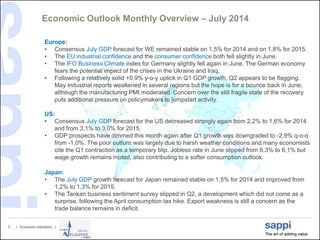

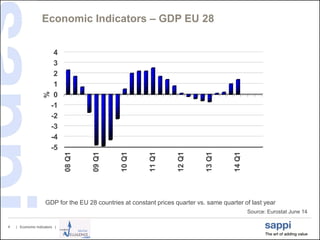

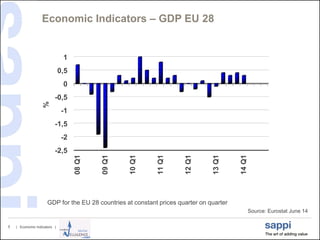

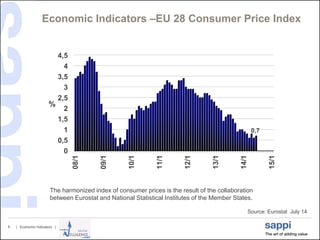

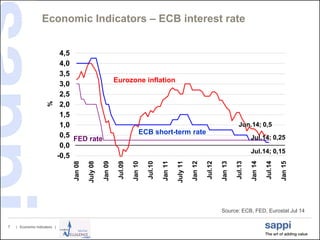

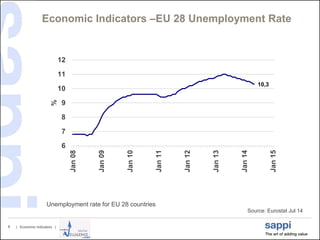

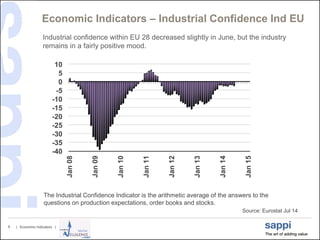

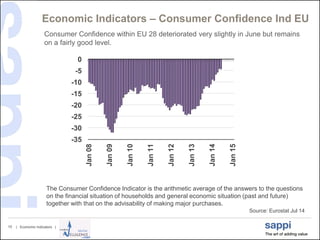

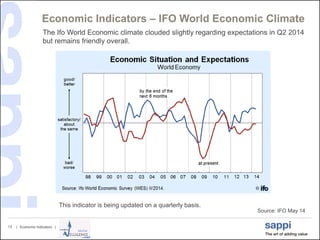

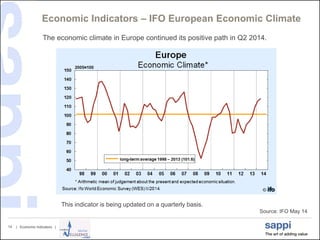

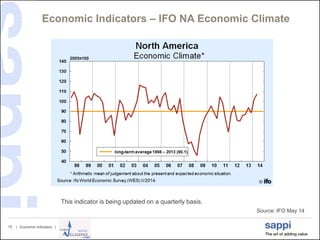

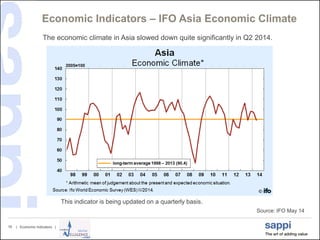

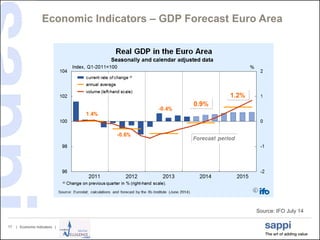

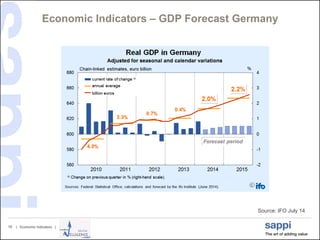

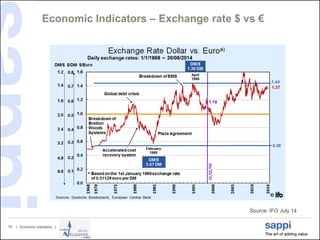

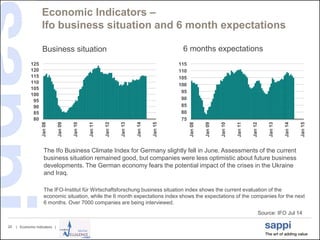

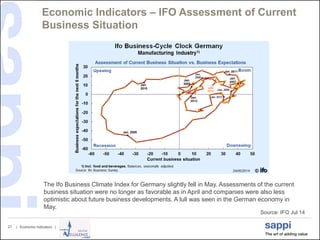

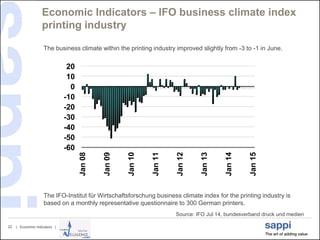

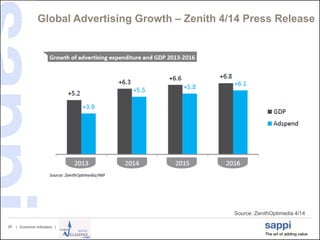

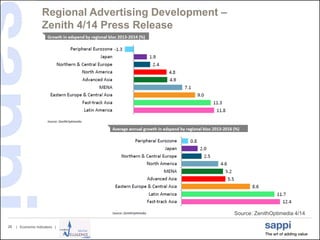

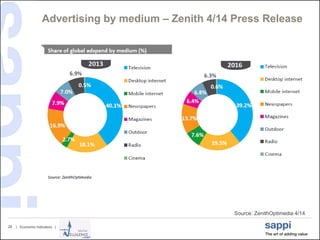

The document provides an overview of recent economic indicators from Europe, the US, Japan, and Germany. It summarizes GDP forecasts, business and consumer confidence indexes, unemployment and inflation rates. GDP growth is expected to be modest in Europe and the US in 2014, while forecasts for Japan remain stable. Several indexes for Germany fell slightly in June due to concerns about the impact of crises in Ukraine and Iraq. Advertising growth forecasts from Zenith also are included, with global growth expected to be 4.7% in 2014.

![| [Presentation title] | [Client Name] | [Date]1

Economic Indicators

Last update 18.7.2014](https://image.slidesharecdn.com/economicindicatorsjuly2014-140718073345-phpapp02/85/Economic-Indicators-July-2014-1-320.jpg)