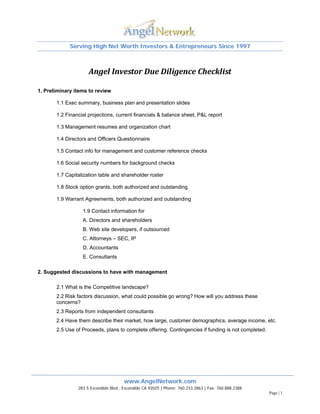

This document provides an extensive checklist for angel investors to conduct due diligence on potential investment opportunities. It outlines 15 key areas for review, including preliminary documents, discussions with management, show stoppers, funding needs, management team assessment, current business status, business plan overview, market opportunity, products/services, competitive analysis, marketing/sales strategy, operations/logistics, financial model, website review, and resources to outsource. The checklist aims to guide investors in thoroughly vetting all relevant aspects of a business seeking funding.