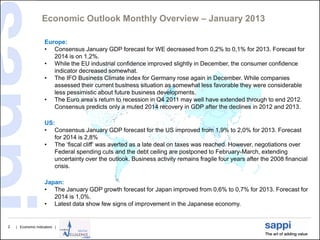

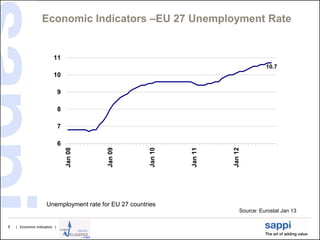

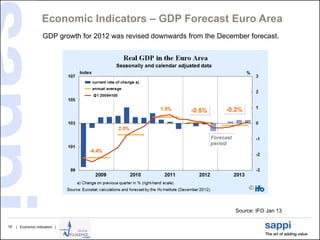

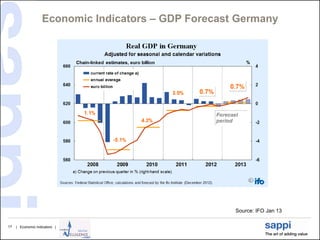

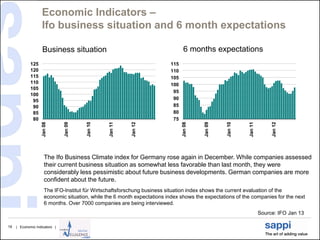

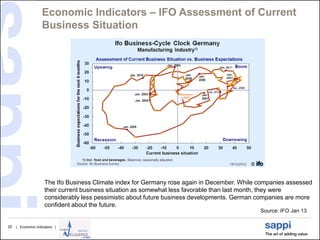

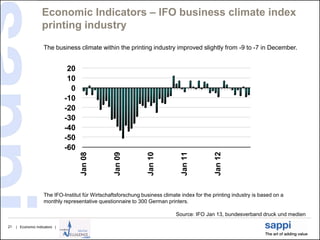

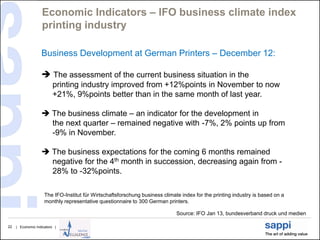

The document summarizes recent economic indicators from Europe, the US, Japan, and Germany. It reports that the GDP growth forecast for Europe in 2013 decreased slightly to 0.1%, while forecasts improved for the US and Japan. The German business climate index rose in December as companies were less pessimistic about the future despite viewing their current situation as somewhat worse. Unemployment in the EU remained high at 10.7% in January 2013.

![Economic Indicators

Last update 18.01.2013

1 | [Presentation title] | [Client Name] | [Date]](https://image.slidesharecdn.com/economicindicators-part1-130122090152-phpapp01/85/Economic-indicators-December-2012-part-1-1-320.jpg)