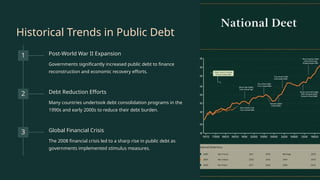

The document outlines the concept of public debt, which is the total amount a government owes to finance operations and spending, highlighting its importance for funding public services and stimulating the economy. It discusses historical trends, the drivers of public debt growth, and the objectives of effective public debt management, emphasizing the need for financial stability and risk mitigation. Additionally, it addresses challenges such as global economic conditions and demographic changes that can impact debt sustainability.

![SCHOOL OF COMMERCE,DAVV

SESION - 2023-2024

COURSE - B.COM [ATM] 4th SEM

TOPIC - PUBLIC DEBT AND ITS OBJECTIVES

SUBMITTED TO:- BHARTI ARYA Mam SUBMITTED BY:- KAJAL MALVIYA

ROLL NO. - BATM/22/2056](https://image.slidesharecdn.com/public-debt-and-its-objectives5-241116180535-d83d252c/75/Public-Debt-and-Its-Objectives-5-pptx-1-2048.jpg)