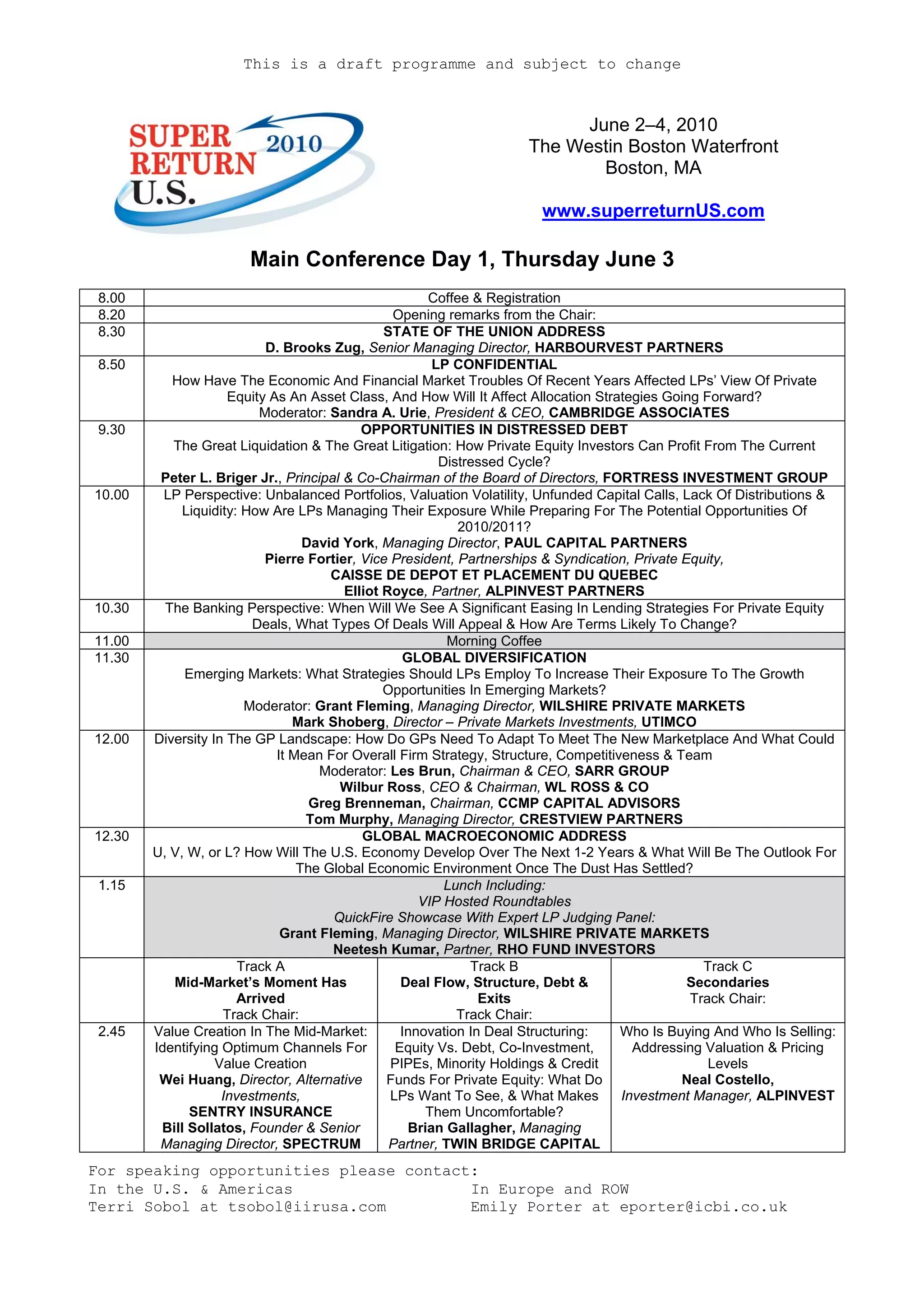

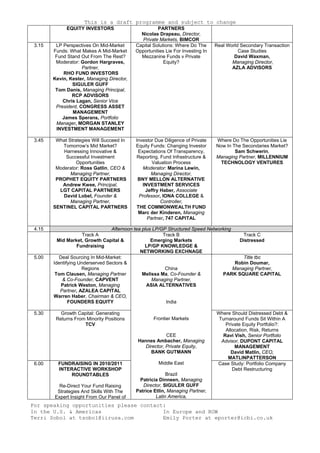

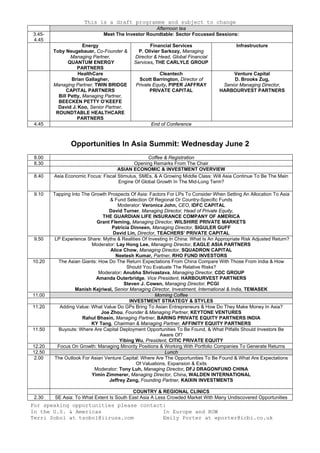

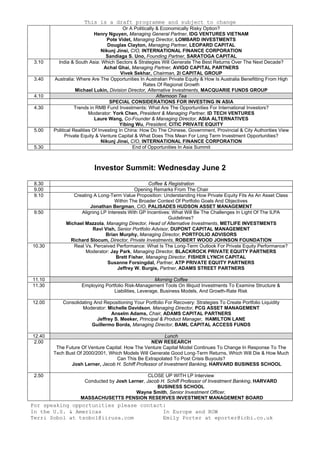

This document provides an agenda for the SuperReturn U.S. 2010 conference taking place June 2-4, 2010 in Boston, MA. The agenda includes keynote speeches, panel discussions, and networking sessions on topics such as the state of the private equity industry, opportunities in distressed debt, global diversification, and regulatory issues. Contact information is provided for those interested in speaking opportunities.