Embed presentation

Download to read offline

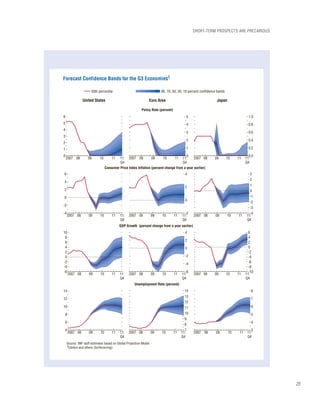

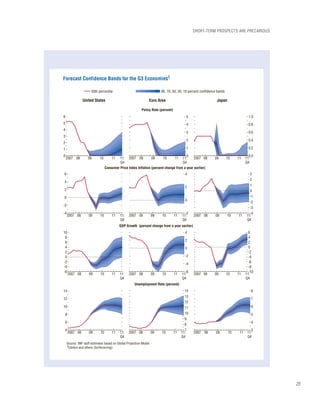

The document is a summary of the World Economic Outlook report from April 2009 published by the IMF. It discusses the state of the global economy during the financial crisis. The key points are: 1) The global economy contracted by 1.3% in 2009, the deepest post-World War II recession, with output declining in three-quarters of the global economy. Growth was projected to pick up to 1.9% in 2010 but remain sluggish. 2) Financial market stabilization was expected to take longer than previously thought, keeping financial conditions weak and reducing credit to the private sector in advanced economies in 2009-2010. Total global write-downs on assets could reach $4 trillion over two years.