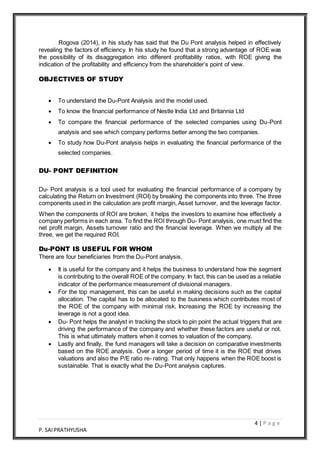

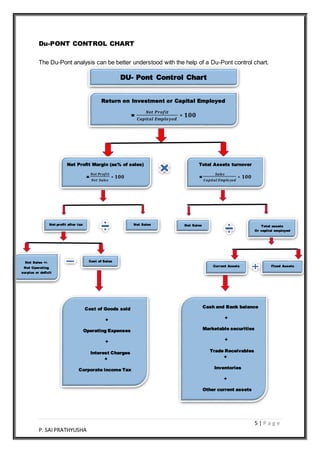

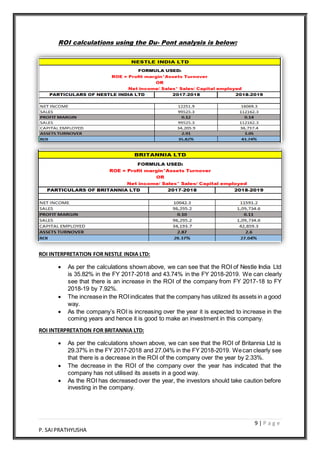

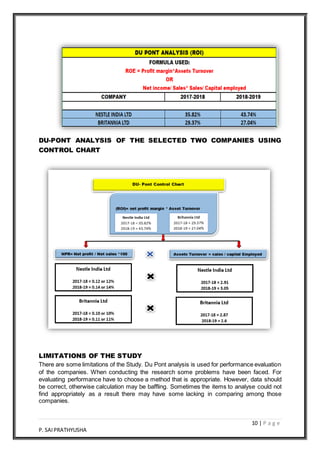

This document presents a study utilizing DuPont analysis to assess the financial performance of two FMCG companies in India: Nestle India Ltd and Britannia Industries Ltd. It focuses on evaluating return on investment (ROI) through a three-step model involving net profit margin, asset turnover, and financial leverage. The study concludes that Nestle consistently outperformed Britannia in terms of ROI and return on equity (ROE) in the years analyzed, suggesting better utilization of assets and management effectiveness.