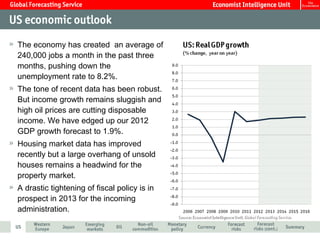

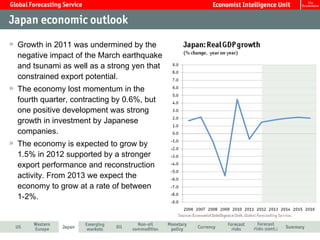

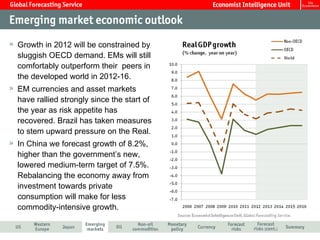

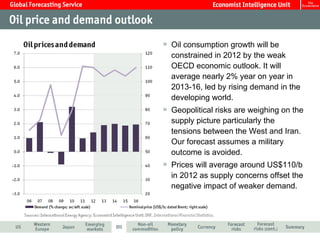

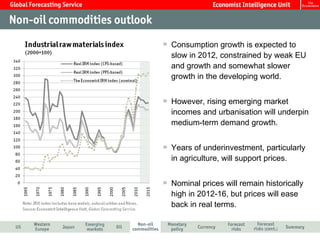

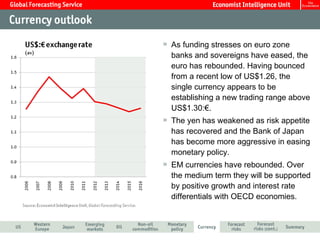

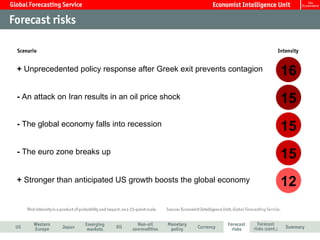

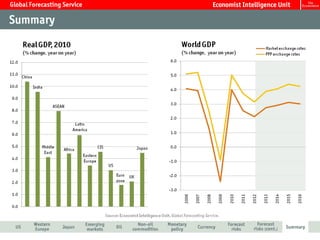

The global economic outlook remains modest. While the US job market has strengthened and the eurozone crisis has been averted, growth remains constrained by high oil prices, fiscal tightening, and sluggish demand. The EIU forecasts US GDP growth of 1.9% in 2012 and contraction of 0.7% in the eurozone. Housing markets are improving but remain a drag. Emerging markets will continue to outperform developed economies. Geopolitical risks pose challenges to oil supply and prices. Central banks aim to keep rates low but further stimulus appears unlikely if jobs growth continues.