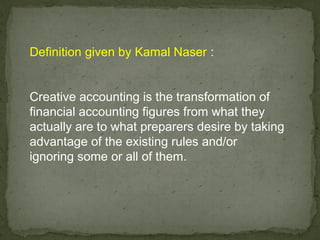

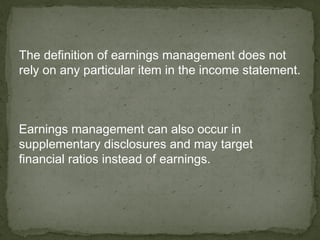

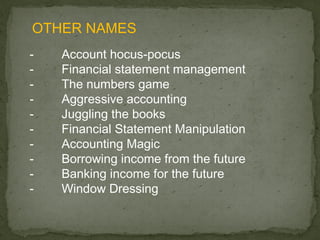

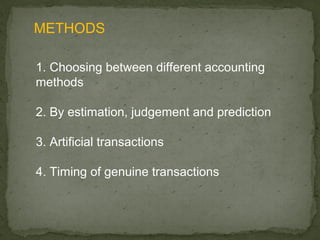

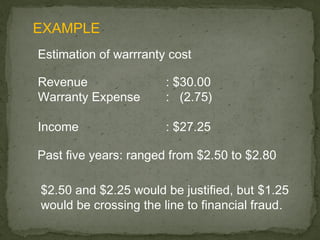

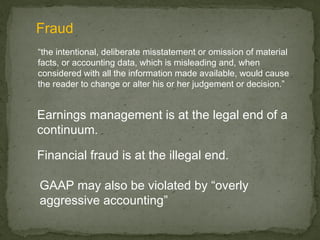

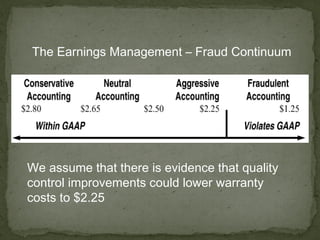

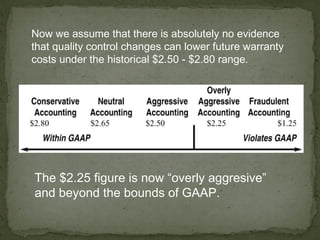

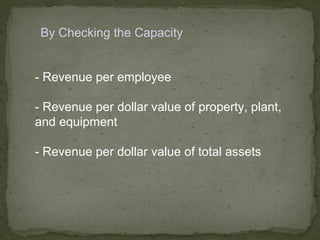

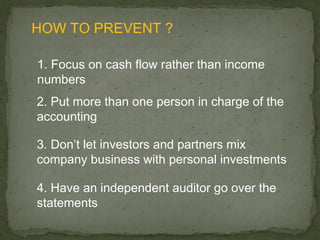

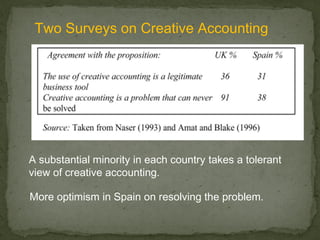

Earnings management refers to reasonable accounting practices used to achieve stable financial results, as opposed to illegal manipulation. It can involve choosing accounting methods, estimates, transactions timing, or disclosures to manage earnings. Reasons include income smoothing, meeting forecasts, or maintaining share prices. Earnings management is detected by analyzing revenue recognition policies, accounts receivable, asset capacity, and comparing income to cash flows. While it can conceal information, some argue it provides a "smooth ride" for shareholders. Surveys found tolerance for creative accounting varies internationally. Accountants must be aware of potential abuse or manipulation.