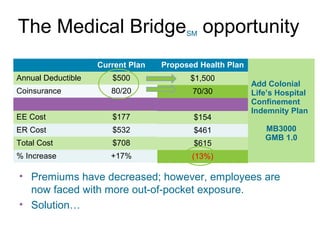

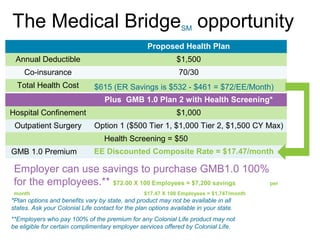

This document introduces the Medical Bridge OpportunitySM, a solution that helps employers and employees manage rising health care costs. It offers benefits counseling and enrollment at no direct cost to employers. The solution involves redesigning health plans with higher deductibles and coinsurance while offering employees supplemental insurance through Colonial Life's Group Medical Bridge 1.0 plan. This bridges the gap in out-of-pocket costs and provides benefits for hospitalization, outpatient surgery, and wellness visits. It is appealing as it offers guaranteed issue underwriting with no health questions and flexible rating options.