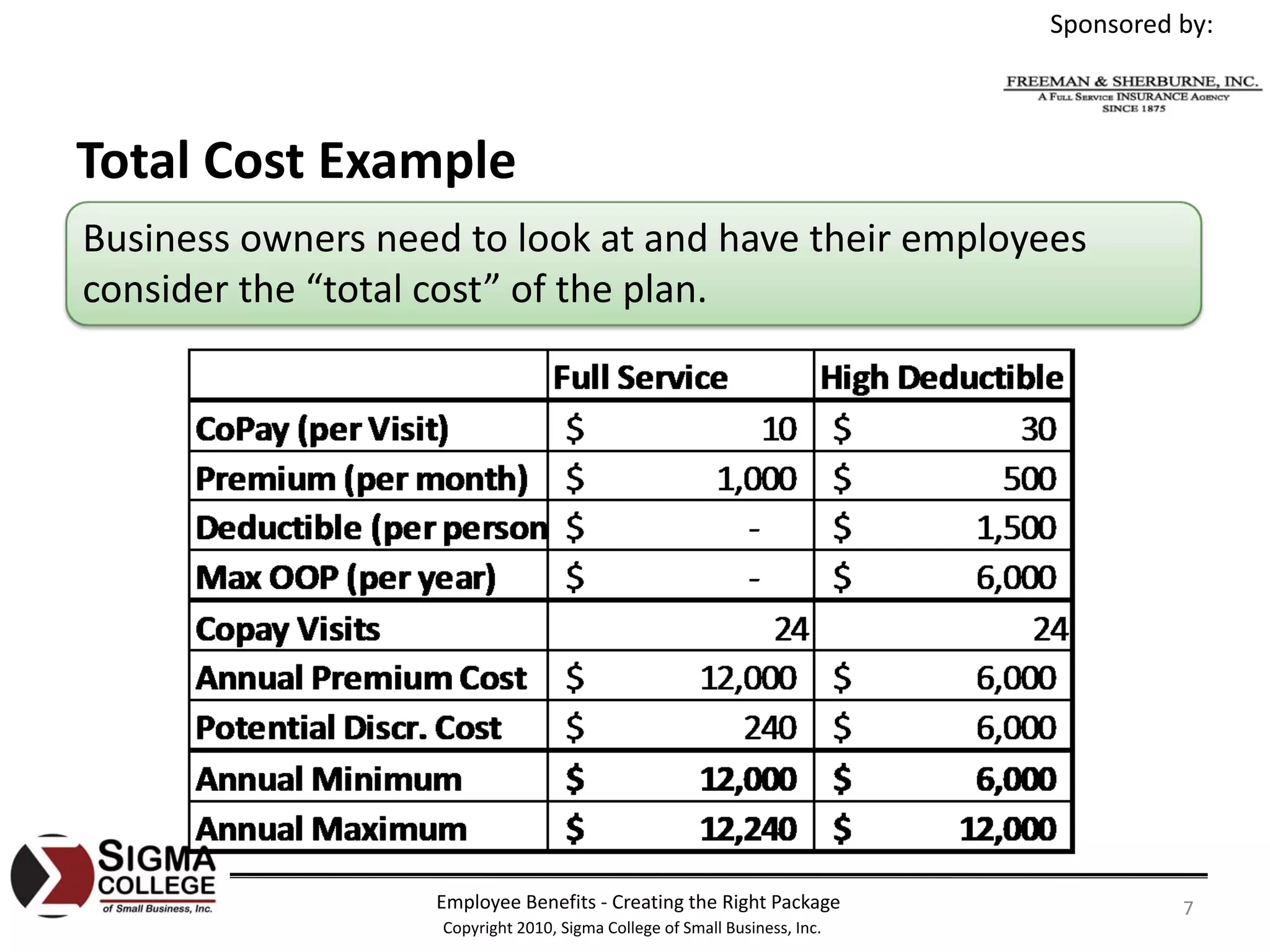

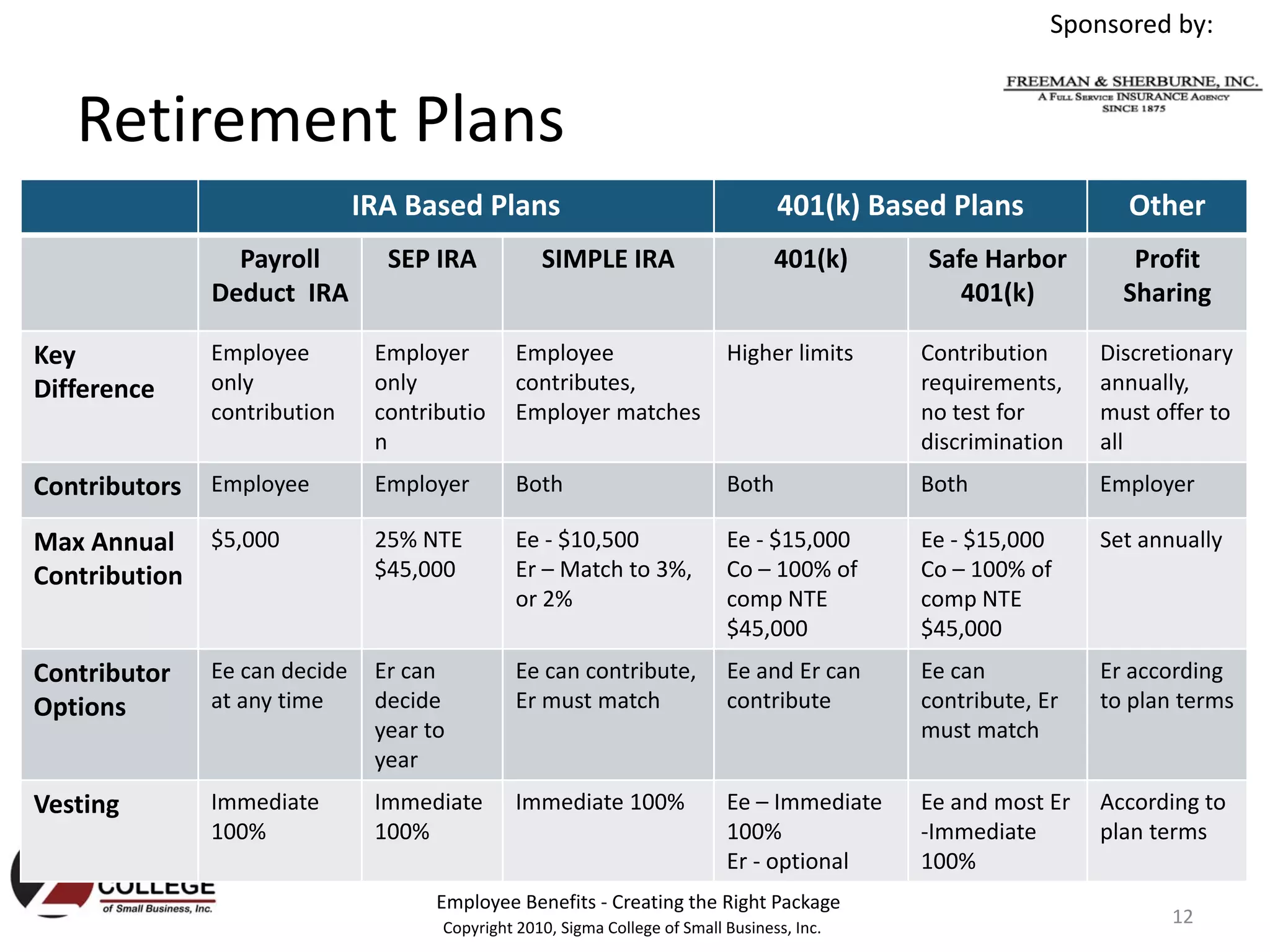

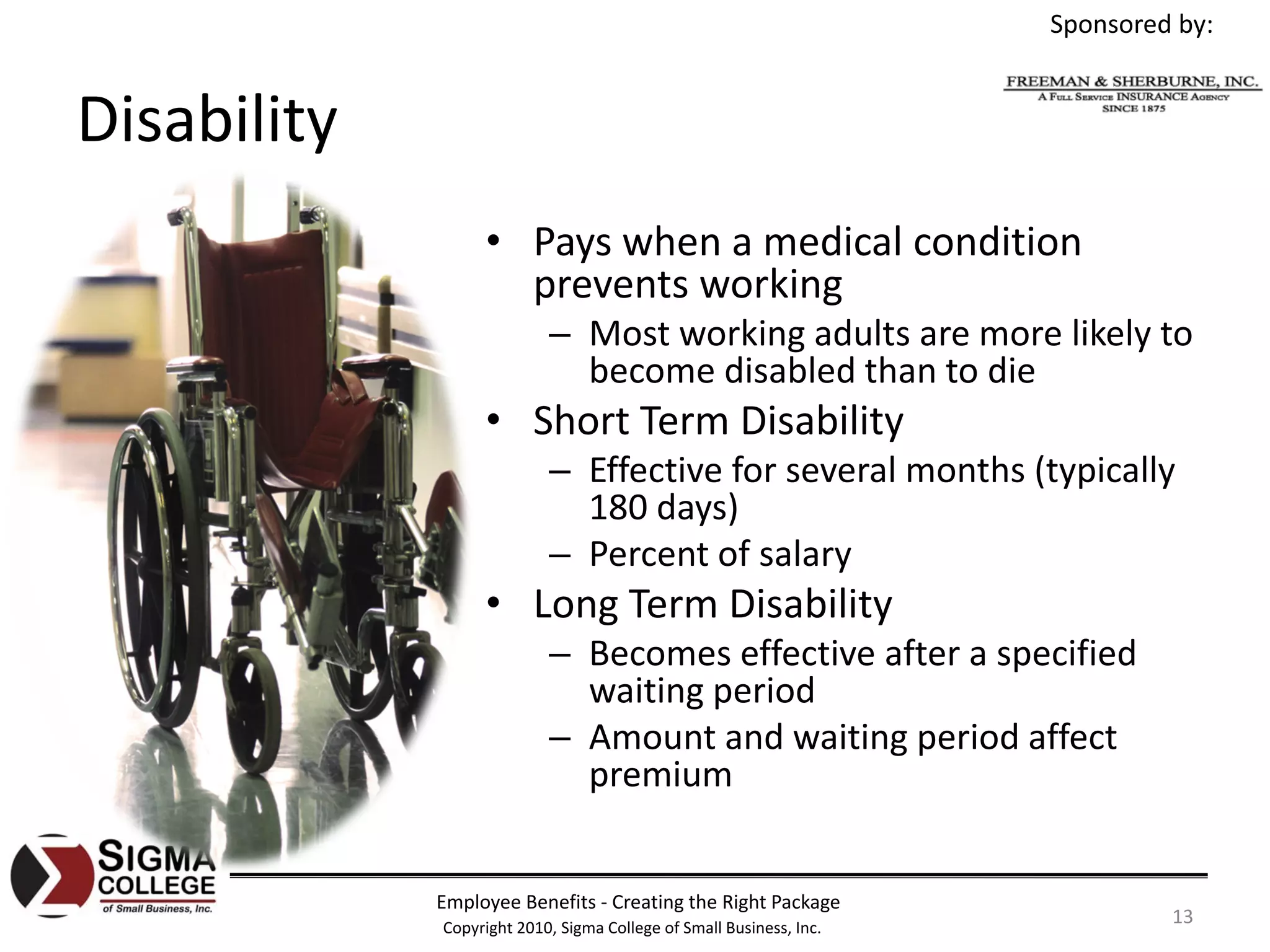

The document is a presentation on creating the right employee benefits package, discussing key aspects such as the value of benefits, types of health insurance, and retirement plans. It covers costs, comparisons between coverage types, and additional benefits, emphasizing the importance of a comprehensive approach to employee welfare. The discussion includes strategies for managing rising costs and the implications of health care reform.