VinaGame - Ratio.pdf

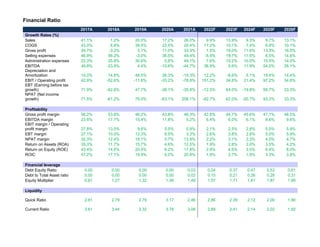

- 1. Financial Ratio 2017A 2018A 2019A 2020A 2021A 2022F 2023F 2024F 2025F 2026F Growth Rates (%) Sales 41.1% 1.2% 20.0% 17.2% 26.0% 9.9% 13.9% 9.3% 9.7% 13.1% COGS 43.0% 6.8% 39.5% 22.5% 20.4% 17.2% 10.1% 7.4% 6.8% 10.1% Gross profit 39.7% -3.2% 3.1% 11.0% 33.3% 1.5% 19.0% 11.6% 13.3% 16.5% Selling expenses 46.9% 56.2% -3.0% 36.5% 49.4% -5.9% 19.7% 11.5% 6.5% 14.6% Administration expenses 22.3% 25.8% 30.6% 0.8% 49.1% 7.6% 15.2% 10.0% 10.5% 14.0% EBITDA 49.6% -23.9% 4.4% -10.6% -44.7% 36.9% 5.6% 11.9% 54.5% 26.1% Depreciation and Amortization 14.0% 14.6% 48.5% 26.3% -15.3% 12.2% -8.6% 5.1% 19.4% 14.4% EBIT / Operating profit 42.9% -52.6% -11.6% -33.2% -78.8% 151.2% 34.8% 21.4% 97.2% 34.6% EBT (Earning before tax growth) 71.9% -62.6% 47.7% -38.1% -35.8% -12.5% 64.0% -19.8% 95.7% 33.3% NPAT (Net income growth) 71.5% -61.2% 75.0% -63.1% 208.1% -82.7% 62.0% -20.7% 93.3% 33.3% Profitability Gross profit margin 56.2% 53.8% 46.2% 43.8% 46.3% 42.8% 44.7% 45.6% 47.1% 48.5% EBITDA margin 23.6% 17.7% 15.4% 11.8% 5.2% 6.4% 6.0% 6.1% 8.6% 9.6% EBIT margin / Operating profit margin 27.8% 13.0% 9.6% 5.5% 0.9% 2.1% 2.5% 2.8% 5.0% 5.9% EBT margin 27.1% 10.0% 12.3% 6.5% 3.3% 2.6% 3.8% 2.8% 5.0% 5.9% NPAT margin 32.3% 12.4% 18.1% 5.7% 13.9% 2.2% 3.1% 2.3% 4.0% 4.7% Return on Assets (ROA) 35.3% 11.7% 15.7% 4.6% 12.5% 1.9% 2.8% 2.0% 3.5% 4.2% Return on Equity (ROE) 43.4% 14.6% 20.5% 6.2% 17.8% 2.9% 4.6% 3.5% 6.4% 8.0% ROIC 47.2% 17.1% 19.9% 5.0% 20.8% 1.9% 2.7% 1.9% 3.3% 3.8% Financial leverage Debt Equity Ratio 0.00 0.00 0.00 0.00 0.03 0.24 0.37 0.47 0.53 0.61 Debt to Total Asset ratio 0.00 0.00 0.00 0.00 0.02 0.15 0.21 0.26 0.28 0.31 Equity Multiplier 0.81 1.27 1.32 1.36 1.49 1.57 1.71 1.81 1.87 1.95 Liquidity Quick Ratio 2.81 2.79 2.79 3.17 2.46 2.86 2.39 2.12 2.00 1.90 Current Ratio 3.61 3.44 3.32 3.78 3.06 2.89 2.41 2.14 2.02 1.92

- 2. Financial Ratio 2017A 2018A 2019A 2020A 2021A 2022F 2023F 2024F 2025F 2026F Coverage ratios Interest coverage (EBITDA/interest) #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! CFO/Current liabilities 3.8 2.0 1.6 3.3 0.3 0.1 0.0 0.0 0.1 0.1 CFO/Interest bearing debt No debt No debt No debt No debt 35.9 No debt No debt No debt No debt No debt Efficiency Receivable Turnover 14.0 12.8 13.9 12.9 11.1 10.8 11.8 11.6 11.6 11.8 Days Receivable Outstanding 26 29 26 28 33 34 31 32 31 31 Inventory Turnover 137.1 138.3 132.1 122.1 55.0 46.4 57.7 57.0 56.8 57.7 Days Inventory Outstanding 3 3 3 3 7 8 6 6 6 6 Payables Turnover 11.0 7.7 6.5 7.1 7.0 6.4 7.4 7.3 7.3 7.4 Days Payable Outstanding 33 47 56 51 52 57 49 50 50 49 Business Cycle (4) (16) (27) (20) (12) (15) (12) (12) (12) (12) Current Asset Turnover 1.6 1.3 1.2 1.1 1.1 1.1 1.1 1.1 1.1 1.1 Fixed Asset Turnover 28.1 20.1 12.5 10.9 14.4 14.5 14.4 14.4 14.9 16.5 Asset Turnover 1.1 0.9 0.9 0.8 0.9 0.9 0.9 0.9 0.9 0.9

- 3. Financial Ratio COST BREAKDOWN (%) 2016A 2017A 2018A 2019A 2020A 2021A Outsourcing Fees 607,373 955,125 1,473,396 1,669,572 2,164,891 3,058,783 Payroll Expense 696,731 845,027 1,059,012 1,307,161 1,532,494 2,105,860 Sofware Licences 614,496 941,076 912,115 1,272,446 1,463,330 1,905,733 Depreciation Expense 156,381 178,291 204,357 303,398 383,295 324,818 Goodwill 2,794 1,567 1,567 1,567 (936) 1,168 Tools and supplies 23,040 40,299 62,573 88,296 88,296 63,720 Others (Material,ect) 93,122 120,538 42,402 39,207 106,136 118,841 COST BREAKDOWN (%) 2016A 2017A 2018A 2019A 2020A 2021A Outsourcing Fees 28% 31% 39% 36% 38% 40% Payroll Expense 32% 27% 28% 28% 27% 28% Sofware Licences 28% 31% 24% 27% 26% 25% Depreciation Expense 7% 6% 5% 6% 7% 4% Goodwill 0% 0% 0% 0% 0% 0% Tools and supplies 1% 1% 2% 2% 2% 1% Others (Material,ect) 4% 4% 1% 1% 2% 2%

- 4. Financial Ratio 2016A 2017A 2018A 2019A 2020A 2021A Revenue/Payroll 4.34 5.05 4.08 3.96 3.96 3.63 16% -19% -3% 0% -8% Revenue/Adjusted-Payroll 4.16 4.94 3.90 3.72 3.65 3.44 Revenue/Sofware Licences 4.79 4.46 4.69 4.05 4.13 4.01 -7% 5% -14% 2% -3% Revenue/Adjust-Sofware Licences 4.37 4.10 4.23 3.60 3.68 3.70 -6% 3% -15% 2% 1%

- 7. Capex