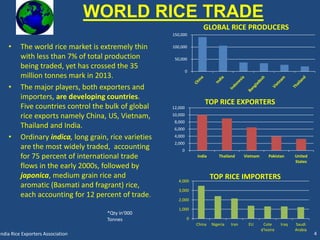

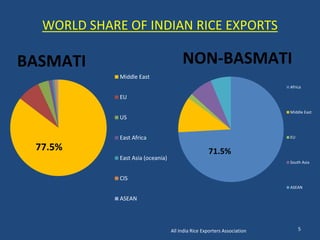

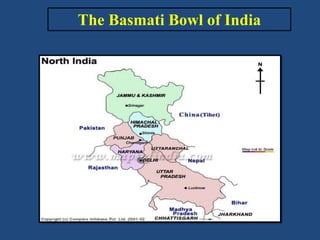

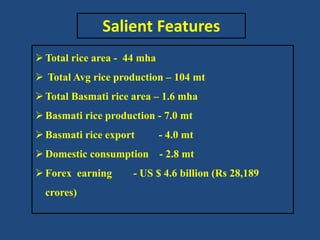

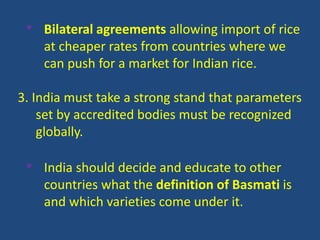

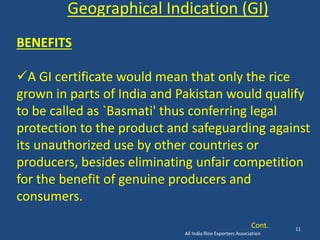

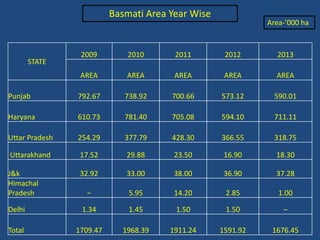

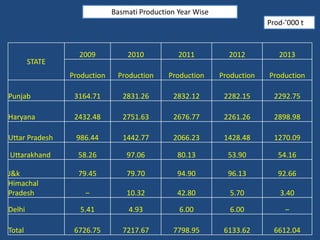

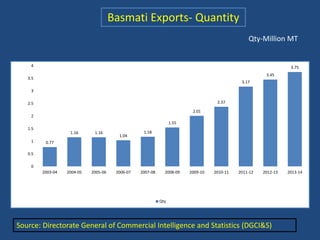

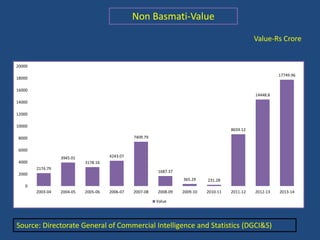

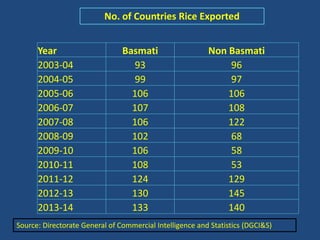

The All India Rice Exporters Association (AIREA) is the apex body for Indian rice exporters. It has over 130 members who account for 90% of India's rice exports. In 2013-14, India exported 10.5 million tonnes of rice worth over Rs 42,669 crore. The document discusses the basmati rice industry in India, including major growing regions, production levels, export markets, and varieties. It notes that the area under basmati rice cultivation in India has decreased in recent years while production has increased. India remains the world's largest basmati rice exporter, with exports worth Rs 29,299.95 crore in 2013-14.