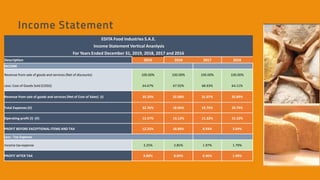

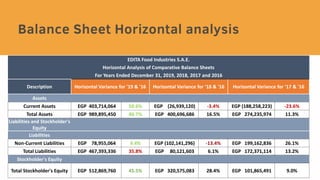

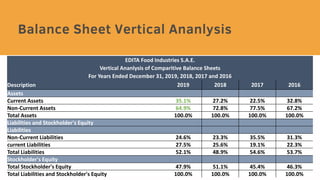

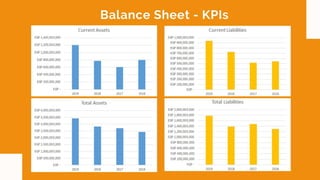

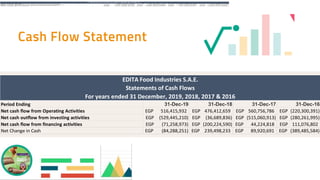

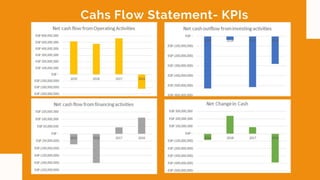

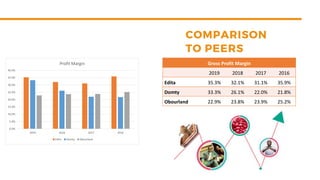

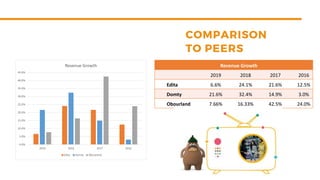

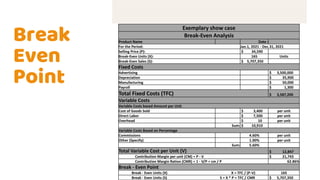

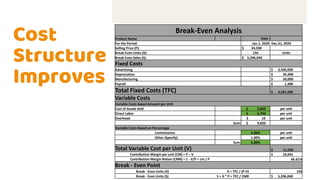

The document provides a detailed financial analysis of Edita Food Industries S.A.E. for the years 2016 to 2019, including income statements, balance sheets, and cash flow statements. It highlights trends in revenue, profit margins, and various financial ratios, reflecting the company's growth and changes in financial position over the years. Additionally, it includes a break-even analysis for the years 2020 and 2021, detailing costs and sales performance.