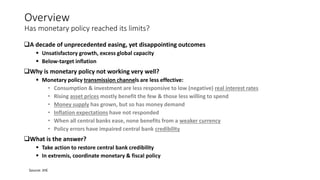

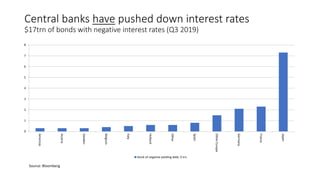

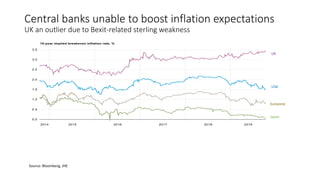

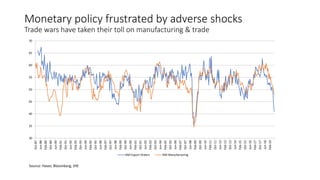

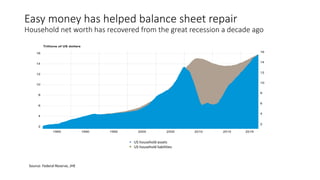

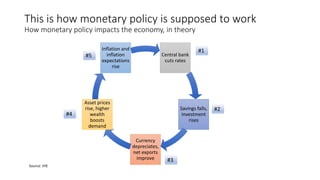

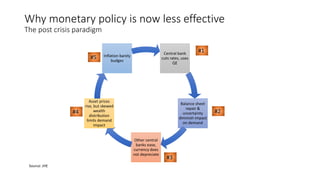

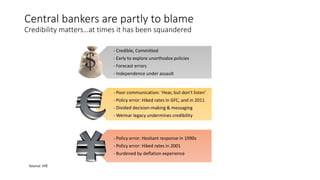

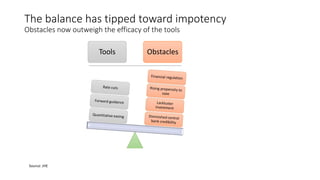

The document discusses why monetary policy has become less effective at stimulating growth and inflation. A decade of unprecedented monetary easing by central banks has led to disappointing economic outcomes, with unsatisfactory growth, excess capacity, and below-target inflation. Several factors have weakened the transmission of monetary policy, including less responsive consumption and investment to low interest rates, rising asset prices mainly benefiting wealthy groups less likely to spend, and unchanging inflation expectations. Further, when all major central banks ease simultaneously, none benefits from a weaker currency. Policy errors have also damaged central bank credibility over time. The balance has tipped toward monetary policy impotency, as obstacles now outweigh the potency of central bank tools.