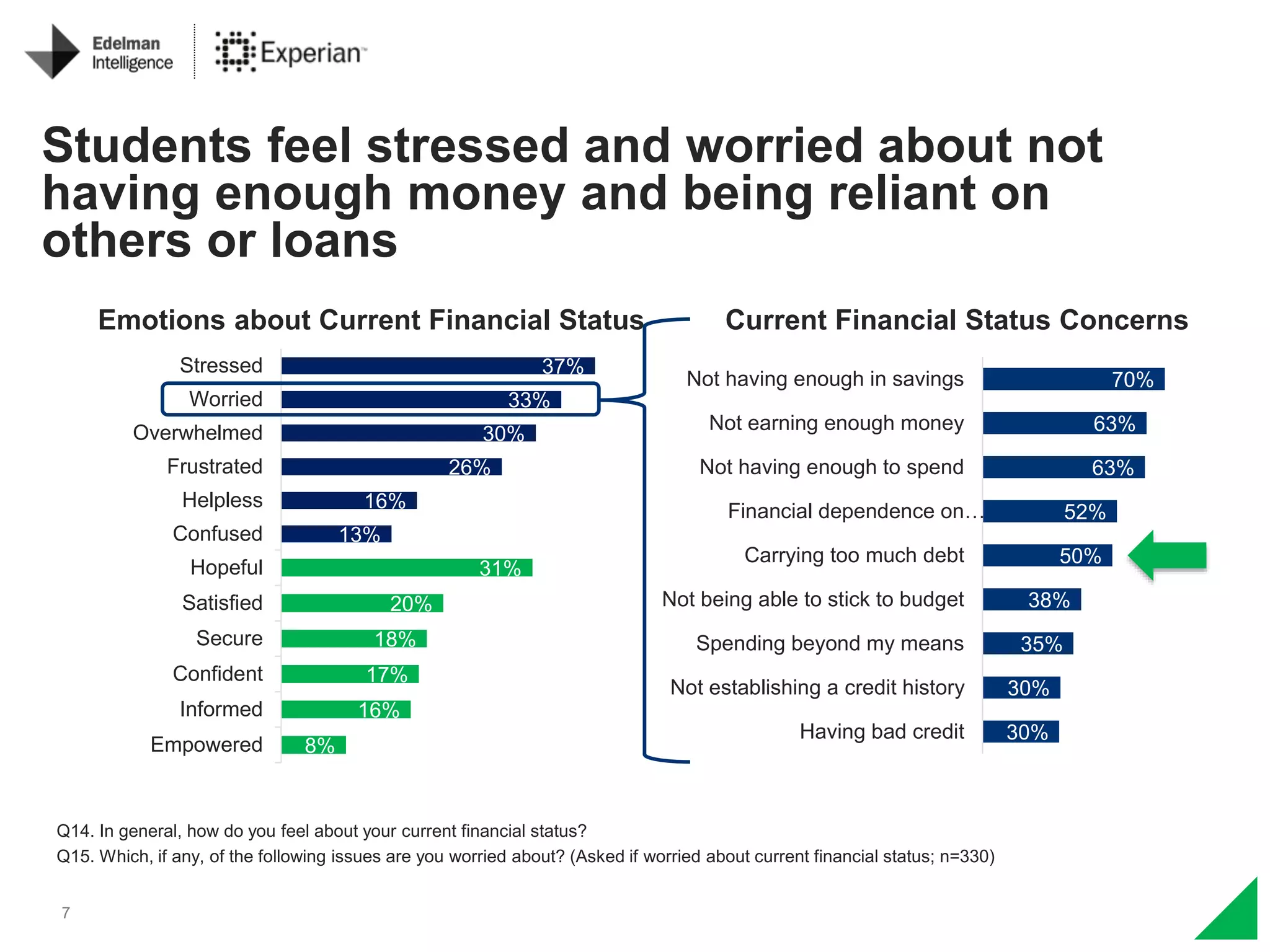

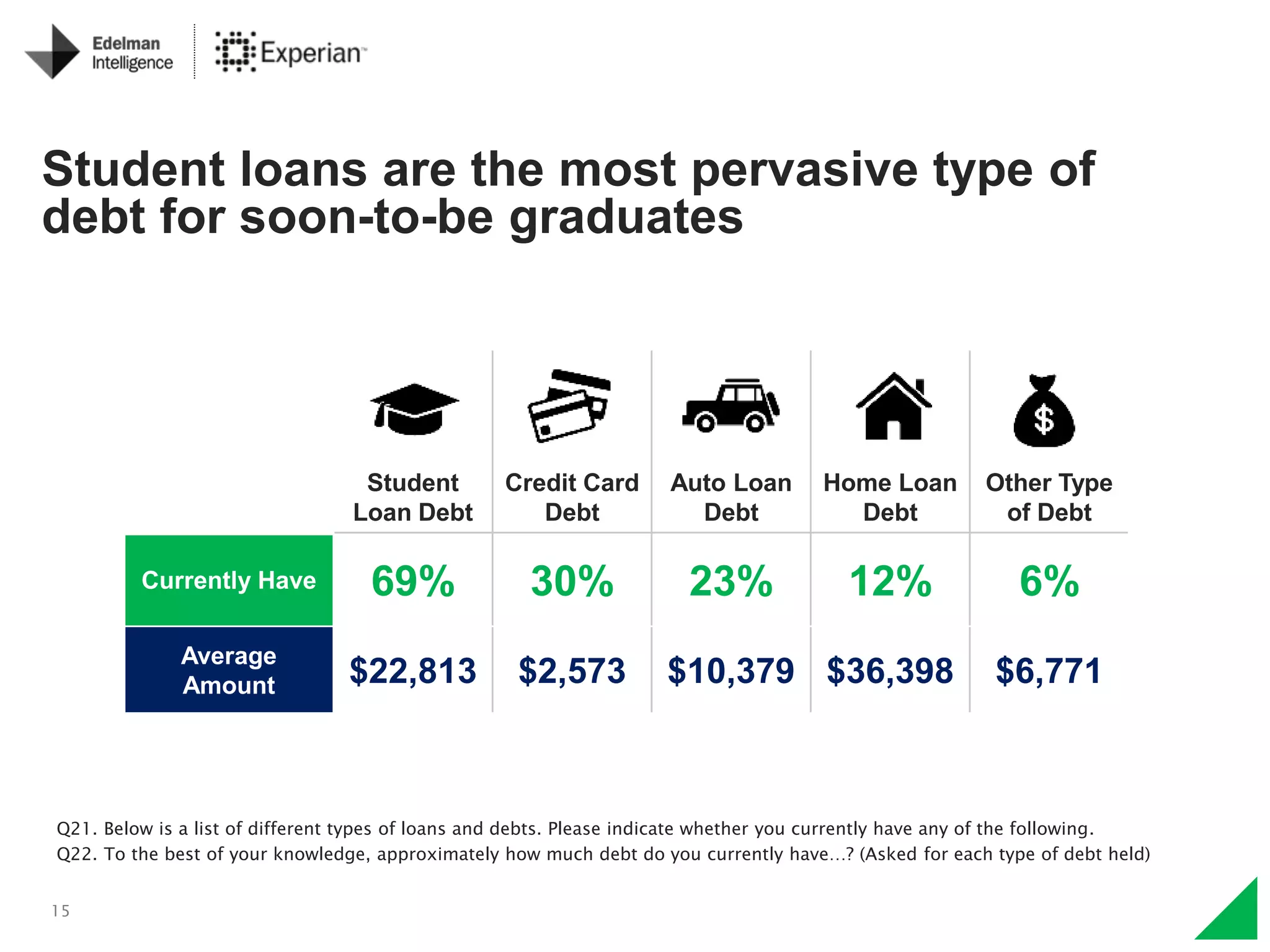

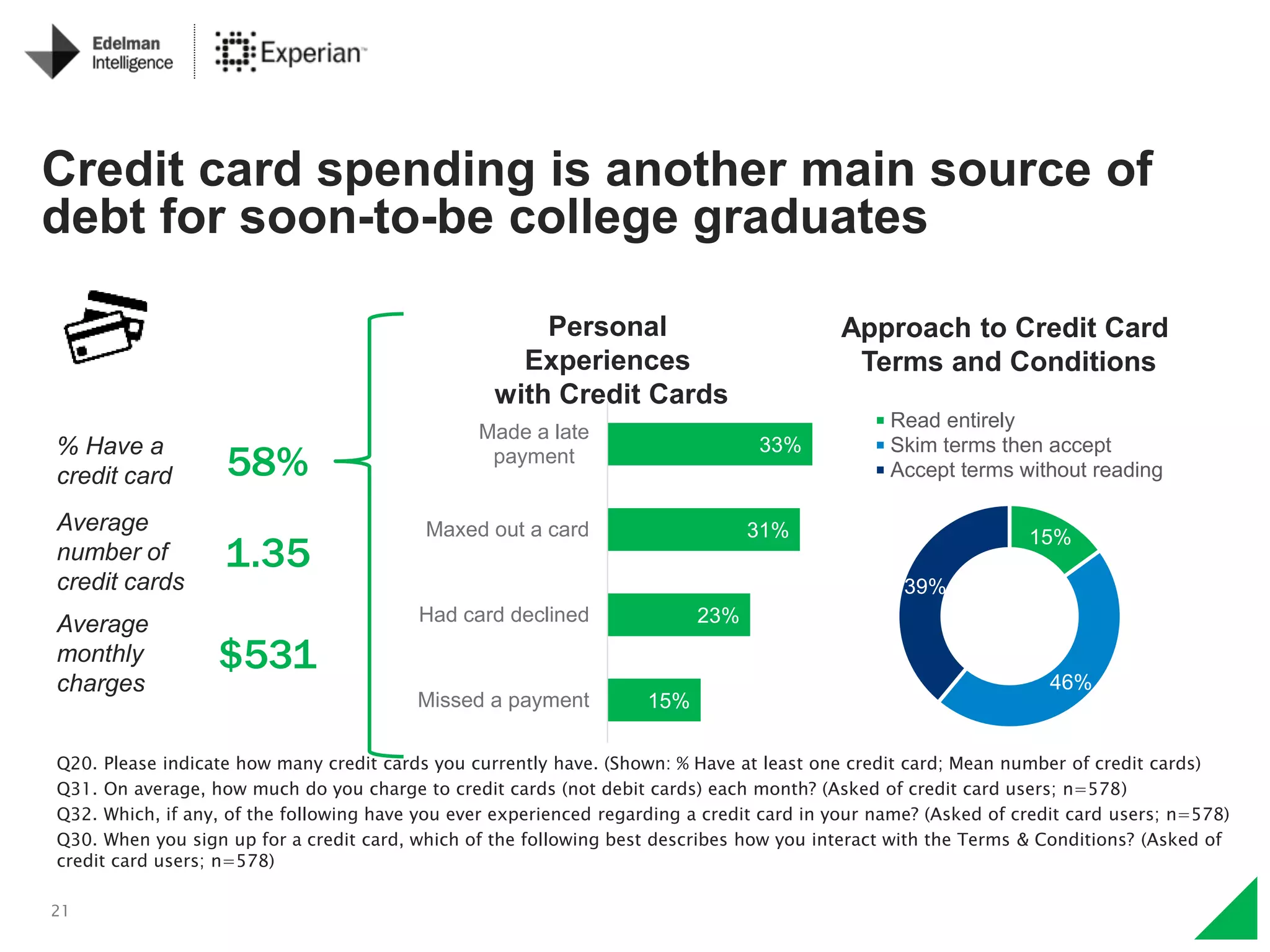

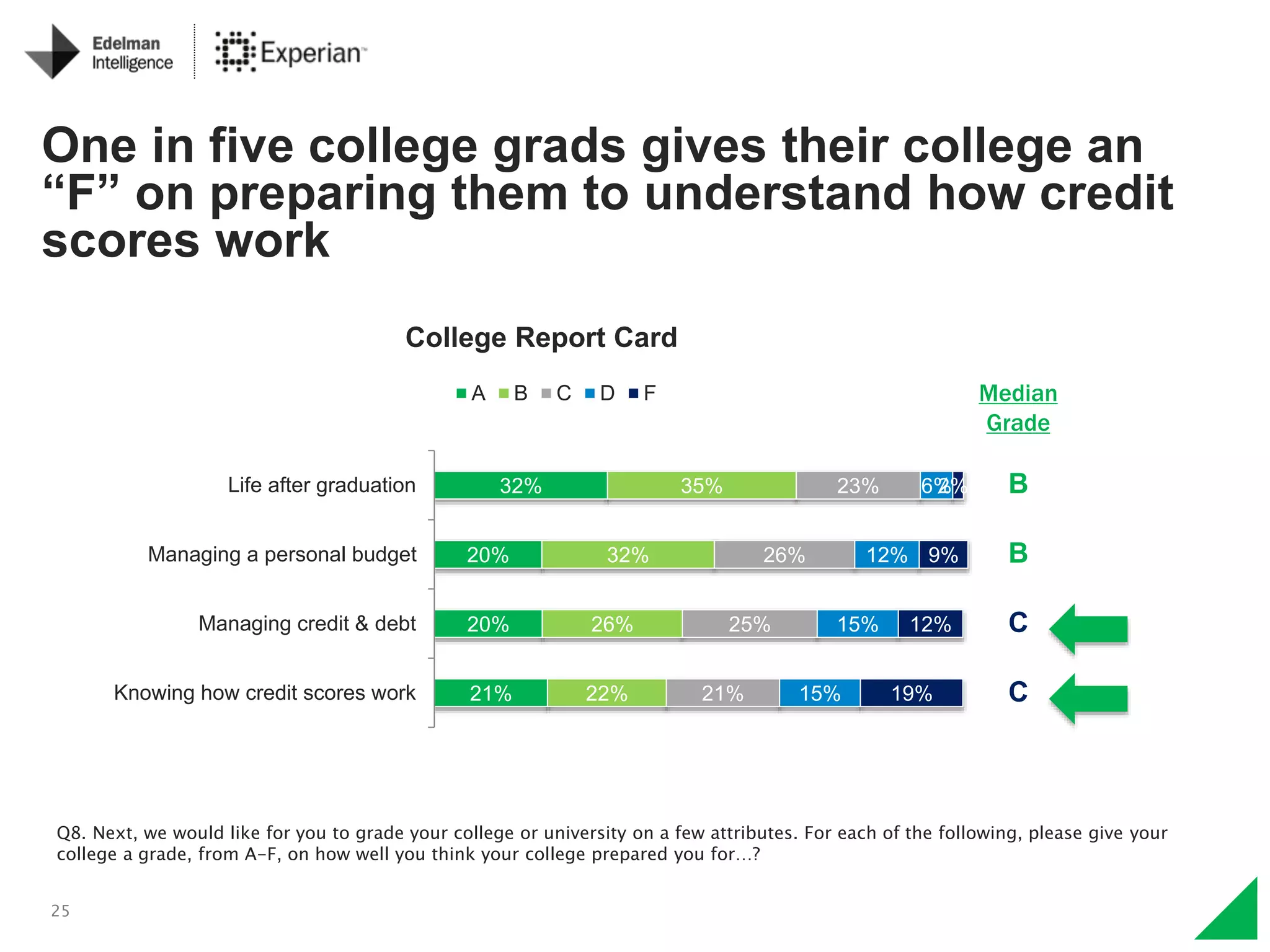

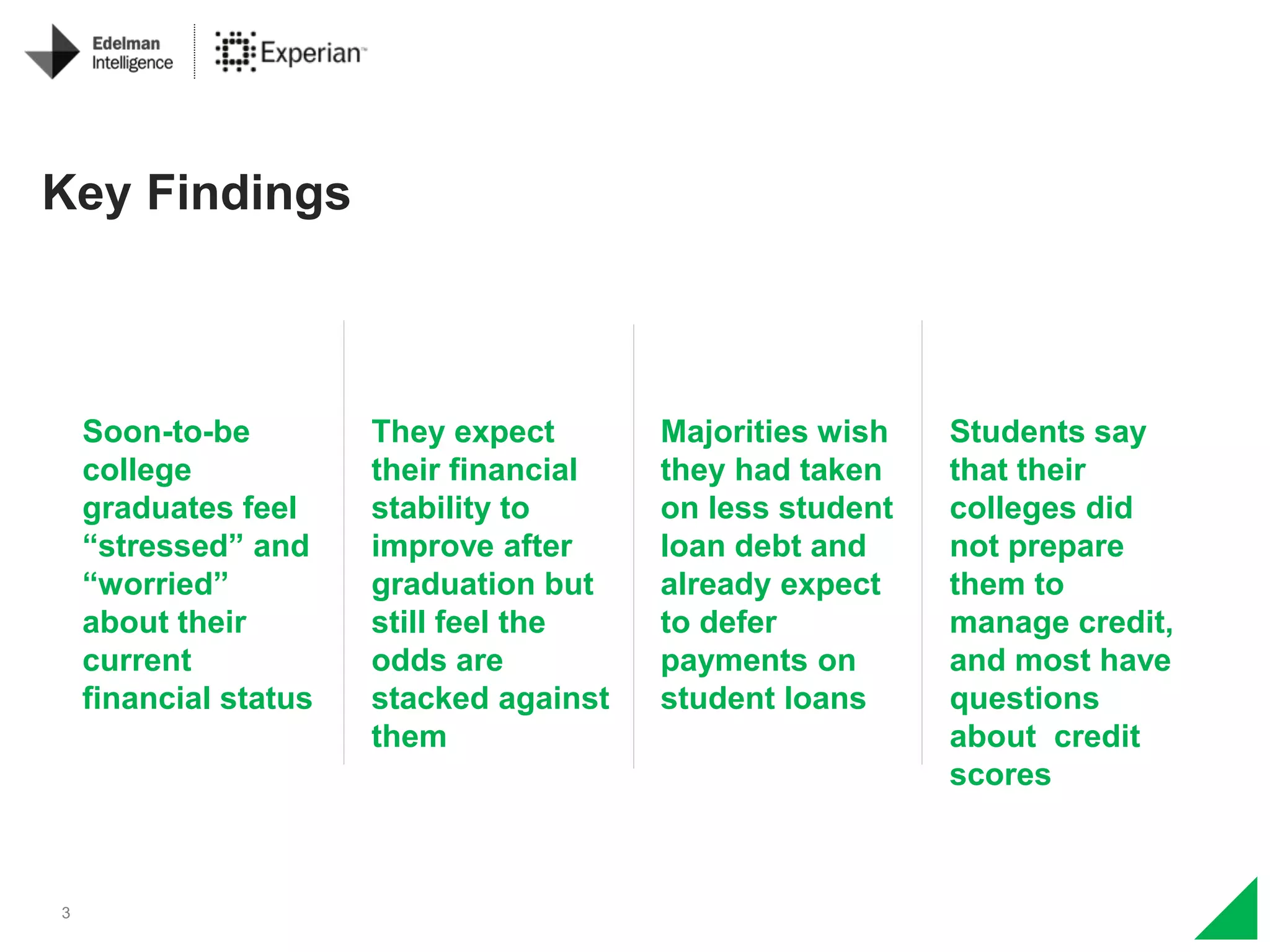

The Edelman Intelligence and Experian survey highlights that soon-to-be college graduates feel stressed about their financial status, primarily due to student loan debt, and many believe their colleges did not adequately prepare them for financial management. Despite expectations of improved financial security post-graduation, a significant portion of respondents anticipate challenges such as job availability and debt repayment. Additionally, there is a strong desire for more education on credit and personal finance, as many students feel they are 'going it alone' in managing their financial futures.

![5

Many college students do not feel financially

secure, driven by low earnings and reliance on

student loans

Excellent Very good Good

Current Financial Security

40%

Rate their

CURRENT financial

security as

POOR/FAIR

14%

16%

20%

23%

36%

40%

42%

42%

43%

49%

Work study doesn't pay enough

Relying on credit cards

Not earning any money

Pressure to spend beyond means

Not putting money into savings

Not enough to spend beyond…

Relying on my parents

Expenses as a student are too…

Relying on student loans

Don't earn enough at part-time job

Reasons for Current Financial Insecurity

Q3. Thinking about your life while enrolled in college, how would you rate your financial security?

Q4: Why did you rate your financial security while enrolled in college as [poor/fair]? (Asked if rated current financial security as poor/fair;

n=403)](https://image.slidesharecdn.com/ecscollegegraduatesurveyreportfinal-160504224734/75/Ecs-college-graduate-survey-report-final-5-2048.jpg)