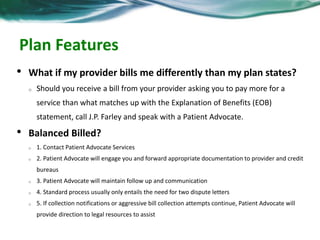

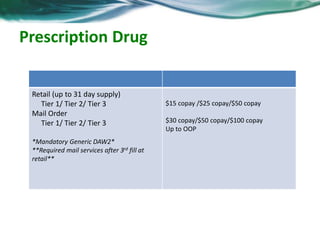

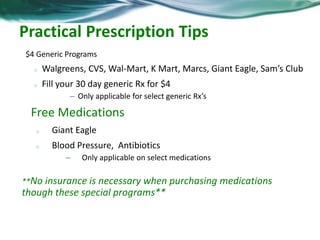

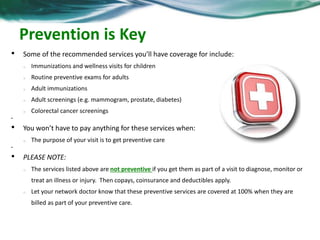

This document summarizes an employee benefits open enrollment presentation. It states that J.P. Farley will be the new plan administrator for medical and prescription drug coverage. All employees must make their benefit elections through the ADP website by November 21st. It provides an overview of the medical, dental, vision, life insurance, and disability insurance plans being offered. The document reviews costs, coverage details, and networks for each plan. It also includes information on dependent eligibility, preventive care coverage, and the process for making qualifying life event changes to benefits.