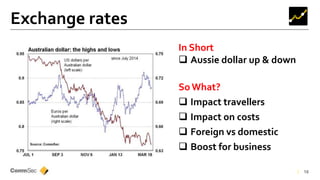

The document provides an economic outlook and analysis from Craig James, Chief Economist at CommSec. It summarizes that the world economy is okay but Australia lacks momentum. Key points are that interest rates will remain low, boosting housing and spending, while the job market risks remain if confidence and wages do not improve. The outlook forecasts moderate economic growth and inflation, with unemployment slowly decreasing and interest rates staying steady.