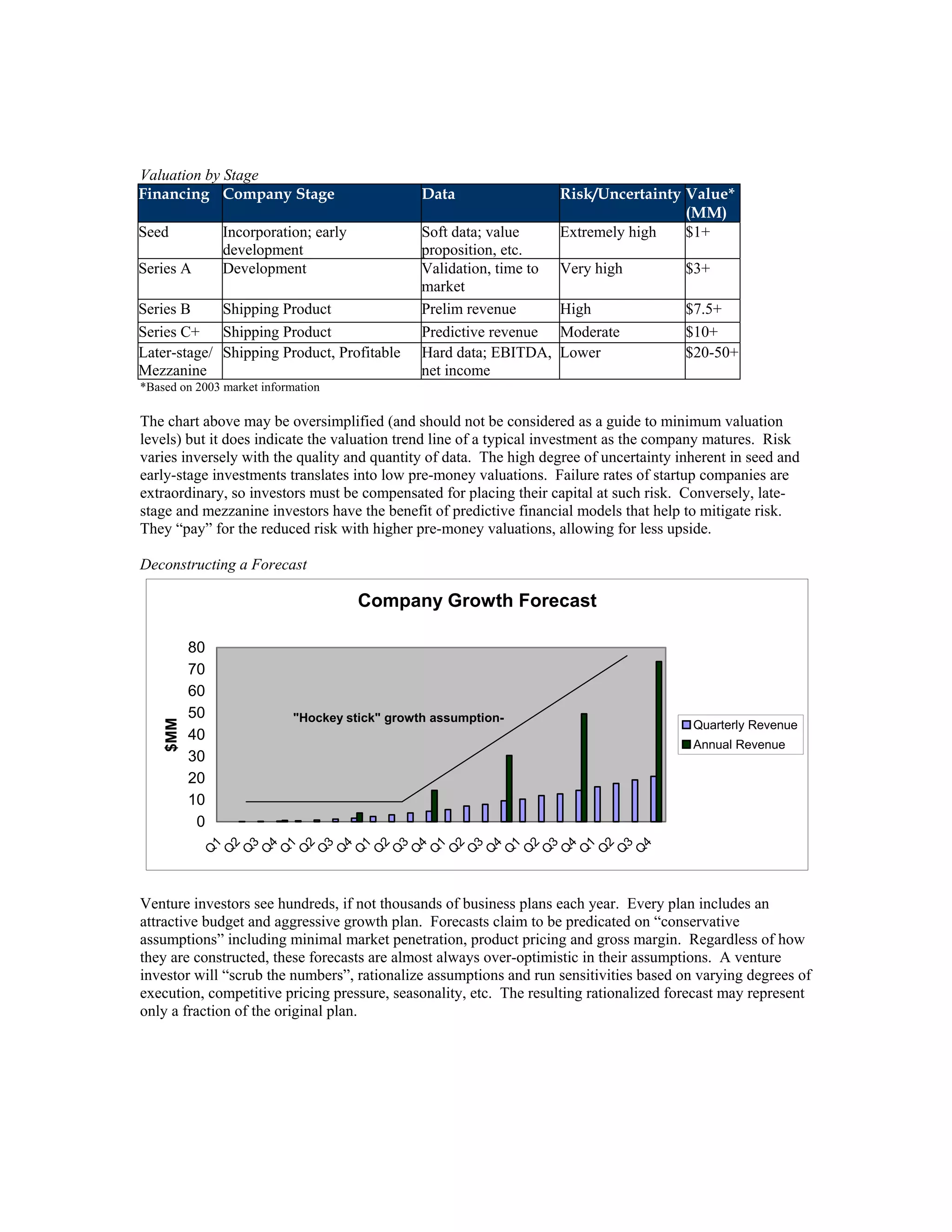

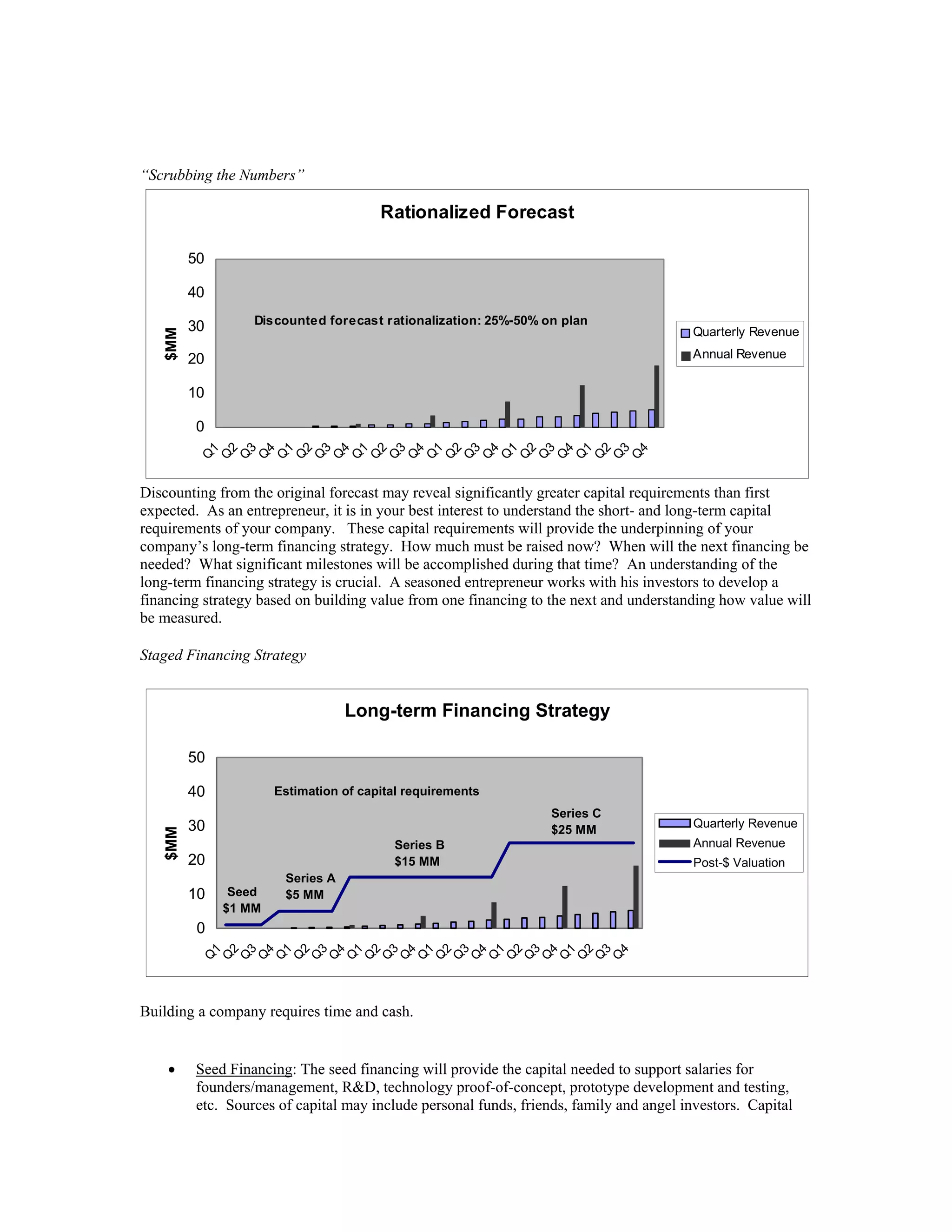

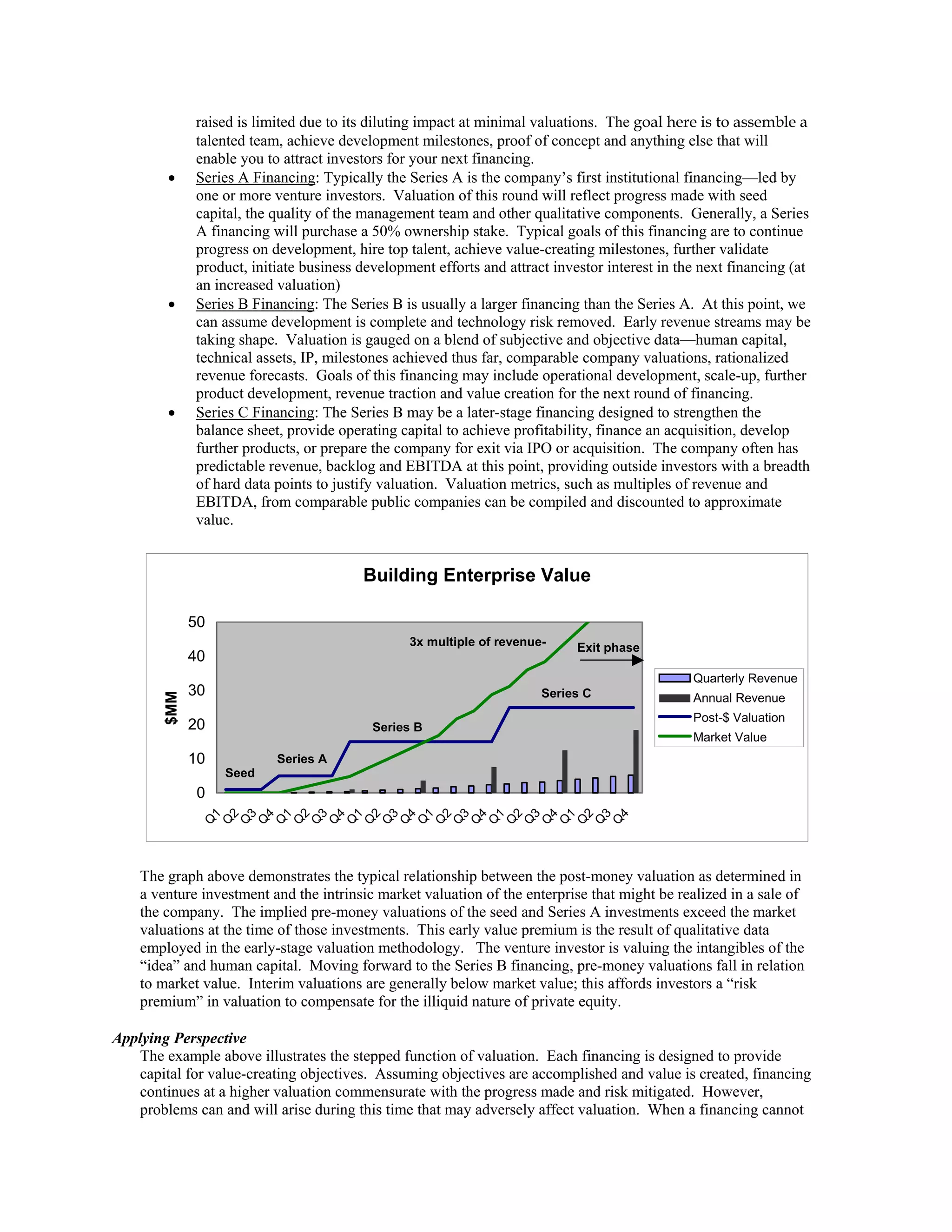

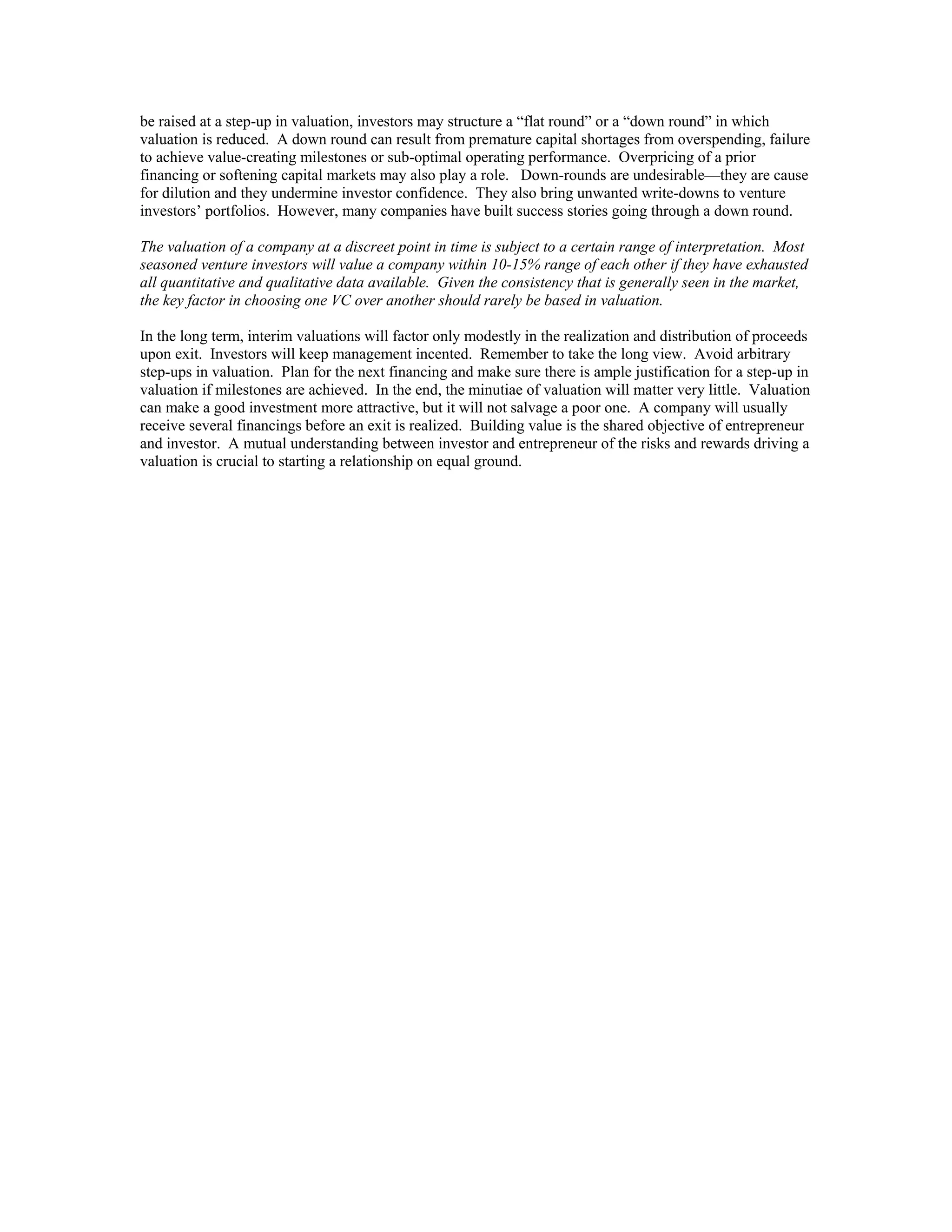

The document discusses how venture investors determine valuations for early-stage companies from the investor's perspective. It explains that valuations are based on both qualitative and quantitative factors depending on the company's stage. In the early stages, valuations are largely subjective based on soft factors. As companies mature and achieve milestones, valuations are based more on quantifiable data like revenue and burn rate. The document also outlines how valuations typically increase with each new round of financing as risk decreases with demonstrated progress and more data.