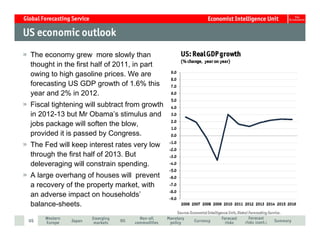

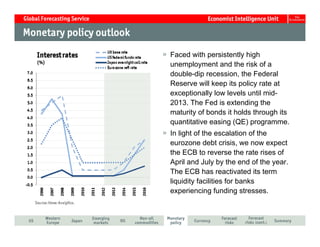

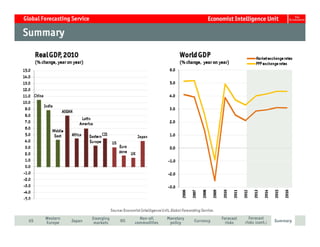

- The global economy grew more slowly than expected in the first half of 2011 due to high gasoline prices, and the US is forecast to grow 1.6% in 2011 and 2% in 2012. However, fiscal tightening will constrain growth in 2012-2013.

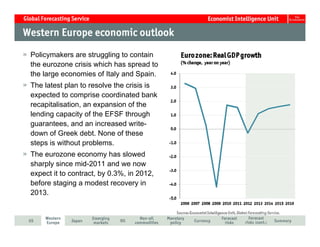

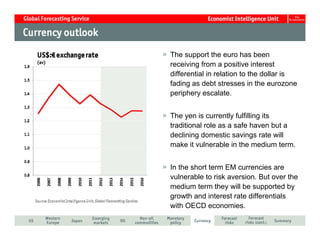

- The eurozone crisis has spread to Italy and Spain, and the latest plan to resolve it faces challenges. The eurozone economy is expected to contract by 0.3% in 2012 before a modest recovery in 2013.

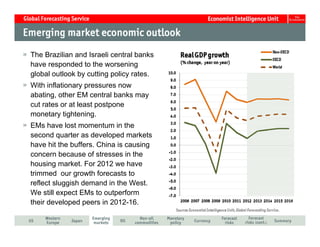

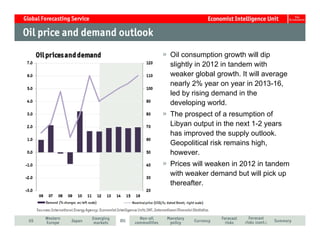

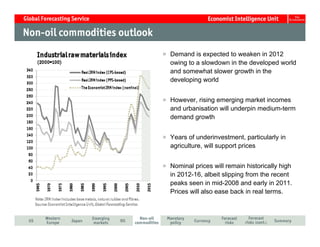

- Emerging markets have lost momentum in the second quarter as developed markets weaken, though EM countries are still forecast to outperform developed economies from 2012-2016. Commodity prices will remain high over this period.