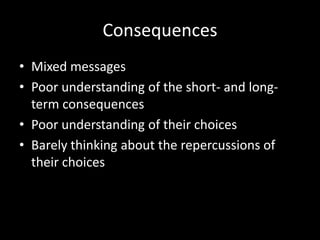

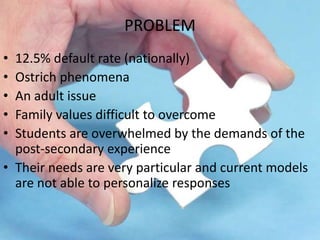

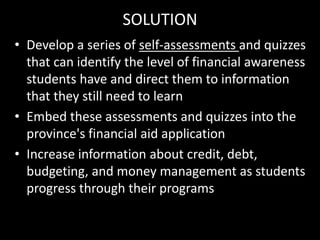

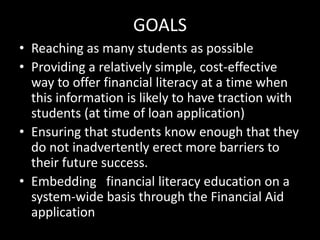

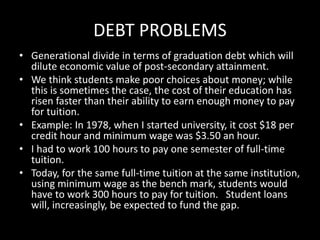

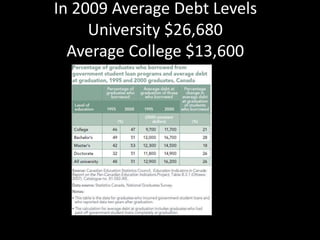

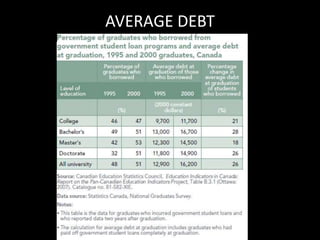

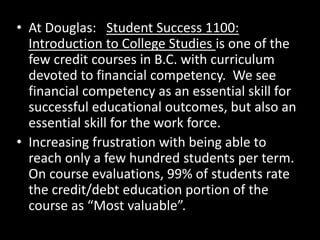

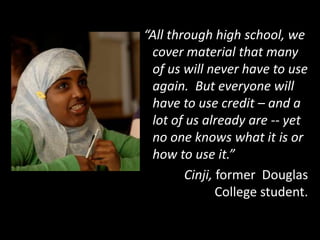

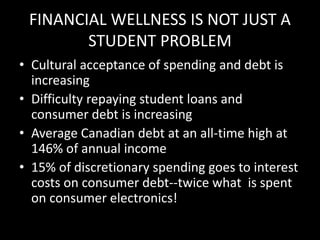

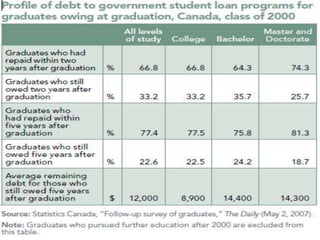

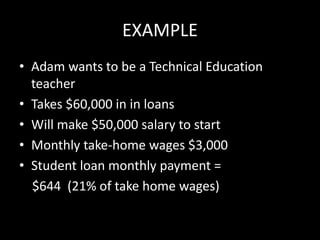

The document discusses improving students' financial literacy through expanding education on managing student loans and credit. It notes that students' knowledge of loans and credit is uneven and many do not understand the long term consequences of taking on debt. The proposal is to develop a system-wide financial literacy project in BC by embedding self-assessments and quizzes about credit into the student financial aid application process to direct students to relevant information and ensure they understand responsibilities of debt before taking out loans. The goal is to help students make better financial choices that do not hinder their future success and career prospects after graduation.

![Starting with a budget

• “Eighty-one percent of students polled said it’s

important to set a budget to manage finances,

but fewer than half of them had actually done

so, according to the Leger Marketing survey

conducted in September [2010] for Bank of

Montreal.”

The Vancouver Sun, October 6, 2010.](https://image.slidesharecdn.com/financialaidpresentationpowerpointfinal-101027201603-phpapp02/85/Financial-aid-presentation-power-point-final-23-320.jpg)