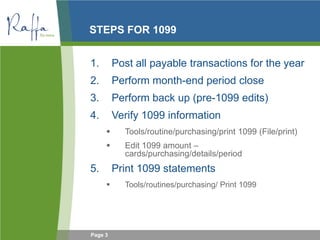

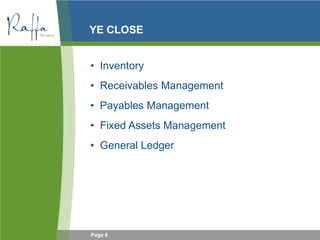

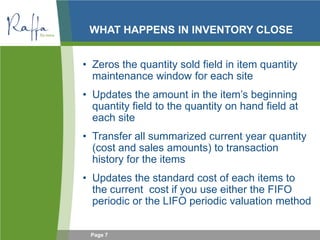

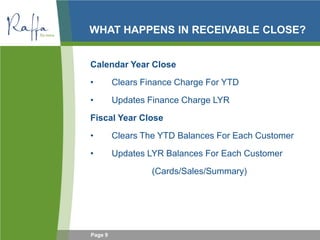

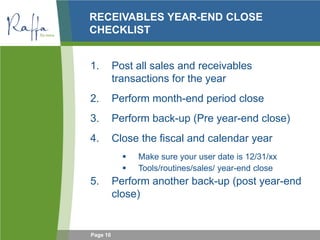

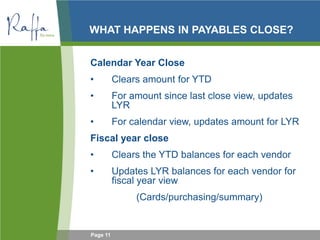

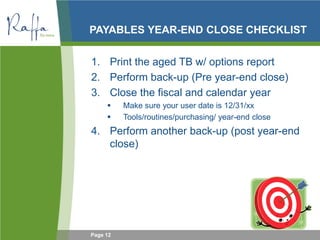

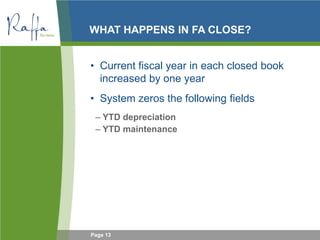

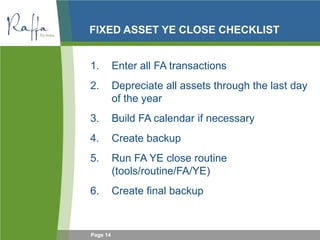

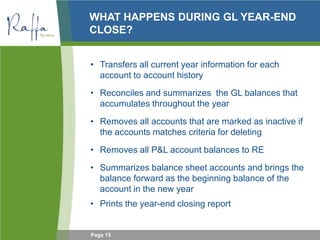

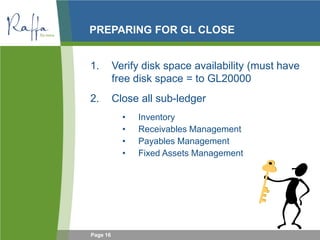

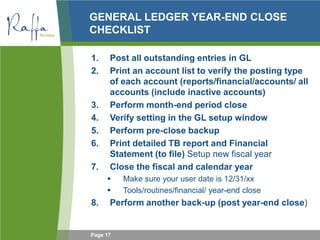

This document provides an agenda and instructions for Microsoft Dynamics GP year-end close processes. It discusses closing procedures for inventory, receivables, payables, fixed assets, and the general ledger. It also addresses generating 1099 forms, W-2 forms, and validating year-end reports. The document provides checklists of steps for each close process and describes the impacts to account balances and fields.