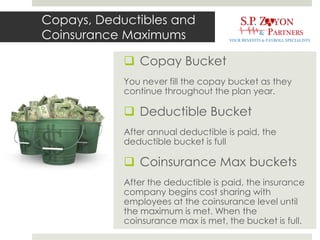

This document discusses best practices for designing employee benefits packages. It recommends that employers consider benefits an important tool for retention, productivity and cost control. It also notes that healthcare costs are rising significantly and represent a large portion of the economy. The document provides guidance on choosing the right medical plans by balancing premium costs with benefits offered and considering all costs of coverage, including employee deductibles and coinsurance. It suggests strategies for controlling costs over time such as encouraging wellness programs and generic drug use. The benefits package should also include other offerings like dental, disability and supplemental insurance.