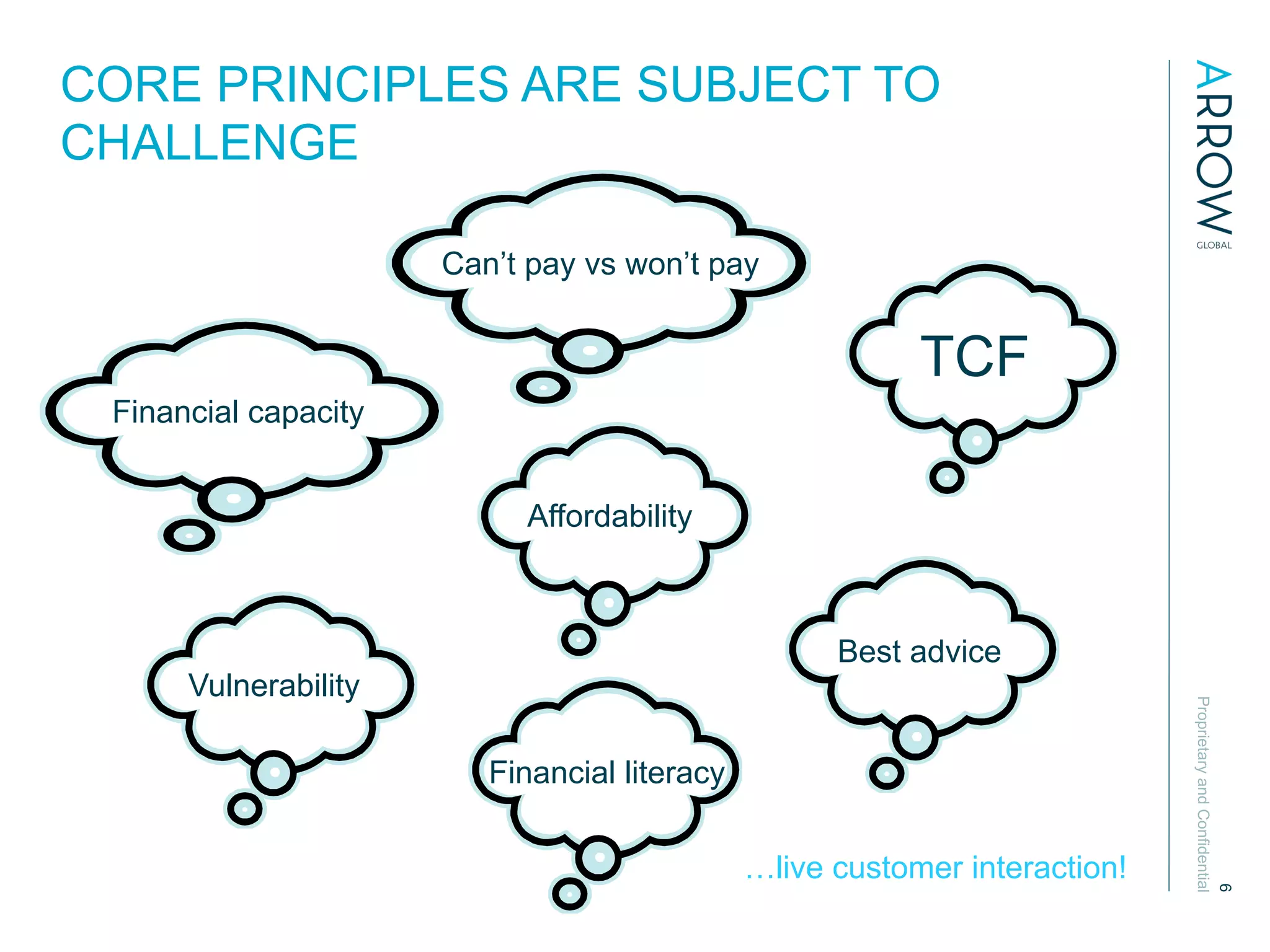

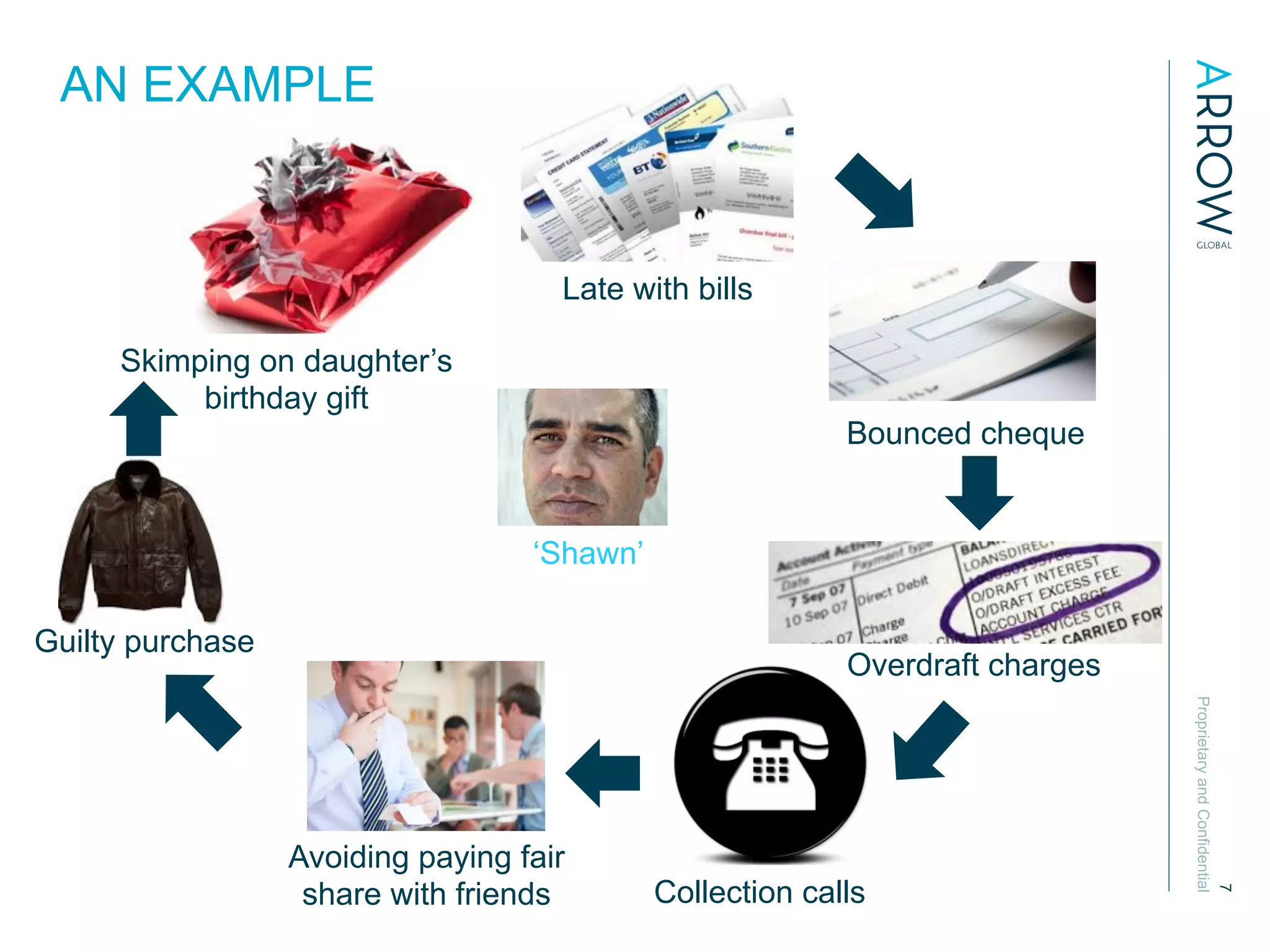

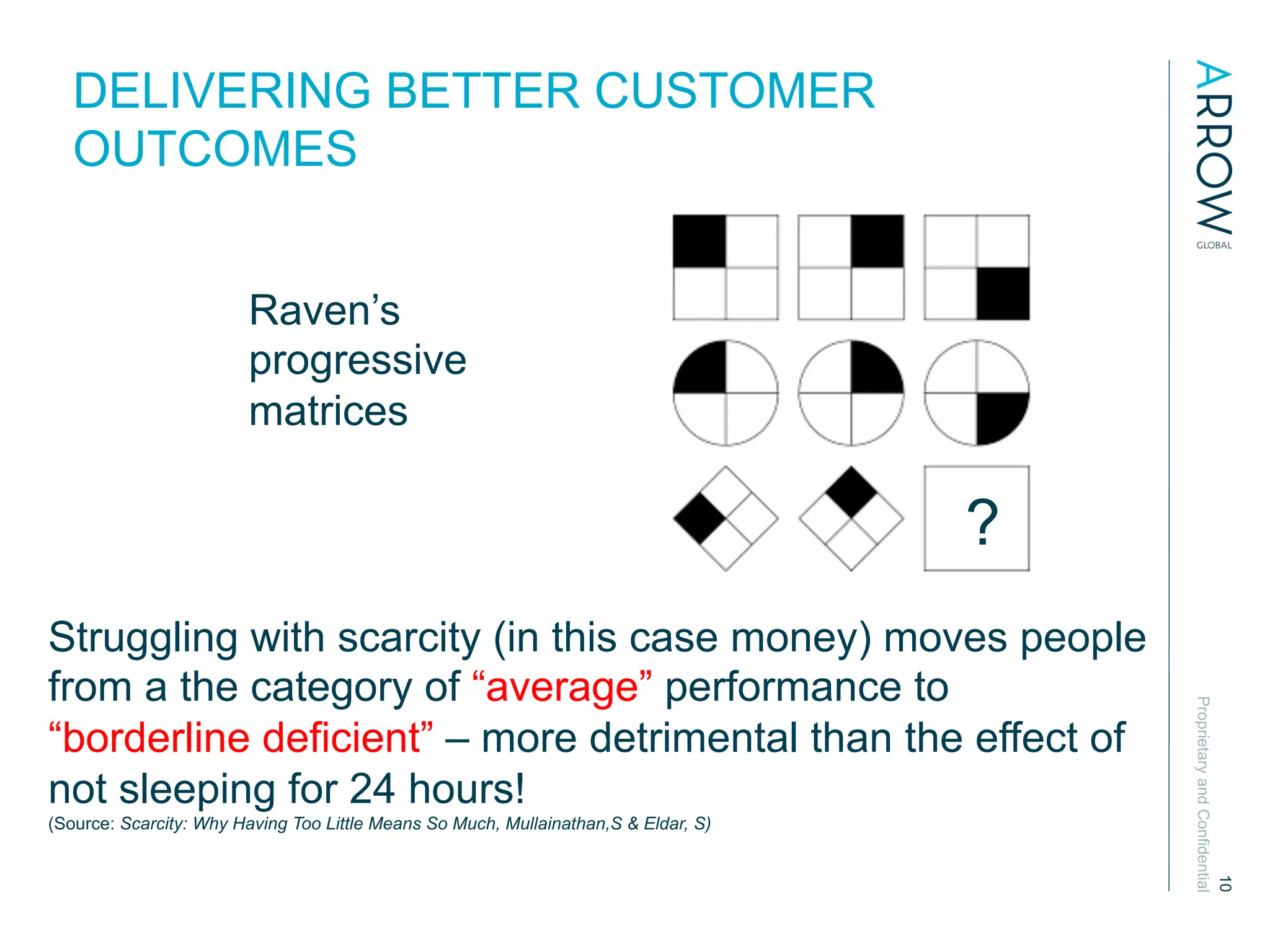

The document discusses the issue of problem debt in the UK, highlighting that approximately 8.8 million people are over-indebted, which affects their ability to maintain a sustainable lifestyle. It explores the complexities of financial stress and behavioral economics, arguing that traditional models may not effectively address customer needs or outcomes. Additionally, it emphasizes the need for better understanding and support for those struggling with debt, considering the societal and economic implications of widespread financial difficulties.