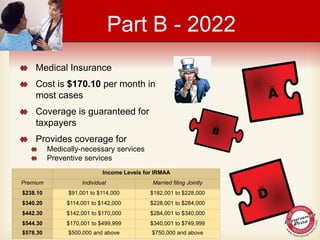

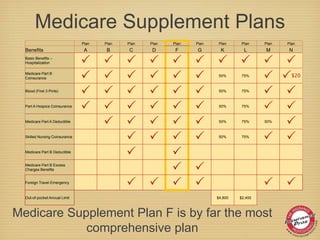

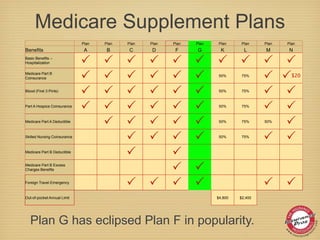

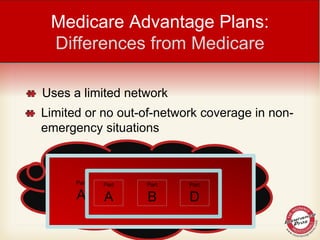

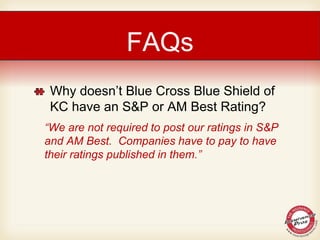

This document provides an overview of Medicare and supplemental insurance options. It begins with an introduction to Medicare, including who is eligible and the different parts of Medicare coverage. It then discusses Medicare Supplement Plans A-N in detail, including benefits covered and sample rates. Next, it covers Medicare Advantage Plans as an alternative that combines Medicare parts into one plan through private insurers. Key differences between Supplement and Advantage plans are outlined. The document concludes by addressing common questions about Medicare enrollment, penalties, and plan considerations.