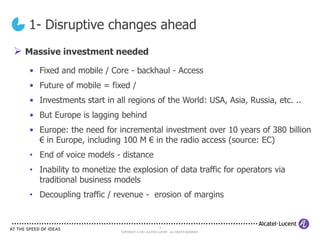

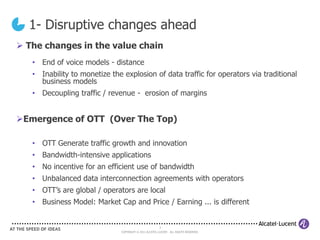

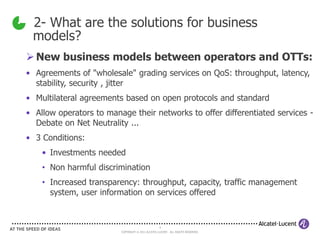

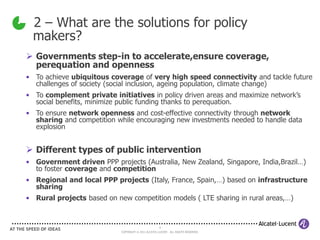

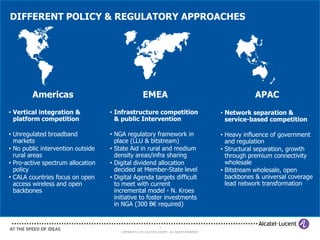

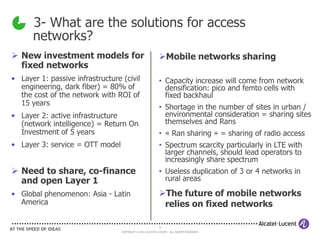

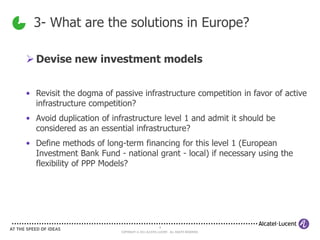

The document emphasizes the urgent need for innovative thinking in digital delivery to address disruptive changes in telecommunications, particularly due to Europe's lagging investment. It discusses new business models for operators and OTTs, and highlights necessary public policy interventions for achieving high-speed connectivity and tackling societal challenges. The document also stresses the importance of investment models and cooperation in sharing infrastructure to enhance mobile networks and accommodate the explosion of data traffic.