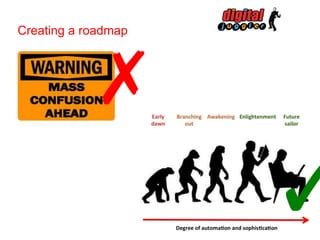

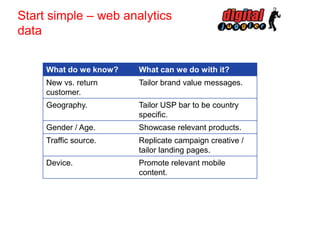

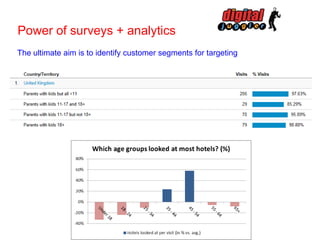

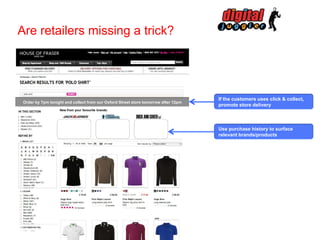

This document provides a roadmap for personalization in ecommerce. It discusses challenges like lack of data integration and unclear ROI. It then outlines a progression of personalization strategies starting with basic web analytics like customer demographics and site behavior. Next steps involve enhancing data with surveys and purchase history to define customer segments. Integrating online and offline customer data through activities like click-and-collect and push notifications is also recommended. A case study demonstrates how connecting online browsing data to member IDs improved targeted event marketing. The overall goal is to develop a unified customer view across channels.