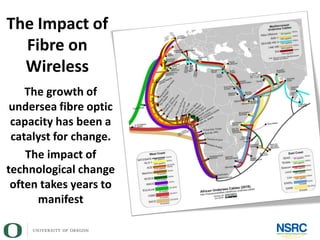

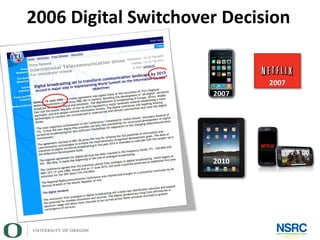

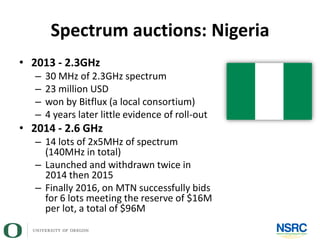

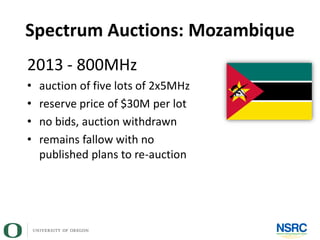

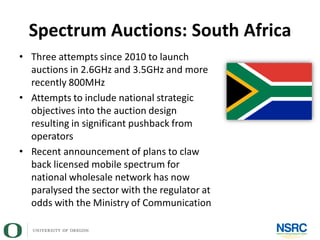

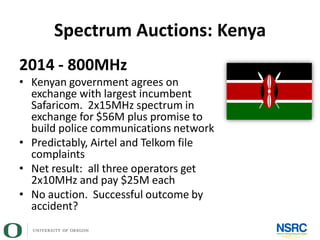

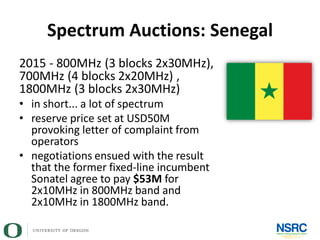

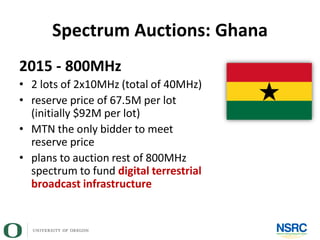

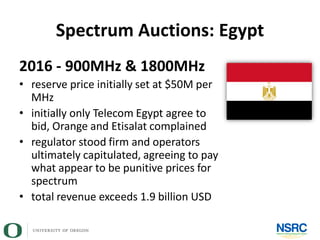

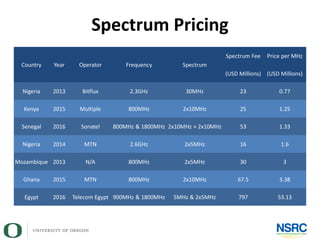

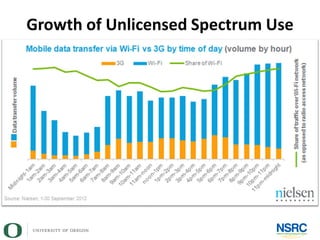

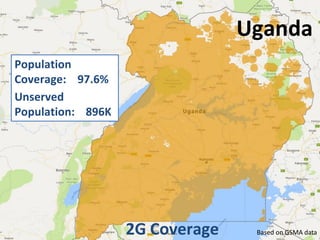

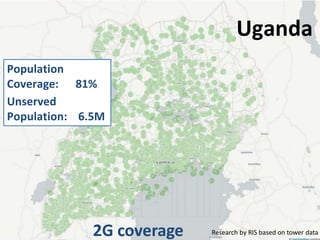

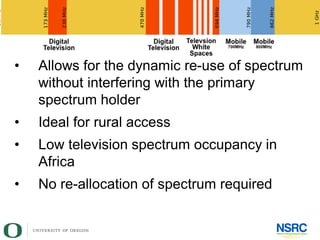

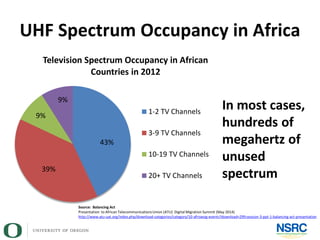

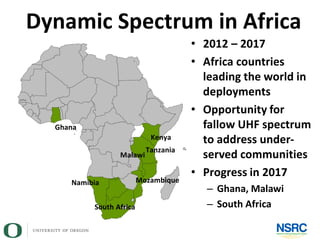

This document discusses challenges and opportunities for wireless regulation in Africa. It notes that increased fibre optic infrastructure provides opportunities to offer competitive services. However, the pace of technological change often outpaces regulation. Spectrum auctions across Africa have faced issues, with reserves prices seen as too high and auctions withdrawn or stalled. Unlicensed spectrum and low-cost wireless networks could help expand access. Television white spaces and dynamic spectrum sharing represent opportunities to reuse fallow spectrum. Regulators need diverse strategies including unlicensed use, dynamic spectrum, and spectrum set-asides.