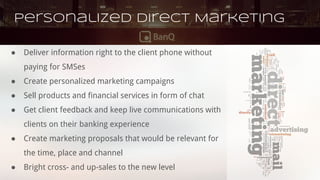

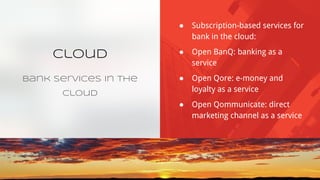

FinQloud provides a digital banking platform with various modules that allow banks to move from cost reduction to revenue generation. The platform includes modules for multichannel self-service, e-money processing, contactless payments, personalized messaging, workflow management, front-office assisted self-service, location-based services, big data analytics, and more. It utilizes open APIs, mobile and web apps, and an integration layer to connect various front-end and back-end systems in a modular, scalable architecture. The platform aims to help banks modernize operations and launch innovative digital services.