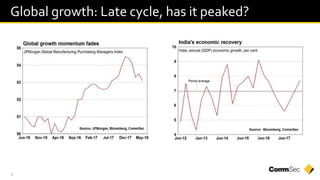

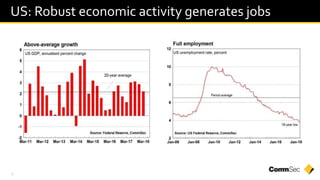

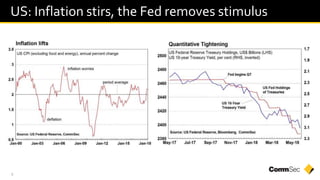

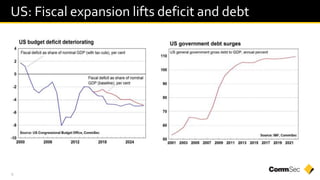

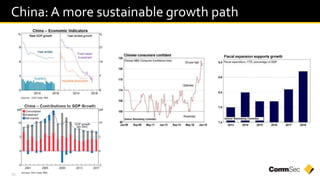

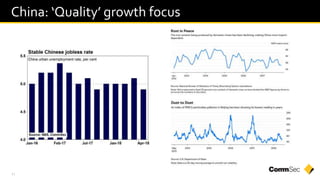

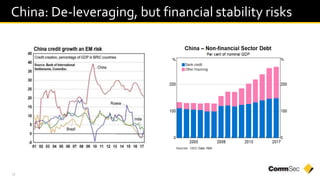

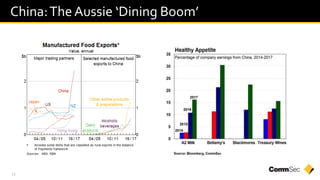

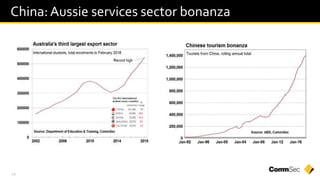

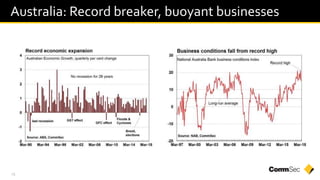

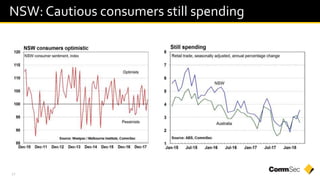

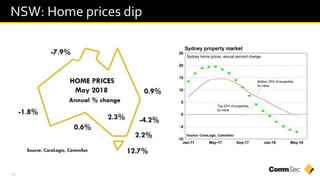

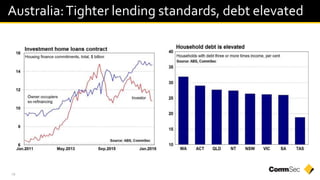

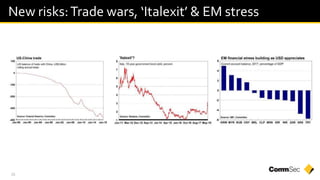

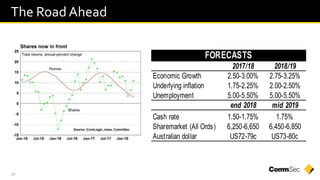

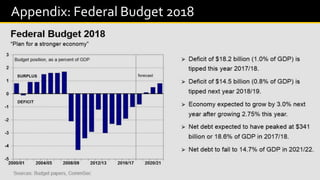

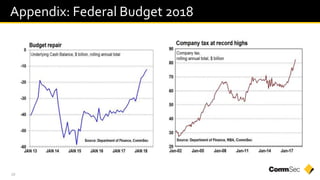

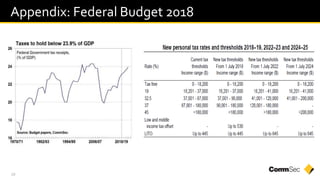

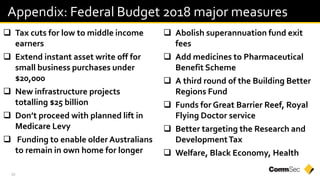

The presentation by Ryan Felsman outlines key economic trends including global growth, rising asset prices, and increasing interest rates, with specific focus on the effects of U.S. policies and China's economic rebalancing. It highlights the current state of the Australian economy, noting modest wage growth and cautious consumer behavior amidst tighter lending standards. Additionally, it summarizes the 2018 federal budget measures, including tax cuts and infrastructure investments.