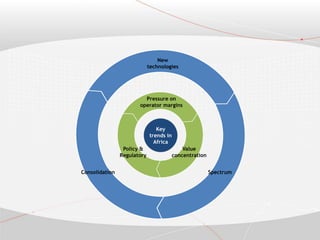

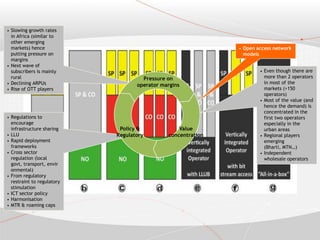

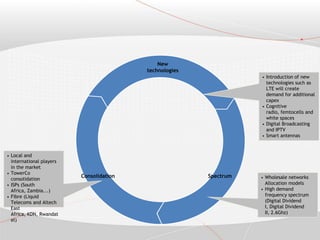

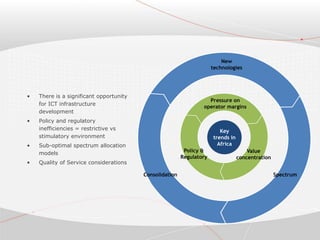

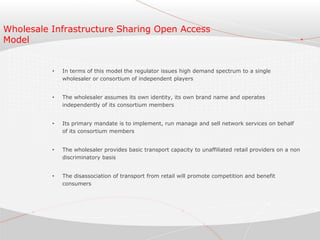

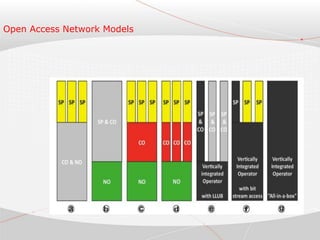

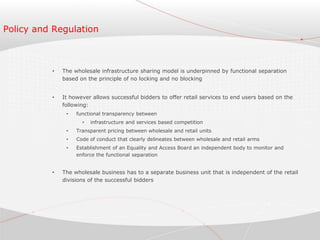

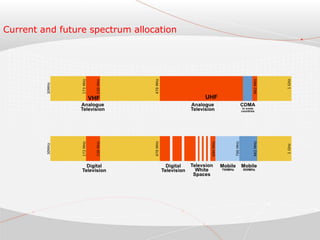

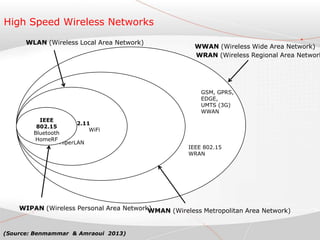

The document discusses key issues around electromagnetic spectrum management in Africa. It notes that spectrum is a public resource that should maximize social benefits. It outlines challenges with Africa's traditional command-and-control spectrum licensing models and with vertically integrated incumbents controlling markets. The document advocates for more flexible models like wholesale open access networks and dynamic spectrum allocation to promote competition and broadband adoption.