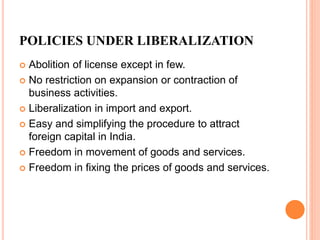

The document discusses India's adoption of liberalization, privatization, and globalization (LPG) policies in 1991 in response to a balance of payments crisis. It overviews the economic situation in 1990-1991 that precipitated the crisis, including high fiscal and current account deficits. It then defines the LPG policies and outlines some of their key aspects, such as abolishing licensing, increasing private sector participation, and reducing trade barriers. Both the advantages, like increased investment and competition, and disadvantages, like job losses and increased inequality, of the reforms are mentioned.