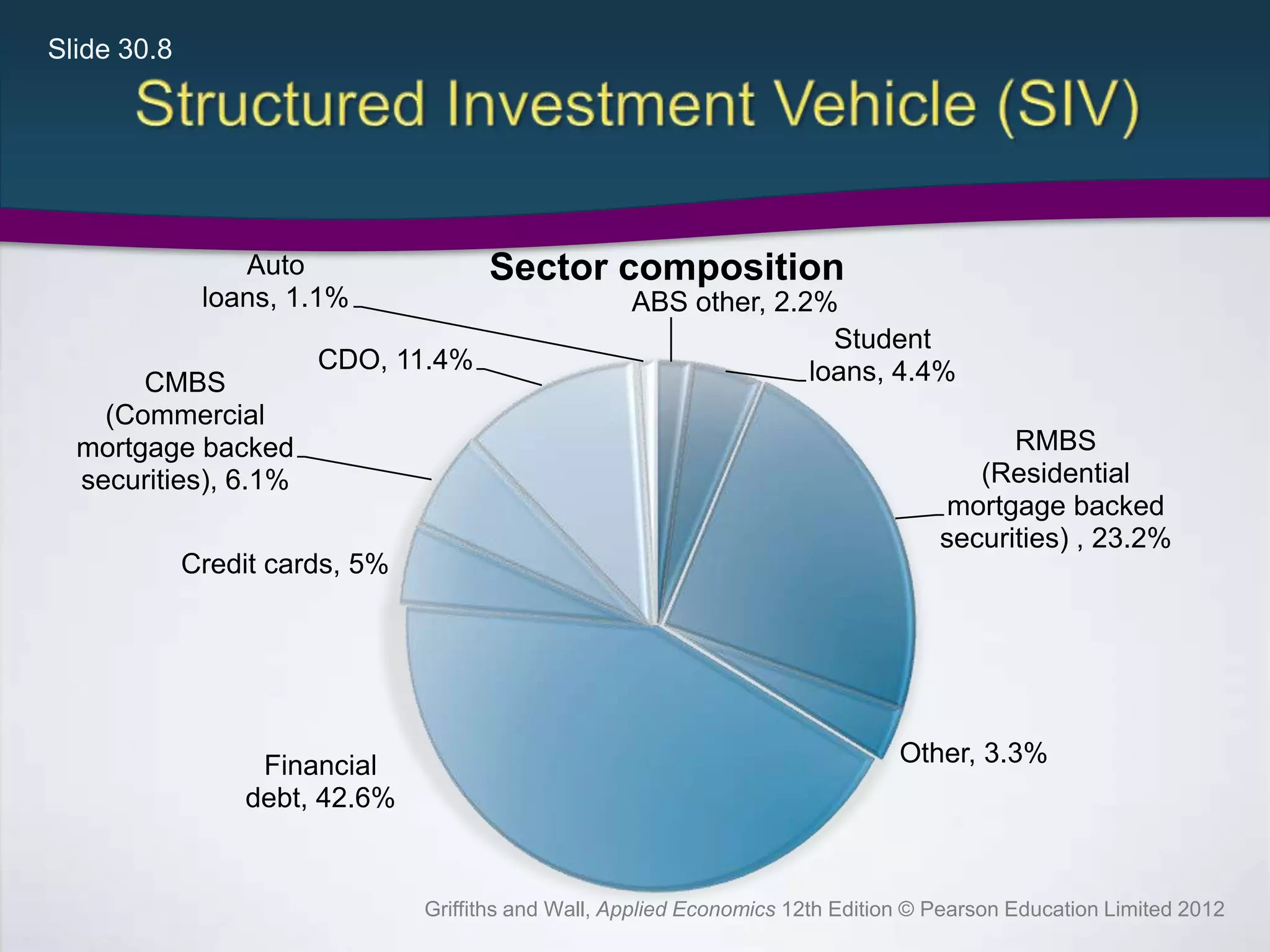

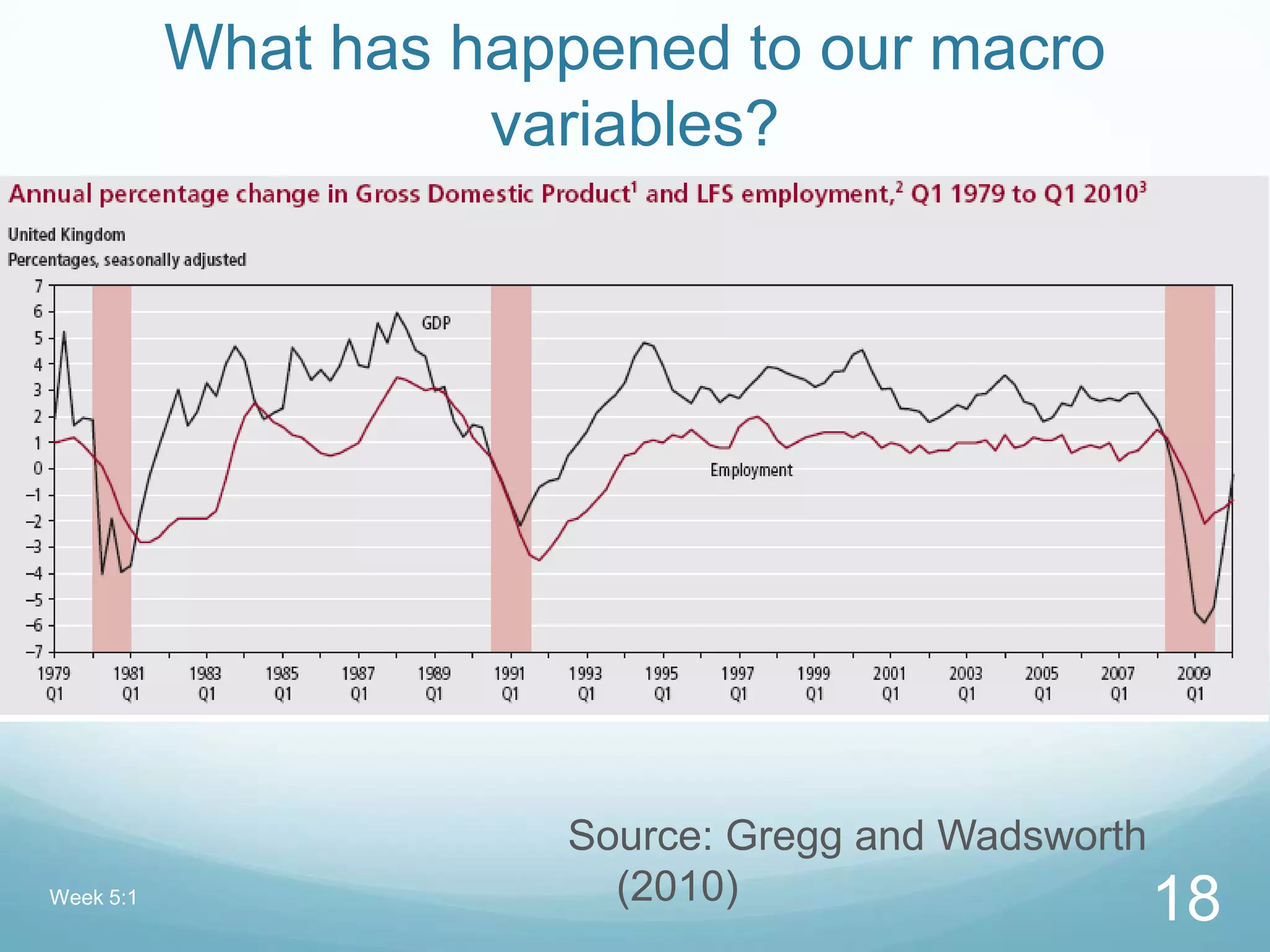

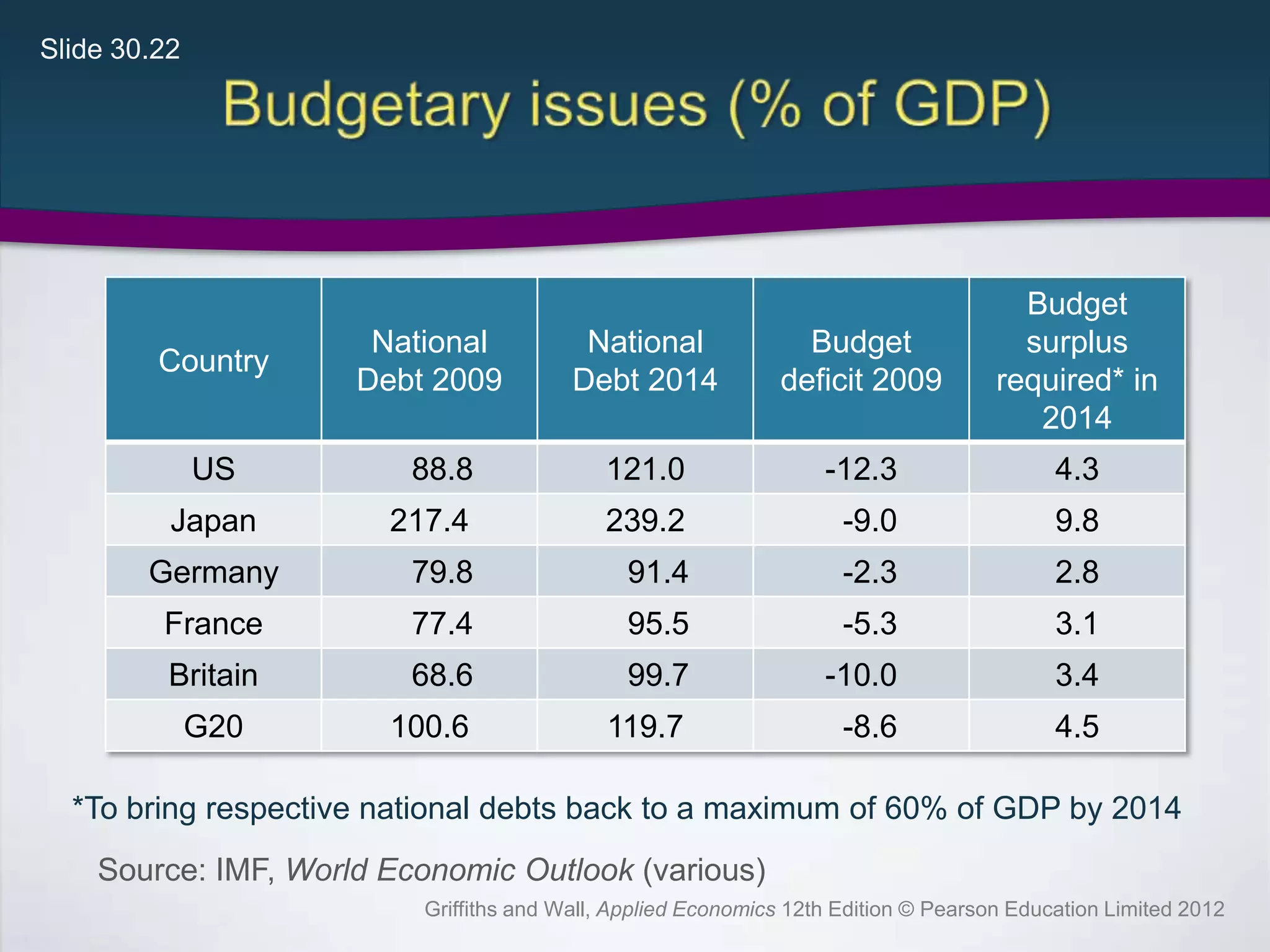

This document outlines the key topics that will be covered in a lecture on recent macroeconomic trends in the British economy. It discusses the causes and consequences of the global financial crisis that began in 2007, including the housing bubble, subprime lending crisis, and contagion effects. It then examines the UK policy response to the recession, including quantitative easing, fiscal stimulus measures, and bank bailouts. Finally, it considers debates around failures of macroeconomic models to predict the crisis and the path to economic recovery.