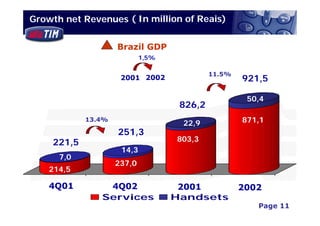

Tele Nordeste Celular reported its 2002 results, with key points including:

1) Revenue growth of 13.4% to 871.1 million reais due to increased customers and services.

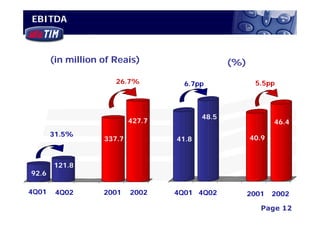

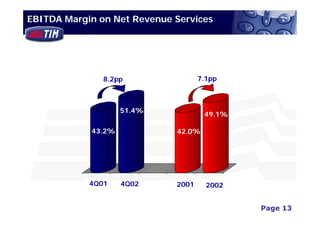

2) EBITDA increased 26.7% to 427.7 million reais and margins expanded.

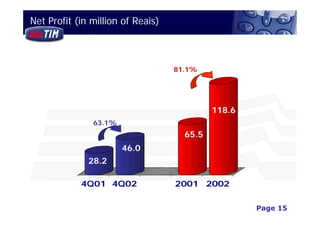

3) Net profit increased 81.1% to 118.6 million reais through revenue growth and cost optimization.