This document provides an overview of macroeconomics topics including:

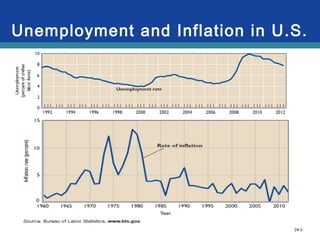

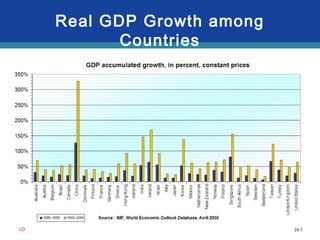

1) The key issues in macroeconomics are economic growth versus business cycle fluctuations and unemployment versus inflation.

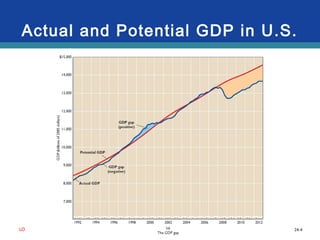

2) Macroeconomic performance is measured using indicators like GDP, GDP per capita, unemployment and inflation rates.

3) Examples of macroeconomic data are provided for countries like the US, China, Mexico, Japan and Greece for 2014.