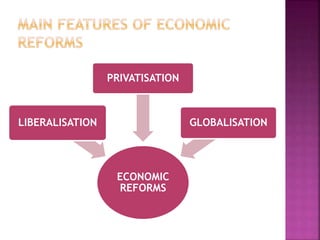

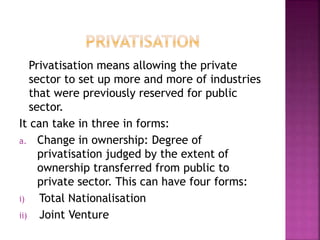

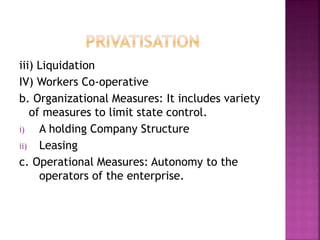

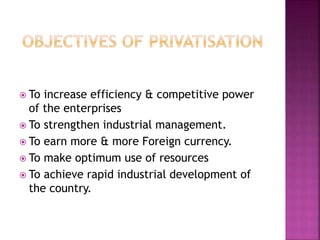

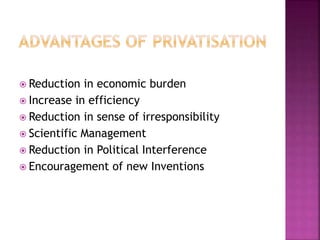

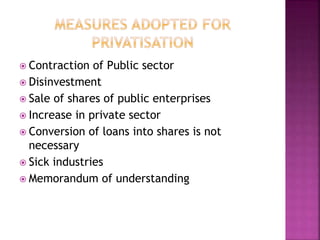

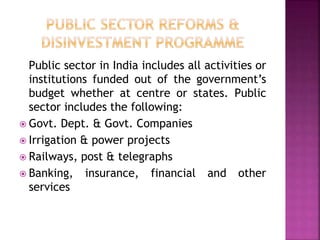

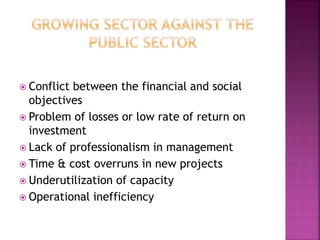

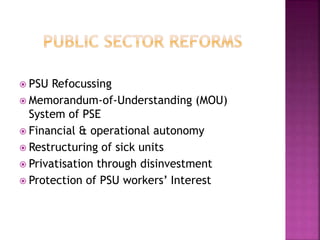

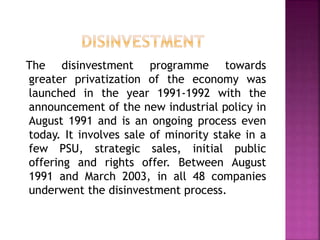

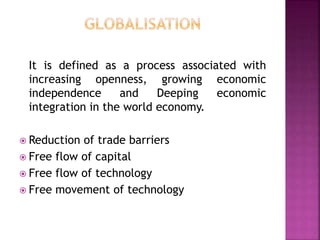

The document discusses India's economic reforms in the early 1990s. It summarizes that the reforms were initiated in 1991 due to a crisis in the economy, with goals of stabilizing growth and reducing fiscal deficits. The key aspects of the reforms were liberalization of controls on industry, privatization of public sector industries, and increasing globalization and openness to foreign trade and investment.