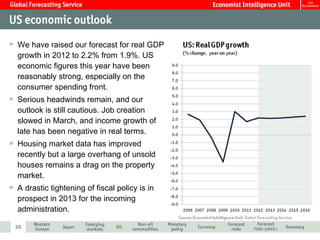

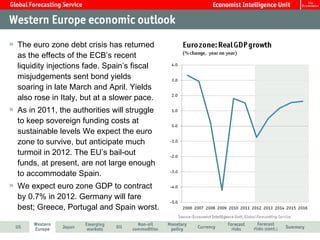

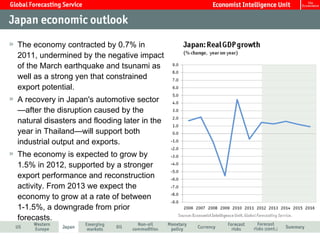

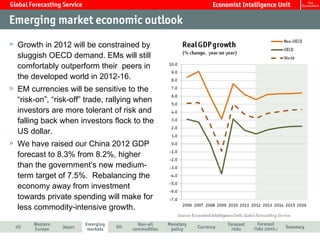

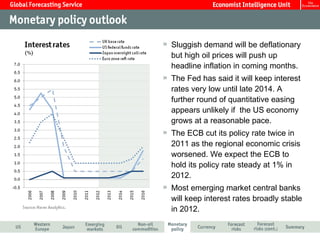

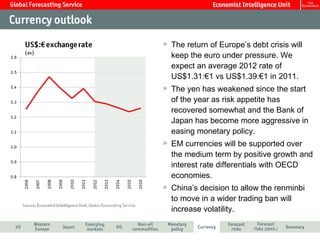

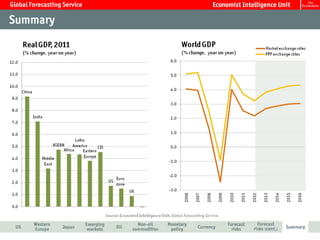

The document provides an economic forecast summary for May 2012 from a global forecasting service. It raises its forecast for 2012 US GDP growth to 2.2% from 1.9% due to reasonably strong economic figures, though job growth slowed in March. The eurozone debt crisis returned as ECB liquidity injections faded, sending bond yields soaring in Spain and Italy. The forecast expects eurozone GDP to contract by 0.7% in 2012, with Germany faring best and Greece, Portugal, and Spain faring worst.