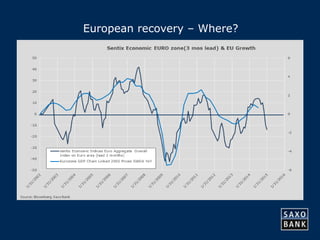

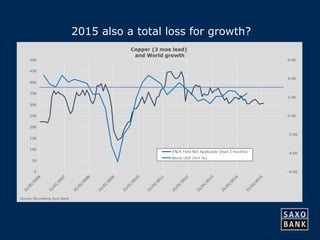

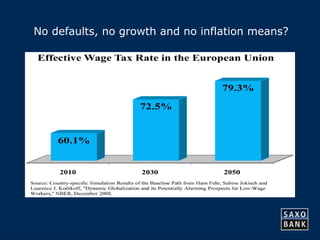

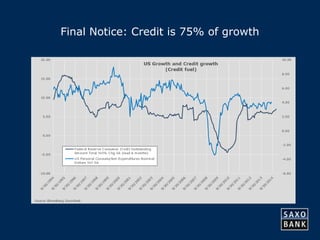

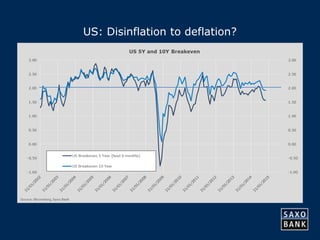

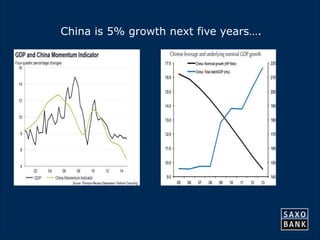

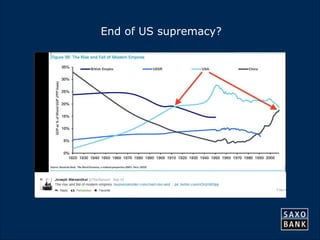

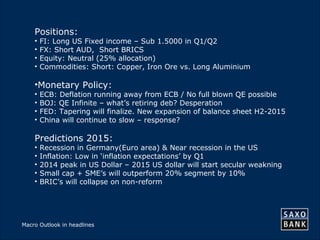

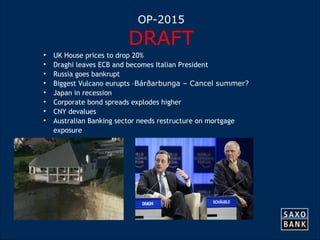

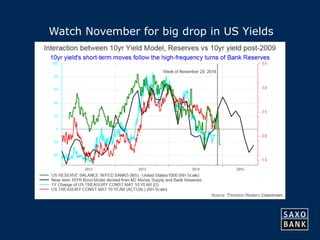

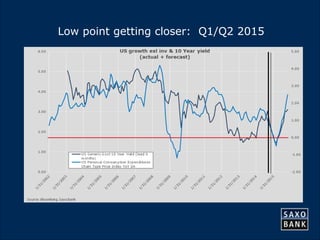

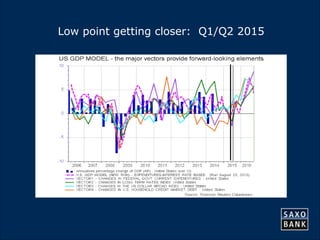

This document summarizes a webinar presented by Steen Jakobsen, Chief Economist and CIO of Saxo Bank. The webinar covered macroeconomic topics including deflation risks in Australia, low growth in Europe, and predictions for interest rates and currencies in 2015-2016. It also provided investment recommendations to be long US fixed income, short the Australian dollar and BRICS currencies, and neutral on equities with a 25% allocation. Key predictions included recession in Germany and a near-recession in the US, as well as a peak in the US dollar in 2014 and its subsequent secular weakening.

![12

80/20-Principle

The Pareto principle (the law of the vital few, and

the principle of factor sparsity) states that, for many events,

roughly 80% of the effects come from 20% of the causes.[1][2]

• 80% of all credit given to 20% listed companies and banks

• 20% of population owns 80% of wealth

• 80% of all jobs comes from Small-and Medium Sized companies

• 20 mio. SME’s in Europe alone (27 mio. in the US)

• 20 mio. people now unemployed in Europe

• 80% economy needs growth to sustain 20%

• 80% return in SME’s vs. 20% in big companies next 5 years?

• ”Betting” on 20% will lead to 80% chance of Japanisation](https://image.slidesharecdn.com/steenwebinarnovember2014-141117194015-conversion-gate01/85/Webinar-with-Saxo-Bank-Chief-Economist-and-CIO-Steen-Jakobsen-12-320.jpg)